Miami’s Leading CPAs: A Comprehensive List

Why Miami Is A Hub For Leading CPAs

CPA Miami is a term synonymous with expertise in accounting services, financial consulting, and tax advisory. When you search for “CPA Miami,” you likely need top-notch, trustworthy financial solutions quickly. Here’s what you need to know:

Comprehensive Accounting Services: From bookkeeping to meticulous financial statement preparation, Miami’s CPAs offer a full suite of accounting services designed to keep your finances in check.

Advanced Tax Advisory: Whether dealing with international tax compliance, state-specific regulations, or the latest tax credits, Miami CPAs have the specialized knowledge to minimize your tax burden.

Strategic Financial Consulting: Receive expert advice on financial planning, growth strategies, and investment opportunities custom to your unique business needs.

I’m Nischay Rawal, founder of NR CPAs & Business Advisors. With over 10 years of experience providing tailor-made accounting and consulting services, I’ve helped countless clients steer the complex financial landscape of Miami. Let’s dig deeper into what makes Miami’s CPAs stand out.

Quick look at cpa miami:

Finding the right CPA Miami can make a significant difference in managing your financial health. Here are some of the top firms that have built a reputation for excellence in Miami:

NR CPAs & Business Advisors

NR CPAs & Business Advisors is a premier CPA firm in Miami, known for its comprehensive range of services including tax planning, financial statement preparation, and business consulting. Their team of experienced professionals is dedicated to providing personalized service to meet the unique needs of each client.

Their commitment to integrity and excellence has made them the go-to firm for many of Miami’s leading businesses and high-net-worth individuals.

Next, we’ll explore the specialized CPA services available in Miami and how they can benefit your business.

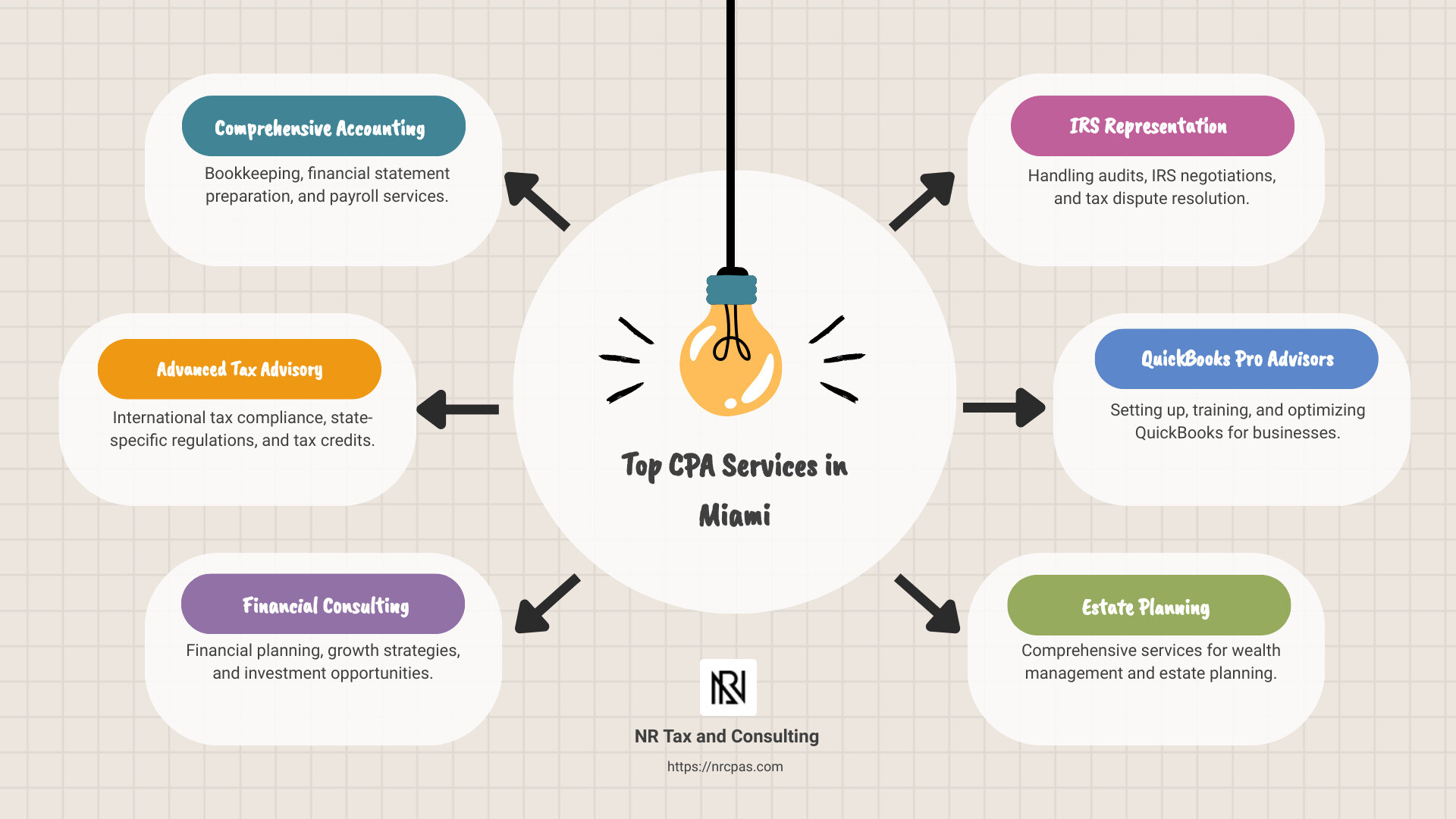

Specialized CPA Services In Miami

Miami’s vibrant business environment demands specialized CPA services to ensure compliance, optimize savings, and provide strategic financial advice. Let’s break down some of the key services offered by top CPA Miami firms.

Tax Consulting

Tax consulting is crucial for both individuals and businesses. Expert CPAs help you steer complex tax laws to minimize liabilities and maximize savings. Services include:

Tax Planning: Personalized strategies to optimize your tax situation.

Tax Compliance: Ensuring adherence to local, state, and federal tax laws.

IRS Audit Support: Professional guidance through the audit process.

Bookkeeping

Accurate bookkeeping is the backbone of any successful business. Miami CPA firms offer comprehensive bookkeeping services to keep your financial records in order. Options include:

Dedicated Account Managers: Handle all paperwork and monthly reconciliations.

Tax-Ready Books: Ensure your books are ready for tax season with 100% accuracy.

Outsourced and Virtual Bookkeeping: Manage your financial records digitally and remotely.

IRS Representation

Dealing with the IRS can be stressful. Miami CPAs provide IRS representation to help you resolve issues efficiently. Services include:

IRS Letter Reviews: Understand the content and implications of IRS communications.

Steps for Compliance: Ensure you meet all IRS requirements and avoid penalties.

QuickBooks Pro Advisors

QuickBooks is a popular accounting software, and many Miami CPAs are certified QuickBooks Pro Advisors. They offer:

Setup and Training: Get your QuickBooks account set up correctly and learn how to use it effectively.

Ongoing Support: Troubleshoot issues and optimize your use of the software.

International Tax Law

Navigating international tax laws can be daunting. Miami CPAs with expertise in international tax law help you comply with regulations and optimize cross-border transactions. Services include:

International Tax Planning: Strategies to minimize global tax liabilities.

Compliance: Ensuring adherence to international tax laws and treaties.

Estate Planning

Estate planning is essential for preserving wealth and ensuring your wishes are honored. Miami CPAs offer estate planning services to help you manage your assets and plan for the future. Services include:

Wealth Transfer Strategies: Efficiently transfer wealth to heirs.

Tax Minimization: Strategies to reduce estate and gift taxes.

Trust and Will Planning: Ensure your estate plan aligns with your wishes and legal requirements.

These specialized services help businesses and individuals in Miami steer the complexities of financial management, ensuring compliance and optimizing financial outcomes.

Why Choose A CPA In Miami?

Choosing a CPA in Miami can make a big difference in your financial health. Let’s explore why.

Experience And Reputation

Miami CPAs bring years of experience to the table. For instance, firms like NR CPAs & Business Advisors have long-standing commitments to serving South Florida clients. This experience means they’ve likely encountered situations similar to yours and can handle complex tax issues with ease.

Client Reviews: Positive client reviews often reflect a CPA’s reliability and expertise. Many firms have earned their reputation through consistent, quality service.

Specialized Knowledge

Specialization Matters: Whether you’re a small business owner or an individual with complex tax needs, specialized knowledge is crucial. For example, NR CPAs & Business Advisors specializes in challenging financial situations like international taxes and cryptocurrency, ensuring you don’t miss out on little-known regulations.

Industry Expertise: Miami CPAs often have experts in specific industries, such as healthcare, real estate, and manufacturing. This specialized knowledge ensures they can provide custom advice and strategies.

Personalized Service

Close Personal Attention: Miami CPAs pride themselves on providing personalized service. Firms like NR CPAs & Business Advisors offer the convenience of traveling to your office for appointments, even during evenings and weekends. They also offer services in both English and Spanish, making it easier for you to communicate your needs.

Accessibility: You’ll find Miami CPAs to be accessible and responsive. This means you can count on them not just during tax season, but year-round for continuous support and advice.

Local Expertise

Understanding Local Laws: Tax laws vary significantly by state and locality. Miami CPAs have a deep understanding of Florida’s specific tax regulations, ensuring you comply and don’t overpay or underpay your taxes.

Community Connection: Being local, Miami CPAs are well-connected within the community. This local expertise can be invaluable for networking and staying updated on regional financial trends.

In summary, choosing a CPA in Miami offers you the benefits of extensive experience, specialized knowledge, personalized service, and local expertise. Up next, we’ll guide you through the steps on how to become a CPA in Florida.

How To Become A CPA In Florida

Becoming a CPA in Florida involves several steps, including meeting education requirements, passing the CPA Exam, completing the licensure process, and staying compliant with the Florida Board of Accountancy. Let’s break it down.

Education Requirements

To become a CPA in Florida, you need a solid educational foundation:

Bachelor’s Degree: You must have a bachelor’s degree from an accredited institution.

150 Credit Hours: You need 150 semester hours of college education, which is more than the typical 120 hours required for a bachelor’s degree. This often means additional coursework or a master’s degree in accounting.

CPA Exam

Passing the CPA Exam is a critical step. The exam is comprehensive and covers four main sections:

Auditing and Attestation (AUD)

Business Environment and Concepts (BEC)

Financial Accounting and Reporting (FAR)

Regulation (REG)

You must score at least 75 on each section to pass. The exam is known for its difficulty, so thorough preparation is essential.

Licensure Process

After passing the CPA Exam, you must complete the licensure process, which includes:

Work Experience: One year (2,000 hours) of work experience in accounting, verified by a licensed CPA.

Ethics Exam: Passing an ethics exam, which tests your understanding of professional conduct and standards.

Florida Board Of Accountancy

The Florida Board of Accountancy oversees the CPA licensure process. They ensure that all CPAs in the state meet the necessary standards and continue to comply with ongoing requirements.

License Application: Submit your application to the Florida Board of Accountancy after completing your education and passing the CPA Exam.

Continuing Education: CPAs must complete 80 hours of continuing professional education (CPE) every two years to maintain their license. This keeps you updated on the latest accounting practices and regulations.

Becoming a CPA in Florida is a rigorous process, but it’s a rewarding career path with high demand and competitive salaries. Up next, we’ll address some frequently asked questions about CPAs in Miami.

Frequently Asked Questions About CPAs In Miami

Why Are CPAs So Expensive?

CPAs, or Certified Public Accountants, often come with high fees due to their extensive experience, specialization, and reputation. Here’s why:

Experience: CPAs typically have years of experience handling complex financial tasks. This expertise allows them to provide valuable insights and avoid costly errors.

Specialization: Many CPAs specialize in areas like international tax law, estate planning, or cryptocurrency. This specialized knowledge can save you money in the long run by optimizing your tax situation and ensuring compliance with intricate regulations.

Reputation: A reputable CPA firm, like those you’ll find in Miami, often charges more because their track record of success justifies it. When clients trust a firm, they’re willing to pay for the assurance that their financial matters are in good hands.

How Much Do CPA Accountants Make In Florida?

Salaries for CPAs in Florida vary based on factors such as experience, location, and specialization. Here’s a quick breakdown:

Average Salary: The average salary for a CPA in Florida is around $70,000 to $80,000 per year.

Top Earners: Experienced CPAs, especially those in senior positions or with specialized skills, can earn over $120,000 annually.

Entry-Level: New CPAs might start with salaries around $50,000 to $60,000, but this can quickly increase with experience and additional certifications.

What Does CPA Mean?

CPA stands for Certified Public Accountant. To become a CPA, one must meet specific licensure requirements and adhere to standards set by the state board of accountancy. Here’s a breakdown:

Licensure Requirements: These typically include completing 150 semester hours of college education, passing the comprehensive CPA Exam, and gaining relevant work experience.

CPA Exam: The exam covers four main areas: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). A score of at least 75 on each section is required to pass.

State Board of Accountancy: This body oversees the licensure process, ensuring CPAs meet ongoing education requirements and maintain ethical standards. For example, the Florida Board of Accountancy requires CPAs to complete 80 hours of continuing professional education (CPE) every two years.

Becoming a CPA is challenging, but it opens doors to a rewarding career with high demand and competitive salaries. Up next, we’ll dive into the top CPA firms in Miami and what makes them stand out.

Conclusion

At NR CPAs & Business Advisors, we understand that every small business is unique. Our personalized financial guidance is designed to help you steer the complex world of accounting and tax compliance with ease.

Our local accountant services ensure that you receive the attention and expertise that only a local firm can provide. We work closely with you to understand your business and offer solutions that make sense for your industry and market.

Our team of experts is dedicated to your success. Whether you need help with tax preparation, financial analysis, or strategic planning, we are here to support you every step of the way.

For personalized guidance and comprehensive services, contact us today and let us help you achieve your financial goals.

Want tax & accounting tips and insights?

Sign up for our newsletter.