Navigating Tax Season: Best Tax Preparation Services In Miami, FL

Navigating Tax Season In Miami, FL: Essential Tax Preparation Services

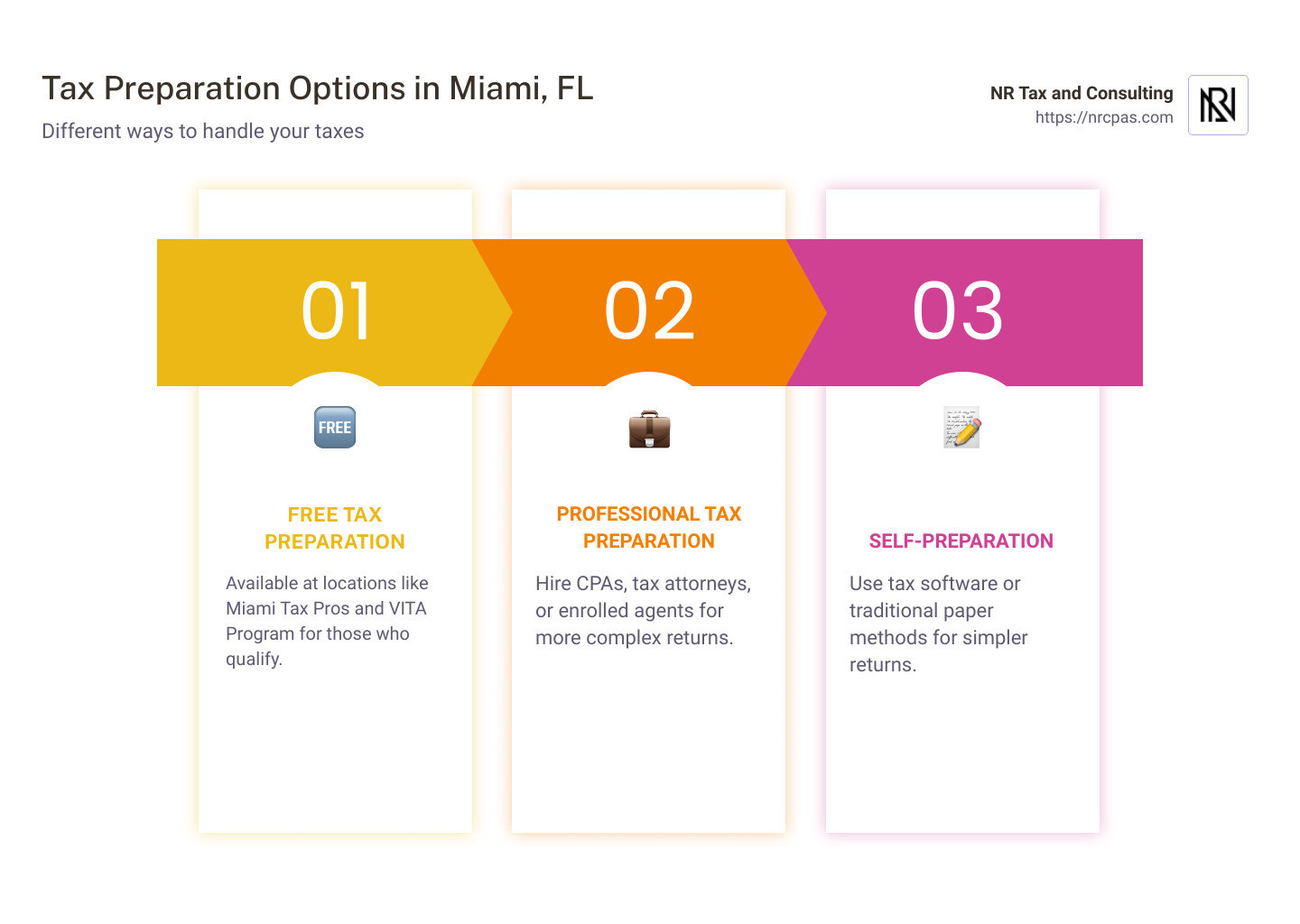

When it comes to tax preparation in Miami, Florida, navigating the myriad of rules and services can be daunting. Whether you’re an individual or a small business owner, having the right tax preparation plan is crucial. Let’s quickly highlight the different tax prep options available:

Free Tax Preparation Services: Through VITA Program, and other community centers.

Professional Tax Preparation: Engage with CPAs, tax attorneys, or enrolled agents for more complex returns.

Self-Preparation: Use tax software or the traditional paper route for simpler cases.

Tax season can be stressful, especially in a city busy like Miami. Besides federal taxes, understanding local rules such as sales tax and property tax can be beneficial. The good news is that with professional help, you can lighten your tax load and ensure compliance with all regulations.

I’m Nischay Rawal, a certified public accountant with over 10 years’ experience. I specialize in simplifying tax preparation in Miami, Florida for both individuals and businesses, ensuring you get the best possible outcome for your unique needs.

Top Tax Preparation Services In Miami, FL

When it comes to tax preparation in Miami, Florida, NR CPAs & Business Advisors stands out with its comprehensive services tailored for both individuals and businesses. Our firm is dedicated to providing you with the highest level of expertise and customer service. We understand the complexities of tax laws and are committed to helping you navigate them with ease.

NR CPAs & Business Advisors

At NR CPAs & Business Advisors, we offer a wide range of tax services designed to meet your specific needs. Our team of certified public accountants and tax professionals are well-versed in the latest tax regulations to ensure that you receive all the deductions and credits you are entitled to. We pride ourselves on our integrity and professionalism, making us a trusted choice for many in the Miami area.

Services Offered By NR CPAs & Business Advisors

Comprehensive Tax Planning and Preparation: Whether you’re an individual or a business, we provide detailed planning and preparation services to help you optimize your tax situation.

IRS Representation: Our experienced professionals can represent you before the IRS, providing support during audits or resolving tax disputes.

Multilingual Support: We offer services in English, Spanish, and Creole, catering to Miami’s diverse population.

By choosing NR CPAs & Business Advisors, you ensure that your tax preparation is in capable hands, allowing you to focus on what matters most to you.

Benefits Of Professional Tax Preparation

Hiring a professional for tax preparation in Miami, Florida offers numerous advantages that can make your tax season less stressful and more efficient.

Accuracy

Professionals are trained to avoid common mistakes that could lead to audits or penalties. According to the IRS, errors in tax returns can result in delays and additional scrutiny. By hiring a professional, you ensure that your tax return is accurate and compliant with all regulations.

Time-Saving

Filing taxes can be time-consuming, especially if you have a complex financial situation. A professional can handle the paperwork, calculations, and submissions, allowing you to focus on other important aspects of your life or business.

Stress Reduction

Tax season can be stressful, but knowing your taxes are in expert hands can reduce anxiety. According to a study, over 85 million Americans use paid preparers to file their taxes, highlighting the peace of mind that professional help can provide.

Maximizing Refunds

Professionals can help you identify all the deductions and credits you qualify for, potentially increasing your refund. For instance, the VITA Program ensures that eligible residents get the most out of their tax returns by identifying all possible deductions and credits.

Compliance

Filing tax returns accurately and on time is crucial to avoid penalties. Tax professionals ensure that all necessary documents are submitted correctly and punctually. They also stay updated on the latest tax laws and regulations, ensuring full compliance.

By hiring a professional, you can steer tax season smoothly and efficiently, making it a worthwhile investment.

Next, we’ll explore the free tax preparation services available in Miami, FL.

Free Tax Preparation Services In Miami, FL

Navigating tax season can be stressful, but Miami offers several free tax preparation services to help ease the burden. Here’s a look at the top options available:

Volunteer Income Tax Assistance (VITA) Program

The Volunteer Income Tax Assistance (VITA) program provides free tax help to individuals who earn $60,000 or less, have disabilities, or are limited English speakers. VITA volunteers are IRS-certified and trained to handle various tax situations.

Eligibility

To qualify for VITA services, you generally need to meet the following criteria:

– Earn $60,000 or less annually

– Have a disability

– Be a limited English speaker

Locations and Services Offered

VITA services are available at multiple locations throughout Miami, including community centers and local non-profits.

By taking advantage of these free tax preparation services in Miami, you can ensure your taxes are filed accurately and on time, without the added stress or cost.

Paid Tax Preparation Services: What To Expect

When opting for paid tax preparation services at NR CPAs & Business Advisors in Miami, FL, you can expect comprehensive support tailored to your financial situation. Here’s what we offer:

Costs

Our pricing is transparent and competitive, reflecting the quality and depth of our services. While costs can vary based on the complexity of your tax situation, we ensure that you receive value for every dollar spent.

Services

Our paid tax preparation services include:

– Detailed Tax Planning: Strategic advice to reduce liabilities and enhance potential refunds.

– Audit Support: Comprehensive assistance in the event of an IRS audit.

– Tax Return Review: Meticulous review to maximize deductions and credits.

– Electronic Filing: Fast and secure submission of your tax return.

– Year-Round Support: Ongoing assistance for any tax-related questions or concerns.

Complexity And Time

Regardless of the complexity of your tax situation, our team is equipped to handle it efficiently, saving you time and stress. Our expertise allows us to manage even the most complex scenarios with precision.

By choosing NR CPAs & Business Advisors, you are opting for a partner who will stand by you not only during the tax season but throughout the year, providing expert advice and peace of mind.

How To Choose The Right Tax Preparation Service

Choosing the right tax preparation service in Miami, Florida can feel overwhelming. Focus on these key factors to make it easier:

Credentials

Ensure your tax preparer has the right qualifications. Look for CPAs, attorneys, or enrolled agents. These professionals have the authority to represent you before the IRS. You can verify their credentials using the IRS’s searchable database.

Experience

Experience matters. A seasoned tax preparer will be familiar with complex tax situations. They can help you avoid common mistakes and maximize your deductions.

Reviews

Check online reviews and ask for recommendations from friends or colleagues. A good reputation often means reliable service.

Language Support

Miami is diverse. Many residents speak Spanish, Creole, and Chinese. Choose a tax service that offers support in your preferred language.

Accessibility

Decide whether you prefer in-person or virtual tax services. Virtual services offer convenience and flexibility, allowing you to upload documents and communicate with your preparer from anywhere. However, some people feel more comfortable with face-to-face interactions.

By focusing on these factors—credentials, experience, reviews, language support, and accessibility—you can find the right tax service to meet your needs.

Next, we’ll answer some frequently asked questions about tax preparation in Miami, Florida.

Frequently Asked Questions About Tax Preparation In Miami, FL

What Is The Cost Of Tax Preparation In Miami, FL?

The cost of tax preparation in Miami, Florida can vary based on several factors, including the complexity of your tax situation and the type of professional you hire. On average, individual tax preparation services range from $150 to $190.

Here are some typical costs:

Filing only a W-2 form: Around $50

Filing a W-2 along with additional forms like 1099-INT and 1098-E: Approximately $150

Several tax forms with additional considerations such as rental property or small business income: Roughly $225

Multiple activities (rentals, small business, etc.) and stock transactions: About $395

That the cost can also depend on the credentials and experience of the tax preparer. CPAs and tax attorneys usually charge more than enrolled agents or PTIN holders.

Where Can Seniors Find Tax Preparation Services In Miami, FL?

Seniors in Miami have several options for tax preparation services, both free and paid.

Free Services:

VITA (Volunteer Income Tax Assistance): Offers free tax prep for eligible residents. They offer in-person and virtual options in multiple languages, including English, Spanish, Creole, and Chinese.

Paid Services:

– Seniors can also opt for paid services from certified public accountants (CPAs) or enrolled agents who specialize in tax preparation. These professionals can provide more personalized services that may be necessary for more complex tax situations.

Are There Free Tax Preparation Services Available In Miami, FL?

Yes, there are several free tax preparation services available in Miami, FL, primarily through the VITA program.

Community Action and Human Services Department: They offer free tax prep services at various Miami-Dade County Community Resource Centers, including locations like Coconut Grove, Hialeah, and Miami Gardens. Residents can request services remotely and upload their documents via email.

For those seeking free tax preparation services, it’s important to check eligibility criteria and the types of services offered at each location.

Conclusion

Navigating tax season can be stressful, but finding the right tax preparation service in Miami, FL can make all the difference. From free services offered by community-based organizations to professional, paid services, there are options to fit every need and budget.

At NR CPAs & Business Advisors, we understand the unique tax landscape of Miami. We focus on providing personalized services custom to your specific needs. Our local expertise ensures that you receive accurate, timely, and compliant tax preparation.

Our team of experienced professionals is dedicated to helping you maximize your refunds and minimize your stress. We offer a range of services, from individual tax preparation to corporate tax compliance. We work closely with you to understand your financial situation and provide solutions that make sense for you.

If you’re looking for reliable and expert tax preparation in Miami, Florida, contact us today to schedule a consultation. Let us help you steer tax season with confidence and ease.

Want tax & accounting tips and insights?

Sign up for our newsletter.