Your Corporate Transparency Act Checklist: Steps To Ensure Compliance

Importance Of The Corporate Transparency Act Checklist

What is the Corporate Transparency Act checklist? The Corporate Transparency Act (CTA) checklist is a set of steps to help businesses comply with new federal regulations designed to combat money laundering and tax fraud. It involves submitting beneficial ownership information (BOI) to the Financial Crimes and Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

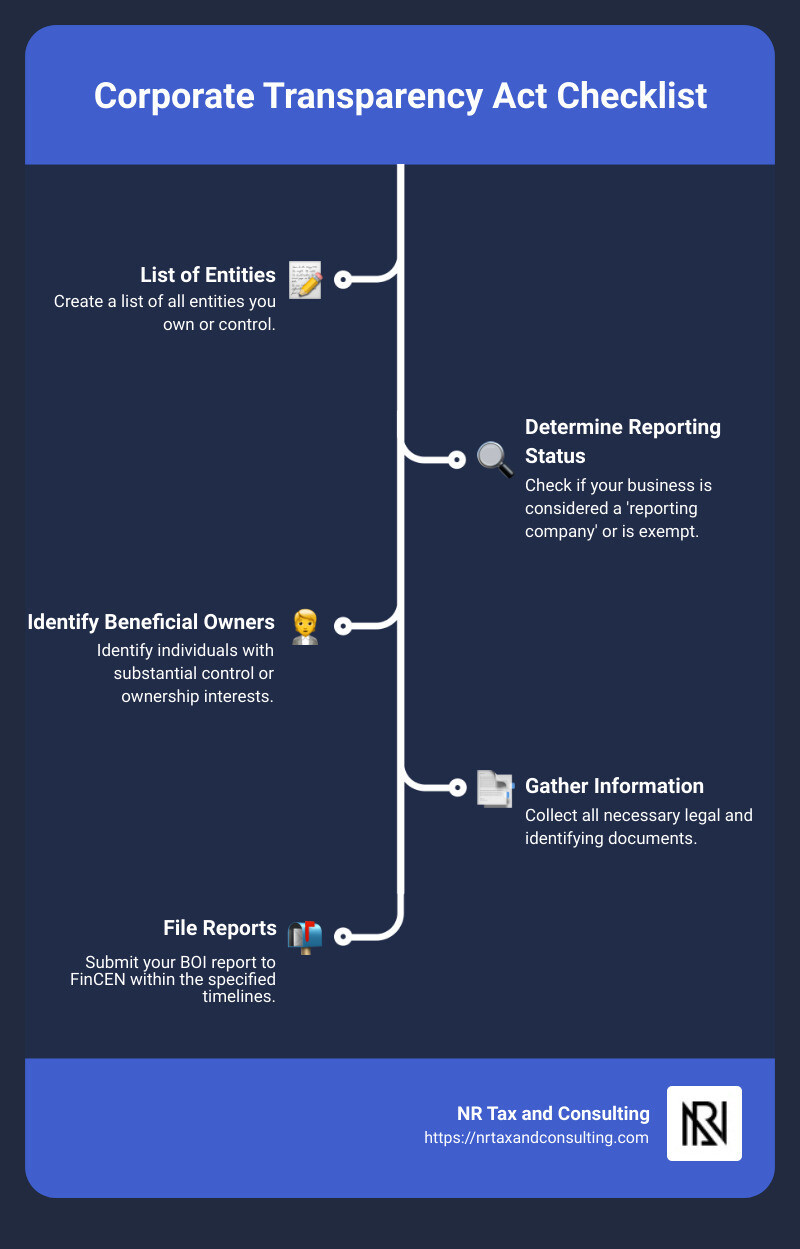

Quick Glance Compliance Steps:

1. List of Entities: Create a list of all entities you own or control.

2. Determine Reporting Status: Check if your business is considered a “reporting company” or is exempt.

3. Identify Beneficial Owners: Identify individuals with substantial control or ownership interests.

4. Gather Information: Collect all necessary legal and identifying documents.

5. File Reports: Submit your BOI report to FinCEN within the specified timelines.

Maintaining compliance with the CTA is crucial for avoiding severe penalties, including fines up to $10,000 and possible imprisonment for noncompliance. Effective from January 1, 2024, the law places a significant burden on U.S. businesses to disclose their beneficial owners, making transparency a statutory requirement.

My name is Nischay Rawal, a certified public accountant and founder of NR CPAs & Business Advisors. With over ten years of experience in accounting and compliance, I’m here to guide you through the complexities of what is the corporate transparency act checklist seamlessly and efficiently.

What Is The Corporate Transparency Act?

The Corporate Transparency Act (CTA) is a new federal law aimed at combating money laundering, tax fraud, and other illicit activities by increasing transparency in business ownership. Enacted on January 1, 2024, the CTA requires many U.S. businesses to report detailed information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

Why the CTA Matters:

Money Laundering And Tax Fraud

The CTA targets financial crimes like money laundering and tax fraud. By mandating the disclosure of beneficial ownership information, the law seeks to prevent individuals from hiding their identities behind anonymous shell companies.

Beneficial Ownership Information

Under the CTA, a beneficial owner is anyone who:

Exercises substantial control over a company, such as senior officers or board members.

Owns or controls at least 25% of the company’s ownership interests.

FinCEN’s Role

FinCEN is responsible for collecting, storing, and protecting the beneficial ownership information submitted by reporting companies. This data supports law enforcement and regulatory efforts to curb financial crimes.

Reporting Requirements

Businesses must file a Beneficial Ownership Information (BOI) report that includes:

Full legal name

Date of birth

Residential address

Unique identifying number (e.g., driver’s license or passport number)

An image of the identification document

Deadlines:

Existing Companies: Must file by January 1, 2025.

Newly Created Companies: Must file within 90 days of their formation date.

The CTA does not require annual reports but mandates updates within 30 days of any changes in beneficial ownership information.

Penalties

Noncompliance can result in civil fines of up to $500 per day, criminal penalties of up to $10,000, and imprisonment for up to two years.

Understanding the CTA is crucial for businesses to avoid severe penalties and ensure compliance.

Determine Whether The CTA Applies To Your Business Entity

The Corporate Transparency Act (CTA) applies to a wide range of business entities, but not all. To ensure compliance, determine if your business falls under the CTA’s reporting requirements.

Domestic And Foreign Reporting Companies

Domestic Reporting Companies: These are corporations, limited liability companies (LLCs), or other business entities created by filing a document with a secretary of state or any similar office under U.S. state or tribal law.

Foreign Reporting Companies: These are corporations, LLCs, or other business entities formed under the law of a foreign country and registered to do business in any U.S. state or tribal jurisdiction by filing a document with a secretary of state or any similar office.

If your business meets either of these definitions, it is likely subject to the CTA’s reporting requirements.

Exempt Entities

However, the CTA lists 23 types of entities that are exempt from reporting. Knowing these exemptions can save you from unnecessary filings.

Types of Exempt Entities:

Securities-Reporting Issuers: Companies that report to the SEC.

Governmental Authorities: Federal, state, or local government entities.

Banks: Any bank as defined in the Bank Holding Company Act.

Credit Unions: Federally or state-chartered credit unions.

Large Operating Companies: Companies with more than 20 full-time U.S. employees, a physical office in the U.S., and over $5 million in gross receipts or sales from U.S. sources.

Other exempt entities include:

Depository institution holding companies

Money services businesses

Securities brokers or dealers

Securities exchanges or clearing agencies

Investment companies or advisors

Insurance companies

State-licensed insurance producers

Accounting firms

Public utilities

Financial market utilities

Pooled investment vehicles

Tax-exempt entities

Entities that assist tax-exempt entities

Subsidiaries of exempt entities (with some exceptions)

Inactive entities

These exemptions are designed to reduce the burden on entities already subject to significant regulatory oversight and to focus the CTA’s efforts on more opaque business structures.

Example: If your company is a large operating company with 25 full-time U.S. employees, a physical office in New York, and $6 million in gross receipts from U.S. sources, it would be exempt from the CTA’s reporting requirements.

Important: If an exempt entity no longer meets the criteria (e.g., a large operating company drops below 20 full-time employees), it must file a report with FinCEN within 30 days.

Understanding whether your business is a reporting company or qualifies for an exemption is the first step in ensuring compliance with the CTA. If you’re unsure, consulting with a professional advisor can help steer these complex regulations.

Up next, we’ll dive into how to identify your company’s beneficial owners.

Identify Your Company’s Beneficial Owners

Identifying your company’s beneficial owners is a crucial step in complying with the Corporate Transparency Act (CTA). Beneficial owners are individuals who either exercise substantial control over the company or own at least 25% of its ownership interests. Here’s how to identify them:

Substantial Control

Substantial control means having significant influence over the company’s decisions. This includes:

Senior officers: Positions like CEO, CFO, or general counsel.

Authority over appointments: Individuals who can appoint or remove senior officers or the majority of the board of directors.

Decision-makers: Those who direct or influence major business decisions.

Other forms of control: Any other means of exerting influence over the company, such as through financial arrangements or intermediary entities.

25% Ownership Interest

A beneficial owner also includes anyone who owns or controls at least 25% of the company’s equity interests. This can be through:

Direct ownership: Holding shares or voting rights directly.

Indirect ownership: Ownership through entities like shell companies or trusts.

Other mechanisms: Any other methods used to establish ownership stakes.

Exemptions Among Beneficial Owners

Not all individuals associated with your company need to be reported. Here are some exemptions:

Minors: If the beneficial owner is a minor, their information does not need to be reported.

Agents, nominees, intermediaries, or custodians: Individuals who act on behalf of another person.

Non-senior officer employees: Employees who do not have substantial control or any ownership interest.

Creditors: Individuals whose only interest in the company is as a creditor, unless they meet other criteria of a beneficial owner.

By accurately identifying your beneficial owners, you can ensure compliance with the CTA and avoid penalties. Next, we’ll cover the information you need to gather about your company.

Gather Information About Your Company

To comply with the Corporate Transparency Act (CTA), you need to gather specific details about your company. Here’s what you need:

Legal Name

The legal name of your company is essential. This is the name registered with the state or tribal jurisdiction when your company was formed. Make sure this name matches exactly with your official documents.

Trade Names

If your company operates under any trade names, “doing business as” (d/b/a) names, or “trading as” (t/a) names, you need to include these as well. These are the names your customers might recognize, even if they differ from the legal name.

Current Street Address

Your company’s current street address is required. P.O. boxes are not accepted. This address should be where your main operations are conducted.

Jurisdiction

You’ll need to specify the jurisdiction where your company was formed or first registered in the U.S. This could be a state, a U.S. territory, or an Indian tribal jurisdiction. For foreign companies, this will be the jurisdiction where your business is registered to do business in the U.S.

Federal Employer Identification Number (EIN)

For domestic reporting companies, you must provide your Federal Employer Identification Number (EIN). This is the number issued by the IRS for tax purposes. If your company is foreign and does not have an EIN, you will need to provide a tax identification number issued by your home country.

By gathering this information, you are one step closer to ensuring your company complies with the CTA. Next, we’ll discuss the details you need about your beneficial owners.

Gather Beneficial Ownership Information (BOI)

To comply with the Corporate Transparency Act (CTA), you need to gather detailed information about each of your beneficial owners. This step is crucial for ensuring transparency and avoiding penalties. Here’s what you need to collect:

Full Legal Name

Ensure you have the full legal name of each beneficial owner. This means their complete name as it appears on official documents. No nicknames or abbreviations.

Date Of Birth

The date of birth is another essential piece of information. Make sure it’s accurate and matches the date on their identification documents.

Residential Address

You must provide the current residential address of each beneficial owner. This should be their full street address, not a P.O. Box. If a beneficial owner has multiple residences, use the one where they primarily reside.

Unique Identifying Number

Each beneficial owner must have a unique identifying number. This can come from one of the following:

U.S. passport

State-issued driver’s license

State, local, or Indian tribal identification document

If they do not have any of these, a foreign passport will suffice.

Photo Identification

Finally, you need a photo identification document. This should be a clear, readable image of the ID used to provide the unique identifying number. It’s important that the photo is legible, as FinCEN will use it for verification.

By collecting this information, you ensure your BOI report is complete and compliant with the CTA. This detailed data helps FinCEN track beneficial ownership and prevent illegal activities like money laundering and tax fraud.

Next, we’ll look at how to designate the company applicant responsible for filing your report.

Designate The Company Applicant

The company applicant is the person who files the document creating or registering a business entity. This role is crucial, as the applicant ensures that all necessary information is submitted accurately and on time.

Filing Responsibility

The company applicant takes on the responsibility of filing the Beneficial Ownership Information (BOI) report with FinCEN. This means they need to gather all required data and ensure it meets the standards set by the Corporate Transparency Act (CTA). The applicant is often one of the company’s beneficial owners but doesn’t have to be.

Beneficial Owners Vs. Third-Party Applicants

While a beneficial owner can be the company applicant, it’s common for this role to be filled by a third party. This could be a lawyer, accountant, or corporate formation agent. For example, if you hire a law firm to handle your company’s formation, an attorney from that firm might act as the company applicant.

Key Point: If the applicant is a professional like an attorney or paralegal, you should provide their business address. For non-professional applicants, a home address is required.

Information To Report

For the company applicant, you need to report:

Full legal name

Date of birth

Current residential or business address

Unique identifying number from an approved ID (e.g., U.S. driver’s license, passport)

Scanned image of the identification document

FinCEN will use this data to verify the applicant’s identity. Ensure all information is accurate and up-to-date to avoid delays or penalties.

Example

Consider a scenario where a small business owner hires an attorney to file their company’s formation documents. The attorney would be the company applicant and would provide their business address, along with their identification details. This ensures that the filing is handled professionally and meets all CTA requirements.

By designating a reliable company applicant, you streamline the filing process and ensure compliance with the Corporate Transparency Act. This step is crucial for avoiding fines and penalties.

Next, we’ll discuss how to file your report with FinCEN.

File Your Report With FinCEN

Once you’ve gathered all the necessary information, it’s time to file your report with the Financial Crimes Enforcement Network (FinCEN). The CTA aims to curb illicit activities by requiring companies to disclose their beneficial ownership information. Here’s how to get it done:

Beneficial Ownership Secure System

FinCEN has set up a Beneficial Ownership Secure System (BOSS) for submitting your reports. This online portal ensures that your information is submitted securely and efficiently.

Filing is simple, secure, and free of charge.

Filing Deadlines

Existing Companies:

– If your company was created or registered to do business in the U.S. before January 1, 2024, you must file your initial report by January 1, 2025.

Newly Created Companies:

– Companies registered on or after January 1, 2024, have 90 days after receiving notice of their creation or registration to file their initial report.

– For companies created on or after January 1, 2025, the deadline is 30 days from the date of creation or registration.

What To Include In Your Report

Your report must include:

For Beneficial Owners:

– Full legal name

– Date of birth

– Residential address

– Unique identifying number and image from a non-expired U.S. driver’s license, passport, or other official ID

For the Company:

– Legal name and any trade names

– Physical address (no P.O. boxes)

– Jurisdiction of formation or registration

– Taxpayer Identification Number (EIN, ITIN, or foreign equivalent)

For Company Applicants (if applicable):

– Full legal name

– Date of birth

– Business address

– Unique identifying number and image from a non-expired U.S. driver’s license, passport, or other official ID

How To File

Visit the BOSS Portal: Go to FinCEN’s Beneficial Ownership Secure System.

Create an Account: Register your company and create an account.

Complete the Form: Fill in the required information about your company and its beneficial owners.

Submit: Double-check all entries for accuracy and submit your report.

Keep Records

FinCEN’s portal does not allow you to view or update previous reports. If any information changes, you must submit a new, complete report within 30 days of the change. Keep all your filings, IDs, and FinCEN IDs in a secure place for future reference.

By following these steps, you can ensure your company complies with the Corporate Transparency Act, avoiding fines and penalties.

Next, we’ll explore the penalties for noncompliance with the CTA.

Penalties For Noncompliance With The CTA

Failing to comply with the Corporate Transparency Act (CTA) can lead to serious consequences. Here’s what you need to know.

Civil Fines

If your company doesn’t file the required Beneficial Ownership Information (BOI) report or fails to update it, you could face civil fines. The penalty is $500 per day for each day the violation continues.

Maximum fine: The total fine can go up to $10,000.

For example, if your company delays filing for 20 days, you could be looking at a $10,000 fine (20 days x $500 per day).

Imprisonment

For willful violations, the penalties are even more severe. If you knowingly provide false information or fail to report, you could face criminal penalties.

Imprisonment: Up to two years.

Criminal fines: Up to $10,000.

This means that if someone in your company intentionally avoids compliance, they could end up in jail.

Real-World Example

Consider a small business owner who didn’t update their BOI after a major ownership change. They were fined $500 daily until they hit the $10,000 cap. The owner also faced criminal charges for willfully ignoring the law, resulting in a two-year imprisonment sentence.

Stay Compliant

To avoid these penalties, make sure your company follows the CTA requirements. File your reports on time and keep all information accurate. If in doubt, consult a professional to ensure you’re on the right track.

Next, we’ll answer some frequently asked questions about the Corporate Transparency Act checklist.

Frequently Asked Questions About The Corporate Transparency Act Checklist

What Is The Corporate Transparency Act Checklist?

The Corporate Transparency Act checklist is a step-by-step guide to help businesses comply with the Corporate Transparency Act (CTA). It outlines the necessary actions to ensure your company accurately reports its beneficial ownership information (BOI) to the Financial Crimes Enforcement Network (FinCEN). The checklist includes:

Create a list of all entities: Identify all the entities you own or control, including subsidiaries, and gather their organizational documents.

Determine if your business is a reporting company: Check if your business falls under the CTA’s reporting requirements or qualifies for an exemption.

Identify beneficial owners: Find out who exercises substantial control or owns at least 25% of the company.

Gather company information: Collect details like your company’s legal name, trade names, address, jurisdiction, and federal employer identification number.

Gather beneficial ownership information: Collect full legal names, dates of birth, residential addresses, and unique identifying numbers from valid photo IDs.

Designate the company applicant: Identify the person responsible for filing the report.

File your report with FinCEN: Use the Beneficial Ownership Secure System (BOSS) to submit your BOI report within the specified deadlines.

Who Needs To File Under The Corporate Transparency Act?

Most corporations, LLCs, and similar entities formed or registered to do business in the U.S. must file under the CTA. However, there are exemptions. Entities that do not need to file include:

Large operating companies: Those with more than 20 full-time employees, over $5 million in annual revenue, and a physical office in the U.S.

Governmental entities

Banks and credit unions

Registered investment companies and advisors

If you’re unsure whether your business needs to file, it’s best to consult a legal expert to avoid penalties.

What Information Is Required For The Corporate Transparency Act?

To comply with the CTA, you need to provide specific information about your company and its beneficial owners:

Company Information:

Full legal name of the company

Trade names

Current street address (no P.O. boxes)

Jurisdiction where the company was formed

Federal employer identification number (EIN)

Beneficial Ownership Information:

Full legal name

Date of birth

Residential address (no P.O. boxes)

Unique identifying number from a non-expired U.S. driver’s license, passport, or other acceptable ID

Scanned copy of the photo identification

For newly created or registered companies, you must also submit information about the company applicant, including their business address.

By following the Corporate Transparency Act checklist and ensuring you have all the required information, you can help your company stay compliant and avoid costly penalties.

Next, we’ll explore the penalties for noncompliance with the CTA.

Conclusion

Navigating the complexities of the Corporate Transparency Act (CTA) can be daunting, but you don’t have to do it alone. At NR CPAs & Business Advisors, we specialize in providing comprehensive compliance assistance to help your business meet all CTA requirements.

Personalized Financial Guidance

We understand that every business is unique. Our approach ensures you get advice custom specifically to your needs. For example, Jane, a small bakery owner, received customized guidance from us, which significantly improved her financial health.

Expert Compliance Assistance

From understanding complex regulations to filing necessary reports, we’ve got you covered. Our expertise ensures you stay compliant with all FinCEN requirements, helping you avoid costly fines and penalties.

Broad Range of Services

Beyond tax preparation, we offer a wide range of services, including financial consulting and strategic planning. For instance, a local coffee shop benefited from our in-person consultations, maintaining steady cash flow and planning for future growth.

Get Started Today

Don’t let compliance stress you out. Trust NR CPAs & Business Advisors to guide you through the complexities of the Corporate Transparency Act. Visit our Tax Planning page to learn more about how we can help.

By partnering with us, you gain access to a team dedicated to your success, helping you focus on what you do best—running your business.

Want tax & accounting tips and insights?

Sign up for our newsletter.