Unlocking the Secrets of Financial Consultants: What You Need to Know

Financial consultant roles might seem confusing, but they are vital for both businesses and individuals seeking a financial boost. Basically, these professionals help you manage money wisely, whether you're planning for retirement, investing, or simply trying to balance a budget. In short, a financial consultant offers expert advice to improve your financial health and reach your goals.

Here's a quick breakdown of what financial consultants do:

Create Financial Plans: They help you with budgeting, saving, and investing strategies custom to your needs.

Long-term Strategies: Advice to ensure financial stability and growth over time.

Investment Choices: Guidance on where to place your money for maximum returns based on your risk tolerance.

Complex Needs: Support for things like estate planning, tax strategies, and insurance necessities.

I'm Nischay Rawal. With over a decade of expertise, particularly as a financial consultant, I've assisted numerous clients in simplifying their financial challenges. This article continues with insights on how financial consultants can aid in effectively managing your finances. Let's dive deeper into their roles.

Image Alt Text: Overview of Financial Consultant Responsibilities - financial consultant infographic infographic-line-5-steps-colors

Financial consultant terminology:

What Does a Financial Consultant Do?

Financial consultants play a key role in helping you steer the complex world of personal finance. Whether it's budgeting, retirement planning, investing, or estate planning, these experts are here to guide you every step of the way.

Budgeting

A solid budget is the foundation of financial health. Financial consultants help you create a realistic budget that aligns with your income and expenses. They assess your financial situation and identify areas where you can save. By doing this, they ensure you have enough to cover your needs and reach your financial goals.

Example: Imagine a family struggling to manage their monthly expenses. A financial consultant can help them track spending, cut unnecessary costs, and allocate funds for future savings.

Retirement Planning

Retirement planning is crucial for a secure future. Financial consultants work with you to determine how much you need to save to enjoy a comfortable retirement. They consider your desired retirement age, lifestyle, and healthcare needs. This personalized plan ensures you won't have to worry about finances during your golden years.

Quote: “Retirement should be as active and rewarding as you want it to be, without financial worries,” says a seasoned consultant.

Investing

Investing is about growing your wealth over time. Financial consultants help you choose the right investments based on your risk tolerance and goals. They monitor your portfolio and make necessary adjustments to maximize returns and minimize risks.

Statistic: Participating in a retirement savings plan is one of the best ways to secure your financial future.

Estate Planning

Estate planning isn't just for the wealthy—it's for anyone who wants to ensure their assets are distributed according to their wishes. Financial consultants help you create wills, trusts, and other legal documents. They also address potential tax implications and legal considerations to preserve your legacy.

Story: Consider a business owner who wants to pass their company to their children. A financial consultant can help set up a trust for a smooth transition.

Financial consultants are essential partners in your financial journey. They offer personalized advice, ensuring you're on the right track to achieving your goals. Next, we'll explore the differences between financial consultants and financial advisors.

Financial Consultant vs. Financial Advisor

When it comes to managing your finances, understanding the distinction between a financial consultant and a financial advisor is crucial. While these terms are often used interchangeably, they serve different roles and can be suited for different needs.

Long-Term Advice

Financial advisors are typically your go-to for long-term financial guidance. They help you plan for lifelong financial goals like retirement, college savings, and estate planning. Their focus is on building a sustained relationship with you to continually adjust your financial strategies as life changes.

Example: Think of a financial advisor as the partner who helps you steer the financial journey from your first job to retirement. They keep an eye on your investments, ensuring they align with your evolving life goals.

Project-Based Solutions

On the other hand, financial consultants often come into play for specific, project-based solutions. They are the experts you call for targeted financial challenges or opportunities. Whether it's optimizing taxes, restructuring a business, or planning an inheritance, consultants provide specialized advice for these distinct situations.

Story: Imagine a business owner aiming to expand operations. A financial consultant can develop a detailed plan for financing the expansion, ensuring the business's financial health remains intact.

Key Differences

Scope of Work: Financial advisors focus on ongoing financial planning, while financial consultants might be hired for specific, short-term projects.

Work Environment: Advisors often work in offices with predictable schedules, whereas consultants may travel frequently and work as outside contractors.

Certifications: Both may hold different certifications, like CFP for advisors and ChFC for consultants, which reflect their specialized expertise.

Understanding whether you need a long-term partner or a project-focused expert can help you choose the right professional for your financial needs.

Next, we'll dig into how financial consultants make money and what to expect when hiring one. Stay with us!

How Financial Consultants Make Money

Financial consultants have unique ways of earning their income, which can be quite different from other financial professionals. Understanding their business model, profit margin, and client base can help you know what to expect when hiring one.

Business Model

Financial consultants operate on various business models. Some work independently, while others are part of larger firms. Independent consultants often have more flexibility in how they charge for their services. They might offer personalized solutions for unique financial challenges, ranging from tax optimization to business restructuring.

Consultants affiliated with firms may have more structured pricing models. These firms usually provide a range of services, and consultants are tasked with delivering specialized advice within this framework. The firm's reputation can add to the consultant's credibility, attracting more clients.

Profit Margin

The profit margin for financial consultants can vary widely. It depends on factors like their experience, the complexity of the services they offer, and the fees they charge. Consultants who specialize in high-demand areas like estate planning or business strategy might command higher fees, leading to greater profit margins.

For example, a consultant who helps a company streamline its operations could charge a premium for saving the company significant costs. This specialized expertise often allows consultants to maintain healthy profit margins.

Client Base

The client base of a financial consultant can range from individuals to large corporations. Some consultants focus on high-net-worth individuals who require detailed financial planning and investment strategies. Others might work with businesses needing advice on mergers, acquisitions, or financial audits.

Image Alt Text: Financial consultants cater to diverse client bases, from individuals to corporations. - financial consultant

Building a strong client base often relies on the consultant's ability to demonstrate value through successful case studies and client testimonials. Word-of-mouth referrals are also crucial, as satisfied clients are likely to recommend their consultant to others.

In summary, financial consultants make money through a combination of specialized expertise, strategic pricing, and a diverse client base. Their ability to adapt to different financial situations and provide custom solutions is key to their success.

Next, we'll explore how much you can expect to pay a financial consultant and the different fee structures they might use.

How Much Do You Pay a Financial Consultant?

When hiring a financial consultant, understand the various ways they might charge for their services. Here's a simple breakdown of the common fee structures you might encounter:

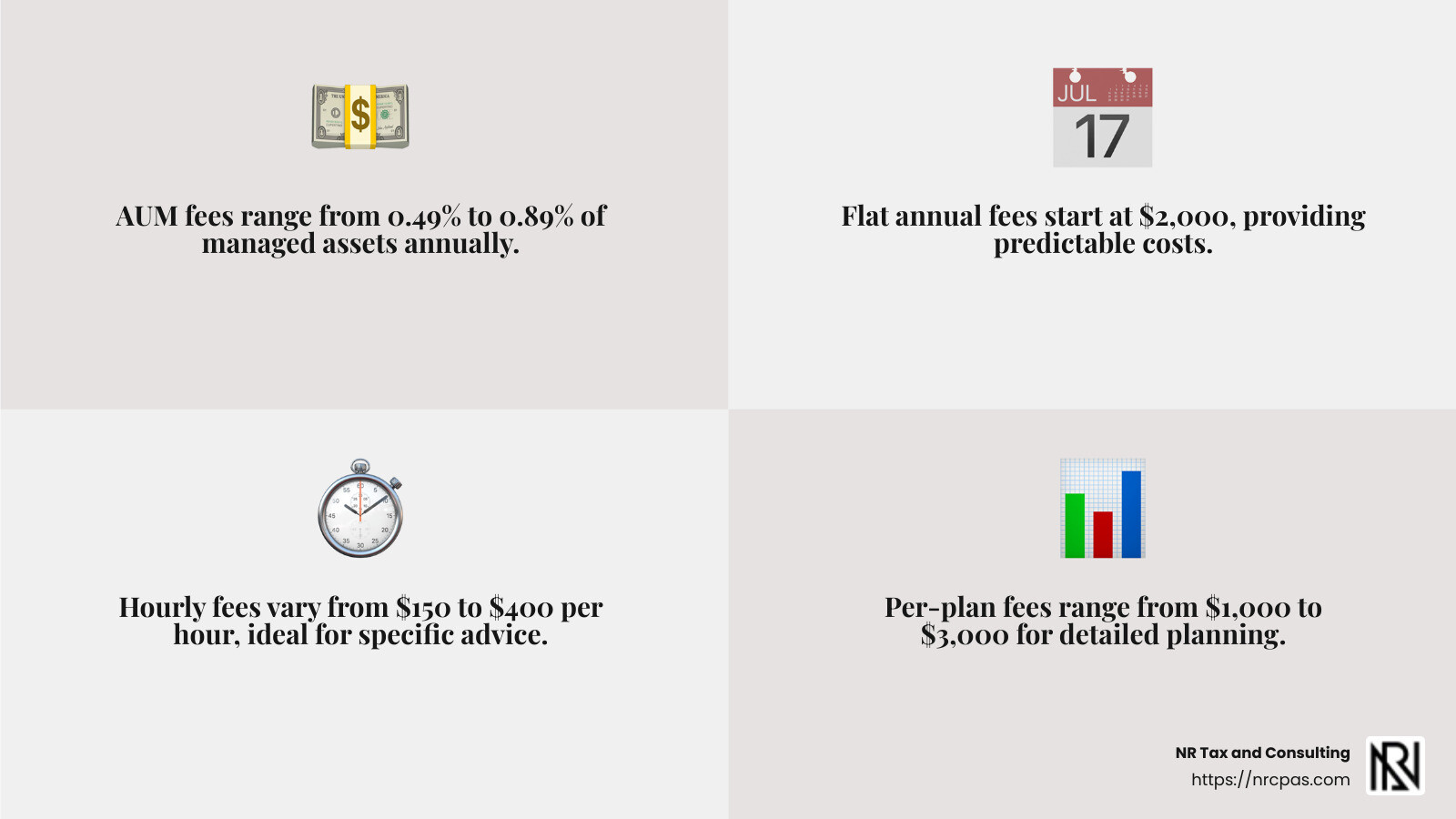

Assets Under Management (AUM) Fees

AUM fees are a popular method where the consultant charges a percentage of the assets they manage for you. Typically, this fee ranges from 0.49% to 0.89% of your total assets annually. For instance, if you have $100,000 in assets, you might pay between $490 and $890 each year. This model aligns the consultant's interests with yours, as they benefit when your assets grow.

Flat Annual Fees

Some consultants prefer a flat annual fee, which remains constant regardless of your asset size. This fee can start at $2,000 per year and go up based on the complexity of your financial situation. This structure provides predictability, allowing you to budget for the consultant's services without surprises.

Hourly Fees

Hourly fees are charged based on the time the consultant spends working on your financial matters. Rates can vary widely, typically ranging from $150 to $400 per hour. This option is ideal if you need specific advice on a one-time basis or for a particular financial project.

Per-Plan Fees

For those seeking a comprehensive financial plan, some consultants offer per-plan fees. These fees are a one-time charge for creating a detailed financial strategy custom to your needs. You can expect to pay between $1,000 and $3,000, depending on the plan's complexity.

Fee Type | Typical Cost | Best For |

|---|---|---|

AUM Fees | 0.49%-0.89% of assets | Ongoing investment management |

Flat Annual Fees | $2,000 and up per year | Comprehensive, ongoing advice |

Hourly Fees | $150-$400 per hour | Specific, one-time advice |

Per-Plan Fees | $1,000-$3,000 per plan | Detailed financial planning |

Image Alt Text: Understanding the costs associated with financial advisor consulting services is crucial for making informed decisions. - financial consultant infographic 4_facts_emoji_grey

Promotions and Discounts

Some financial consultants might offer promotions to attract new clients, such as a 3-Month Satisfaction Guarantee or a $200 reward for transferring assets. Be sure to ask about any available discounts to make the most of your investment in their services.

Understanding these fee structures can help you choose a financial consultant whose services align with your needs and budget. Up next, we'll address frequently asked questions about financial consultants to further clarify your understanding of their role and value. Stay with us!

Frequently Asked Questions about Financial Consultants

What is the difference between a financial advisor and a consultant?

The terms financial advisor and financial consultant are often used interchangeably, but there are subtle differences. A financial advisor typically offers long-term advice on overall financial planning. They focus on helping clients achieve goals like retirement planning, investment management, and estate planning over many years.

In contrast, a financial consultant might tackle narrow problems or specific financial issues. They often work on a project basis, providing targeted solutions for tasks like mergers and acquisitions or company restructuring. This means they might work with a client for a shorter period compared to a financial advisor.

Do financial consultants make money?

Yes, financial consultants do make money, and often quite well. Their income can vary based on their business model and client base. Consultants can earn more than financial analysts, especially if they work with high-profile clients or on complex projects that demand higher fees.

The profit margin for financial consultants can be substantial because they often charge for specialized expertise. Their business model might include different fee structures, such as project-based fees or retainers, allowing them to tailor their services to each client's needs.

How much do you pay a financial consultant?

When it comes to paying a financial consultant, it's crucial to understand the different fee structures:

AUM Fees: These are based on a percentage of the assets managed, typically ranging from 0.49% to 0.89% annually. This fee structure aligns the consultant’s interests with yours since they earn more as your assets grow.

Flat Annual Fees: Some consultants charge a set annual fee, starting at $2,000. This fee provides predictability, as it doesn’t fluctuate with asset size.

Hourly Fees: If you need advice on a specific issue, you might prefer an hourly rate, which can range from $150 to $400 per hour.

Per-Plan Fees: For comprehensive financial planning, you might pay a one-time fee between $1,000 and $3,000, depending on the complexity of the plan.

Understanding these fees will help you choose the right financial consultant for your needs and ensure there are no surprises along the way.

Stay tuned as we dive deeper into how NR Tax and Consulting can provide personalized guidance and local accountant services to meet your financial needs!

Conclusion

At NR Tax and Consulting, we pride ourselves on offering personalized guidance custom to meet your unique financial needs. Our team of experts is dedicated to providing solutions that address your specific challenges and objectives, whether you're planning for retirement, managing investments, or navigating complex tax laws.

We understand that every financial journey is unique. That's why our approach is always custom, ensuring that you receive advice and strategies that are relevant to your situation. One of our success stories involves Jane, a small bakery owner who partnered with us to improve her financial health. With our personalized advice on cash flow management and tax deductions, Jane was able to focus on growing her business effectively.

Moreover, our emphasis on local accountant services means we have a deep understanding of the community and market you operate in. This local focus ensures that we provide relevant and effective solutions, catering to businesses in Miami, FL, and beyond.

Ready to take control of your financial future? Let us help you achieve your goals with our comprehensive financial services. Contact us today to learn how we can support your financial journey.

Want tax & accounting tips and insights?

Sign up for our newsletter.