Unlocking International Tax Solutions: Miami CPA Expertise

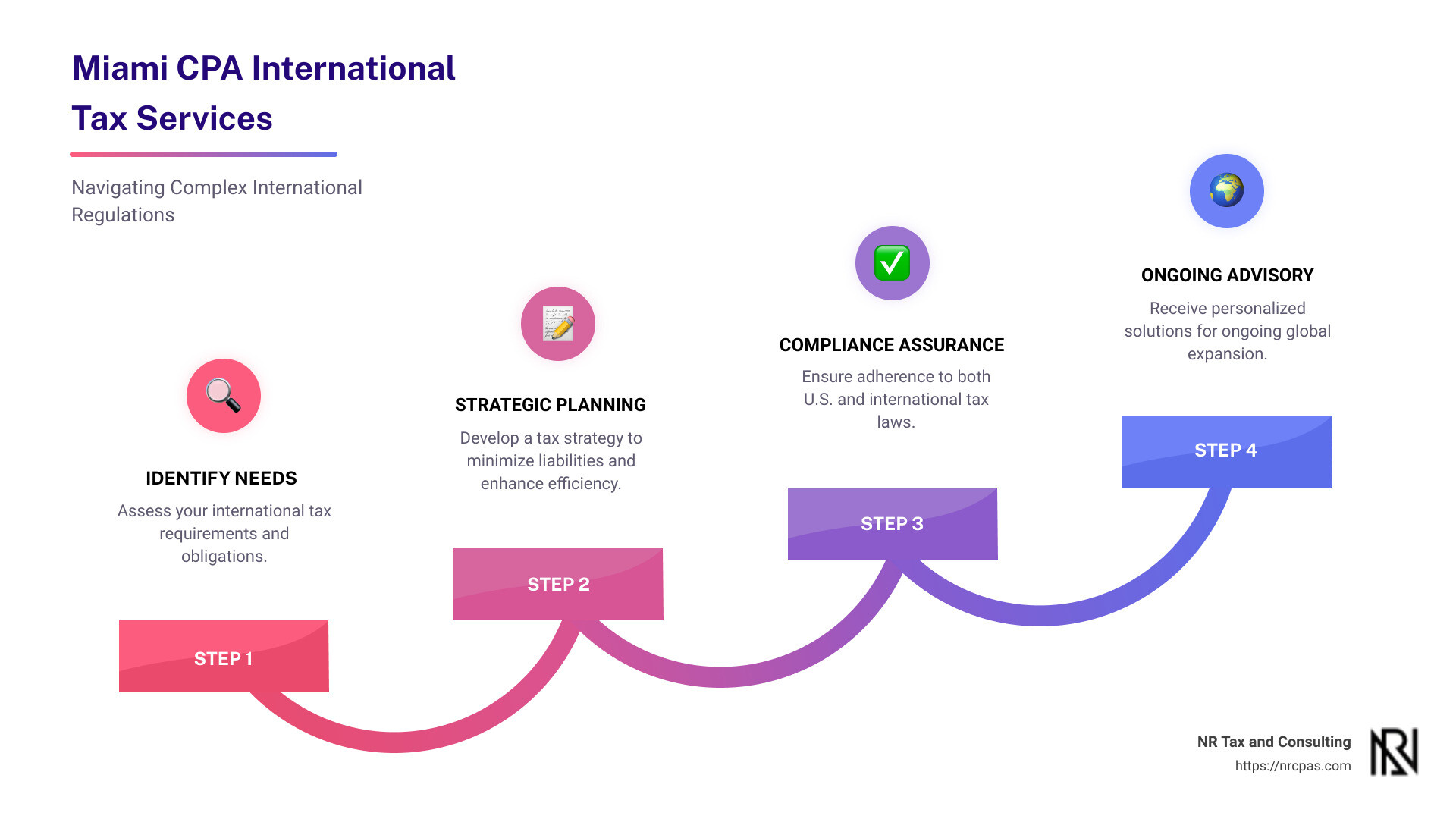

Miami CPA international tax services can be a game-changer for businesses navigating complex international regulations. Whether you're an entrepreneur with overseas interests or a U.S. business exploring new markets, understanding the intricacies of international tax is crucial. Here’s a quick breakdown of what a Miami CPA can offer:

Tax Planning: Strategic advice to minimize liabilities.

Compliance: Ensuring adherence to both U.S. and international tax laws.

Advisory: Personalized solutions to support global expansion.

Finding the right CPA in Miami can save not only on taxes but also on the resources spent managing them, allowing you to focus on growth.

My name is Nischay Rawal, and I've dedicated over a decade to helping clients solve the complexities of Miami CPA international tax. Leveraging this expertise, I aim to offer practical solutions that simplify your tax responsibilities and optimize your financial outcomes.

Image Alt Text: Infographic illustrating international tax solutions offered by a Miami CPA - Miami CPA international tax infographic step-infographic-4-steps

Understanding International Taxation

International taxation is a complex field that impacts both individuals and businesses engaged in cross-border activities. Navigating this landscape requires a deep understanding of local and international tax laws, compliance requirements, and ongoing regulatory developments.

Local and International Taxation

When dealing with international taxation, recognize the interplay between local and international tax systems. Businesses operating in Miami, for example, must comply with U.S. tax regulations while also considering the tax laws of foreign jurisdictions where they conduct business. This dual focus ensures that companies meet their obligations both at home and abroad.

A Miami CPA specializing in international tax can help manage these complexities by providing expertise in areas such as foreign tax credits, which can prevent double taxation on the same income. They can also assist with transfer pricing, ensuring that transactions between related entities in different countries are priced fairly, in line with global standards.

Tax Compliance

Compliance is a critical aspect of international taxation. Companies must adhere to various reporting and documentation requirements, such as the Foreign Account Tax Compliance Act (FATCA) and the Foreign Bank Account Report (FBAR). These regulations aim to prevent tax evasion through offshore accounts and require detailed reporting of foreign financial assets.

A Miami CPA can guide businesses through these compliance challenges, ensuring that all necessary documents are filed correctly and on time. This expertise helps avoid costly penalties and keeps businesses in good standing with tax authorities.

Regulatory Developments

The world of international tax is ever-changing, with new regulations and treaties continually being introduced. For instance, recent proposals from the Biden Administration could significantly alter international tax planning and reporting requirements. Staying informed about these changes is crucial for businesses to remain compliant and capitalize on new opportunities.

Miami CPAs are well-positioned to keep clients updated on these developments, providing timely advice and adjustments to tax strategies as needed. By staying ahead of regulatory changes, businesses can maintain tax efficiency and avoid unexpected liabilities.

In summary, understanding international taxation involves a careful balance of local and global considerations, meticulous compliance, and awareness of regulatory changes. A Miami CPA international tax expert can be an invaluable partner in navigating this intricate field, helping businesses achieve their financial goals while minimizing tax burdens.

Image Alt Text: Understanding international tax complexities - Miami CPA international tax

Miami CPA International Tax Services

In the field of international taxation, partnering with a Miami CPA can open up a suite of services that streamline tax planning, advisory, and compliance. These services are crucial for businesses and individuals navigating the complexities of cross-border financial activities.

Tax Planning

Effective tax planning is the cornerstone of international tax management. A Miami CPA can help you design a tax strategy that aligns with both U.S. and international regulations. This involves understanding tax treaties, leveraging foreign tax credits, and optimizing the structure of your foreign operations to minimize tax liabilities.

Imagine a Miami-based startup expanding into Europe. A skilled CPA can guide the business through the intricacies of international tax laws, ensuring that it benefits from favorable treaty provisions and avoids double taxation. By doing so, the business can focus on growth rather than getting bogged down by tax complexities.

Tax Advisory

Beyond planning, Miami CPAs offer expert tax advisory services that provide personalized guidance tailored to your unique situation. Whether you're a multinational corporation or an individual with overseas investments, having a knowledgeable advisor can make all the difference.

Consider the case of a real estate investor acquiring properties in multiple countries. A Miami CPA can advise on the most tax-efficient ownership structures, taking into account local tax laws and potential deductions. This strategic advice not only maximizes returns but also ensures compliance with international regulations.

Compliance Services

Compliance is non-negotiable in international taxation. With a myriad of reporting requirements, such as FATCA and FBAR, businesses must maintain meticulous records and submit accurate reports to avoid penalties. A Miami CPA can handle these tasks, ensuring that all filings meet the necessary standards.

For example, a company with subsidiaries in different countries must navigate varying tax regimes and reporting obligations. A Miami CPA can coordinate these efforts, ensuring that the company remains compliant across all jurisdictions. This proactive approach not only mitigates risks but also improves the company's reputation with stakeholders and tax authorities.

In conclusion, the expertise of a Miami CPA international tax specialist is invaluable for effective tax planning, advisory, and compliance services. By partnering with a knowledgeable CPA, businesses and individuals can navigate the complexities of international taxation with confidence, optimizing their tax positions and achieving their financial objectives.

Key Challenges in International Taxation

Navigating international taxation is like solving a puzzle with constantly shifting pieces. Businesses and individuals face several key challenges, including regulatory problems, tax structuring, and transfer pricing complexities.

Regulatory Challenges

International tax regulations are a moving target. Each country has its own set of rules, which can change frequently. For example, the Biden Administration's proposed international tax changes are expected to significantly impact tax planning and compliance strategies. Staying updated with these changes is crucial but daunting.

A Miami CPA with expertise in international tax can help businesses keep pace with regulatory developments. They ensure compliance with local and international laws, helping to avoid costly penalties. For instance, businesses operating in multiple countries must adhere to the Foreign Account Tax Compliance Act (FATCA) and other reporting requirements like FBAR. A skilled CPA can streamline these processes, ensuring accurate and timely submissions.

Tax Structuring

Effective tax structuring is essential for minimizing tax liabilities. This involves selecting the right entity type, choosing optimal jurisdictions, and leveraging tax treaties. However, structuring for tax efficiency while remaining compliant is complex.

Consider a multinational corporation looking to expand its operations. A Miami CPA can guide the company through the process of setting up subsidiaries or branches in foreign countries. By understanding the nuances of tax treaties, they can structure operations to minimize withholding taxes and avoid double taxation, thus enhancing profitability.

Transfer Pricing

Transfer pricing is a critical issue for companies with cross-border transactions. It involves setting prices for goods, services, or intellectual property transferred between related entities in different countries. The challenge lies in setting prices that comply with local regulations while optimizing tax outcomes.

A Miami CPA can assist with developing a robust transfer pricing strategy that aligns with both U.S. and international guidelines. For example, they can help document and justify pricing decisions to tax authorities, minimizing the risk of audits and adjustments.

In summary, addressing these key challenges in international taxation requires a strategic approach. A Miami CPA international tax expert can provide the necessary guidance to steer regulatory changes, optimize tax structures, and manage transfer pricing effectively. This expertise not only ensures compliance but also positions businesses for global success.

Benefits of Hiring a Miami CPA for International Tax

Tax Efficiency

Engaging a Miami CPA for international tax matters can significantly boost tax efficiency. A skilled CPA understands the intricacies of tax laws across different jurisdictions. They can help businesses and individuals leverage tax treaties and credits to reduce overall tax liabilities. For instance, they might identify opportunities for Foreign Tax Credit (FTC) planning to avoid double taxation on income earned abroad.

By optimizing tax structures, a CPA ensures that you're not leaving money on the table. This might involve advising on entity selection or identifying applicable tax incentives. The result? More money stays in your pocket, enhancing your financial health and supporting business growth.

Global Compliance

Staying compliant with tax regulations globally is no small feat. Each country has its own rules, and failing to comply can result in hefty fines. A Miami CPA specializing in international tax can help you steer these waters. They keep abreast of regulatory changes, ensuring your business meets all local, national, and international filing requirements.

For example, if you're involved in cross-border transactions, a CPA can assist with compliance under the Foreign Account Tax Compliance Act (FATCA). They ensure that all necessary reports, like FBAR, are filed accurately and on time, mitigating the risk of penalties.

Personalized Guidance

Every business and individual has unique tax needs. A Miami CPA offers personalized guidance custom to your specific situation. They take the time to understand your goals, whether you're expanding internationally or investing in foreign assets.

This personalized approach means you receive strategies that align with your objectives. Whether it's pre-immigration planning, compensation planning, or residency issues, a CPA provides advice that fits your unique circumstances. Their expertise can help you make informed decisions, ensuring that your international tax strategy supports your broader financial goals.

In conclusion, hiring a Miami CPA international tax expert offers numerous benefits. From enhancing tax efficiency and ensuring global compliance to providing personalized guidance, a CPA is an invaluable partner in navigating the complexities of international taxation.

Frequently Asked Questions about Miami CPA International Tax

What services do Miami CPAs offer for international tax?

Miami CPAs provide a range of services custom to the complexities of international tax. They offer tax planning to help clients structure their business operations in a tax-efficient manner. This includes advising on foreign tax credits, transfer pricing, and cross-border transactions.

Compliance services are another critical offering. CPAs ensure that businesses and individuals meet all necessary local, national, and international tax filing requirements. They help with implementing anti-money laundering compliance programs and ensure adherence to regulations like the Foreign Account Tax Compliance Act (FATCA).

In addition, Miami CPAs provide advisory services. They assist with strategic decisions such as entity selection, organizational structuring, and treaty positions. This guidance helps clients steer the complex international tax landscape effectively.

How can a Miami CPA help with international tax compliance?

A Miami CPA plays a crucial role in maintaining regulatory compliance. They stay updated on the ever-changing tax laws across different jurisdictions, ensuring that clients are always compliant. This proactive approach helps in avoiding penalties and fines associated with non-compliance.

For example, CPAs assist with the accurate and timely filing of reports like the FBAR for foreign accounts. They also help businesses understand and comply with the nuances of various tax treaties, ensuring that all international transactions are reported correctly.

Why choose a Miami CPA for international tax solutions?

Choosing a Miami CPA for international tax solutions offers several advantages. Their expertise in international taxation means they can provide informed and strategic advice. They understand the global tax environment and can help clients optimize their tax positions.

Moreover, Miami CPAs offer personalized service. They take the time to understand each client's unique situation and goals. Whether you're a multinational corporation or an individual with foreign investments, a CPA can tailor their services to meet your specific needs.

This combination of expertise and personalized service ensures that clients receive effective and efficient tax solutions, helping them achieve significant tax savings. By leveraging their knowledge, Miami CPAs can help clients minimize their tax liabilities while staying compliant with global tax regulations.

Conclusion

At NR Tax and Consulting, we understand the complexities of international taxation and how they can affect your business or personal finances. Our team of experts is dedicated to providing expert financial guidance custom to your unique needs.

Navigating the intricate web of international tax laws can be overwhelming. That's why we offer custom solutions designed to fit your specific situation. Whether you're managing cross-border transactions or dealing with foreign tax credits, we have the expertise to help you succeed.

Our approach is simple: we listen, we plan, and we execute. We take the time to understand your goals and challenges, ensuring that our strategies align with your objectives. This personalized service is what sets us apart and helps our clients achieve tax efficiency and global compliance.

If you're ready to open up the potential of your international ventures with the help of a Miami CPA international tax expert, get in touch with us today. Let us guide you through the complexities of international tax, so you can focus on what truly matters—growing your business and achieving your financial goals.

Want tax & accounting tips and insights?

Sign up for our newsletter.