Unlocking Excellence: Best Certified Financial Planning Services

Certified financial consultant best financial planning service is a phrase synonymous with financial excellence. In today's world, managing finances effectively is essential for success, particularly for small business owners who are often juggling numerous responsibilities. For those seeking clarity and strategic direction, certified financial consultants provide invaluable support by delivering custom plans that optimize financial outcomes and help achieve long-term objectives.

Here's why certified financial consultants are considered the best in their field:

Expertise: Certified financial consultants come equipped with top-notch credentials like CFP and ChFC, ensuring they're well-versed in comprehensive financial planning and investment advice.

Fiduciary Duty: They prioritize your interests, offering trusted guidance that's custom to your unique financial situation.

Holistic Approach: From retirement planning to asset management and tax strategies, certified consultants craft detailed plans to secure your financial future.

I am Nischay Rawal, and with over a decade of experience in accounting and financial consulting, I've helped numerous individuals and businesses steer their financial landscapes. At NR Tax and Consulting, our mission is to provide certified financial consultant best financial planning service that aligns with your specific goals, promoting growth and financial optimization.

Image Alt Text: Key features of certified financial consultant services: Expertise, Fiduciary Duty, Holistic Approach - certified financial consultant best financial planning service infographic infographic-line-5-steps-blues-accent_colors

Certified financial consultant best financial planning service definitions:

Understanding Financial Planning Services

Financial planning is like a roadmap for your money. It helps you see where you are now and where you want to go. At its core, financial planning involves making smart decisions about your finances to achieve your goals.

Investment Advice

Investing can be confusing, especially with so many options out there. A certified financial consultant provides investment advice that aligns with your financial goals and risk tolerance. They help you choose the right mix of stocks, bonds, and other assets to maximize growth while managing risk.

For example, if you're saving for a child's education, your advisor might suggest a college savings plan that offers tax benefits and growth potential.

Retirement Planning

Retirement planning ensures you have enough money to live comfortably in your later years. Advisors consider factors like your desired retirement age, lifestyle, and healthcare needs. They help you determine how much to save and the best ways to grow your retirement funds.

A financial advisor might say, “Retirement should be as active and rewarding as your working years, without the stress of financial worries.”

Tax Strategy

Taxes can take a big bite out of your earnings. A tax strategy helps minimize what you owe and maximize your savings. Financial consultants analyze your situation and recommend ways to reduce your tax burden. This might include tax-advantaged accounts, deductions, or credits.

Consider a business owner who wants to pass their company to their children. A financial advisor can set up a trust to ensure a smooth transition while minimizing taxes.

These services are integral parts of a comprehensive financial plan. They ensure that all aspects of your financial life work together to build a secure future. Whether it's investment advice, retirement planning, or tax strategy, a certified financial consultant offers personalized guidance to help you achieve your goals.

Certified Financial Consultant: Best Financial Planning Service

When it comes to financial planning, having a certified financial consultant by your side can make a world of difference. These professionals aren't just advisors; they are your partners in navigating the complex world of finance.

What Sets Certified Financial Consultants Apart?

Certified financial consultants are more than just financial advisors. They are experts who adhere to the highest fiduciary standard. This means they are legally obligated to act in your best interest, ensuring that your financial well-being is their top priority.

Consider the case of a family planning for their children's education while also saving for retirement. A certified financial consultant can create a personalized plan that balances both goals, ensuring that immediate needs don't compromise long-term objectives.

Personalized Guidance Custom to You

One of the standout features of working with a certified financial consultant is the personalized guidance they offer. Unlike one-size-fits-all solutions, these consultants take the time to understand your unique financial situation, goals, and challenges.

They provide custom advice, whether you're looking to invest for growth, plan for retirement, or develop a tax strategy. For instance, if you're a small business owner, a consultant might help you find tax-efficient ways to reinvest profits into your business, maximizing growth while minimizing tax liabilities.

The Fiduciary Standard: Your Best Interest First

Working with a consultant who upholds the fiduciary standard ensures that your interests are always prioritized. Unlike some advisors who might push products for commission, certified financial consultants recommend strategies and solutions that truly benefit you.

This commitment to your best interest is what makes certified financial consultants the best choice for comprehensive financial planning services. They offer peace of mind, knowing that the advice you receive is unbiased and focused on helping you achieve your financial goals.

In summary, choosing a certified financial consultant means choosing a partner dedicated to open uping your financial excellence. With their expertise, fiduciary duty, and personalized approach, they provide the best financial planning service to guide you towards a secure financial future.

Top Financial Certifications for Consultants

In financial planning, certifications matter. They show a consultant's expertise and dedication. Let's explore some of the top certifications that set the best consultants apart.

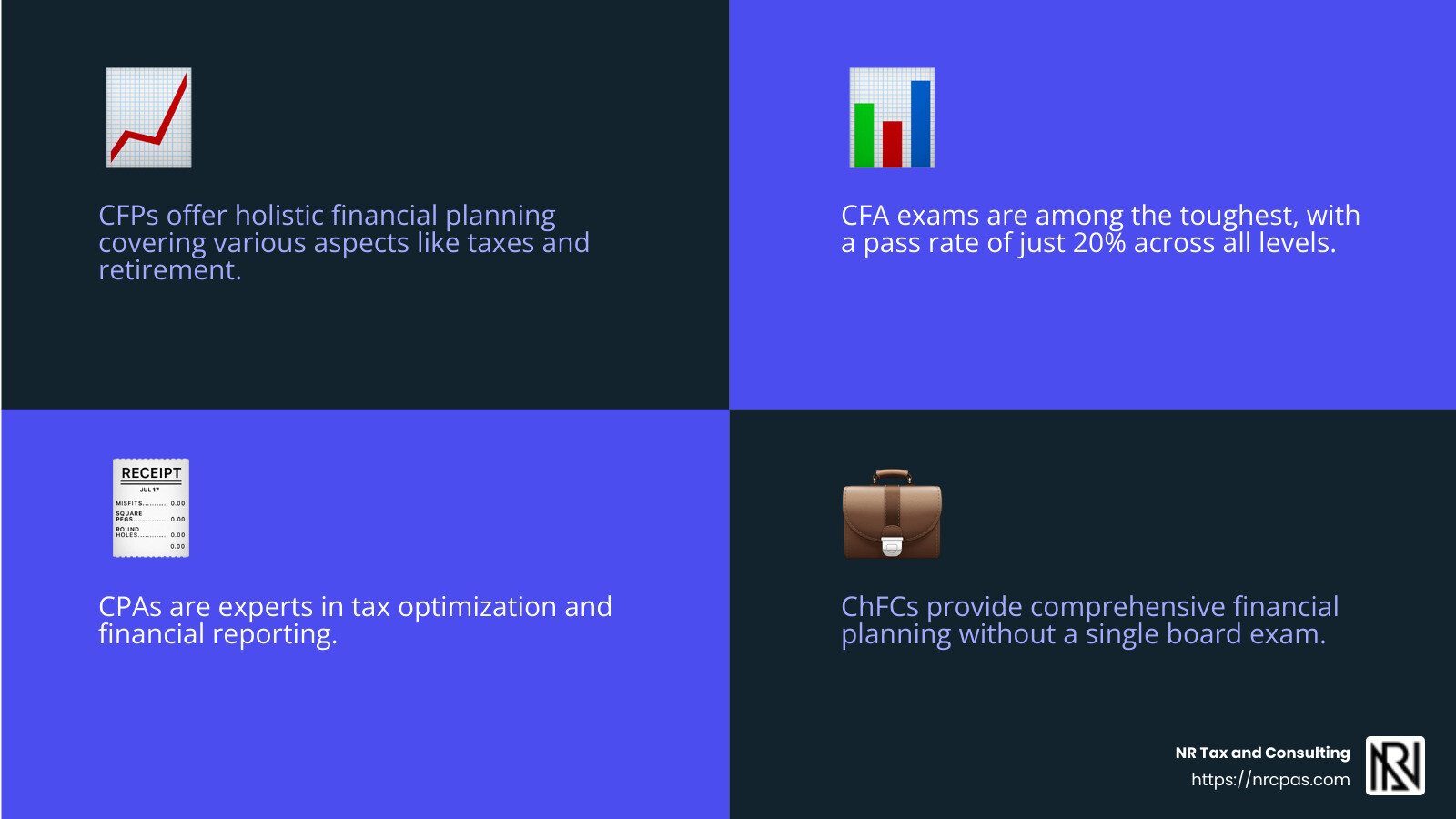

Certified Financial Planner (CFP®)

A Certified Financial Planner (CFP®) is like the gold standard in financial planning. They undergo rigorous training and must pass a tough exam. CFPs are committed to ethical standards and must always put your interests first. They offer holistic financial planning, helping with everything from taxes to retirement.

Fun Fact: It takes about 12-18 months to complete the required coursework and exam to become a CFP.

Chartered Financial Analyst (CFA®)

A Chartered Financial Analyst (CFA®) specializes in investments. CFAs are experts in portfolio management and financial analysis. They work well with clients who have significant assets and need expert investment advice. The CFA exam is known for being one of the toughest in the finance industry.

Did You Know? The pass rate for all three levels of the CFA exam is just 20%.

Certified Public Accountant (CPA)

When you think of taxes, think of a Certified Public Accountant (CPA). CPAs are not just tax experts; they are also skilled in financial reporting and audits. They help keep your finances in check and can save you money by optimizing your tax strategy.

Interesting Tidbit: The CPA certification has been around since the late 19th century!

Chartered Financial Consultant (ChFC®)

A Chartered Financial Consultant (ChFC®) is similar to a CFP, offering comprehensive financial planning. The ChFC designation requires more coursework but no comprehensive board exam. This makes it a great choice for those who prefer an in-depth study without the pressure of a single exam.

Quick Note: The ChFC program covers topics like behavioral finance and planning for special needs families.

Retirement Income Certified Professional (RICP®)

The Retirement Income Certified Professional (RICP®) focuses on retirement planning. They help clients manage retirement income, claim Social Security, and steer Medicare. RICPs ensure that your retirement years are financially secure and stress-free.

Key Insight: RICPs are trained to understand all factors impacting retirement, from healthcare to taxation.

Image Alt Text: The RICP certification is sought by experienced financial advisors, lawyers, accountants, and bankers. - certified financial consultant best financial planning service infographic 4_facts_emoji_blue

These certifications ensure that financial consultants are equipped with the knowledge and skills to provide top-notch advice. When choosing a financial consultant, looking for these designations can help ensure you're getting the best service possible.

How to Choose the Right Financial Planning Service

Choosing the right financial planning service can feel overwhelming, but breaking it down into key factors makes it easier. Here's what to consider:

Advisor Fees

Understanding how financial advisors charge is crucial. Fees can be structured in several ways:

Assets Under Management (AUM): A percentage of your total assets, often around 1%. This can be costly if you have substantial assets.

Flat Fees: A set amount per year, which can be more predictable.

Hourly Rates: Pay for the time spent on your financial planning.

Per-Plan Fees: A one-time fee for creating a specific financial plan.

Always ask, "How do you charge for your services?" and "Are there any additional fees?"

Fiduciary Responsibility

A fiduciary is legally required to act in your best interest. Not all financial advisors are fiduciaries, so it's important to confirm this. Working with a fiduciary helps ensure that the advice you receive is unbiased and custom to your needs.

Quote: "You’ll likely want to work with an advisor who’s a fiduciary, which means they’re required to put your interests before their own or their firm’s."

Service Needs

Identify what you need from a financial planner. Are you looking for investment advice, retirement planning, or tax strategy? Some advisors specialize in certain areas, so ensure their expertise aligns with your goals.

Investment Advice: Ideal if you're focused on growing your assets.

Retirement Planning: Crucial for ensuring a comfortable future.

Tax Strategy: Helps in optimizing your finances through effective tax planning.

In-Person vs. Online

Decide whether you prefer meeting face-to-face or are comfortable with virtual consultations.

In-Person: Offers a personal touch and may be preferable for complex situations.

Online: Often more convenient and can be less expensive. Many online services still offer personalized advice through video calls or chats.

Case Study: A family working with a financial advisor might receive a detailed plan to save for their children’s college education while also building a retirement fund, demonstrating the value of custom financial planning.

Choosing the right certified financial consultant best financial planning service involves evaluating these factors based on your personal preferences and financial goals. This ensures you get the most value and expertise for your needs.

Frequently Asked Questions about Financial Planning Services

What is the most recognized professional designation for financial planners?

When it comes to financial planning, the Certified Financial Planner (CFP) designation stands out as the most recognized. This credential is highly respected because it requires rigorous training and adheres to strict ethical standards. According to the Certified Financial Planner Board of Standards, CFPs must pass a comprehensive exam and commit to ongoing education. They also have a fiduciary duty, meaning they must always act in their clients' best interests.

How much does a certified financial planner cost?

The cost of hiring a certified financial planner can vary significantly based on how they charge for their services. Here are some common fee structures:

Assets Under Management (AUM): Typically ranges from 0.49% to 0.89% of your assets annually. For a $100,000 portfolio, this could mean paying between $490 and $890 per year.

Flat Annual Fees: These can start at around $2,000 per year, regardless of asset size, providing a predictable cost for comprehensive advice.

Hourly Rates: Often between $150 and $400 per hour, making it a good option for those who need specific, one-time advice.

Per-Plan Fees: Usually range from $1,000 to $3,000 for a detailed financial plan, depending on complexity.

Understanding these costs helps you decide which payment method aligns best with your budget and needs.

What's the difference between a certified financial advisor and a certified financial planner?

The terms "financial advisor" and "financial planner" are often used interchangeably, but they can refer to different specialties:

Financial Advisor: A broad term that includes various roles such as investment managers, stockbrokers, and consultants. They may offer a range of services, including investment advice and asset management.

Financial Planner: Focuses more on creating comprehensive plans to help clients meet their financial goals. They often specialize in areas like retirement planning, tax strategy, and estate planning.

Both professionals can hold certifications like the CFP, but it's crucial to understand their specialties and fiduciary responsibilities to ensure they meet your specific financial needs.

Conclusion

Navigating financial planning can be complex, but NR Tax and Consulting is here to simplify the journey for you. Our approach is centered around offering personalized financial guidance that aligns with your unique goals and needs. We believe that every client deserves custom advice that considers their specific financial situation.

At NR Tax and Consulting, we pride ourselves on our expert consulting services. Our team stays up-to-date with the latest financial trends and regulations to provide you with the most relevant and effective strategies. Whether it's investment advice, retirement planning, or tax optimization, we are committed to helping you make informed decisions that can lead to financial success.

By choosing us, you're not just getting a service; you're entering a partnership with a team dedicated to your financial well-being. We understand the importance of trust and integrity, which is why we uphold the highest standards in all our interactions.

Ready to take control of your financial future? Contact us today to learn more about how our certified financial consultant services can help you achieve your goals. Let's open up excellence together.

Want tax & accounting tips and insights?

Sign up for our newsletter.