Taxing Times: How to Plan for Cryptocurrency Gains

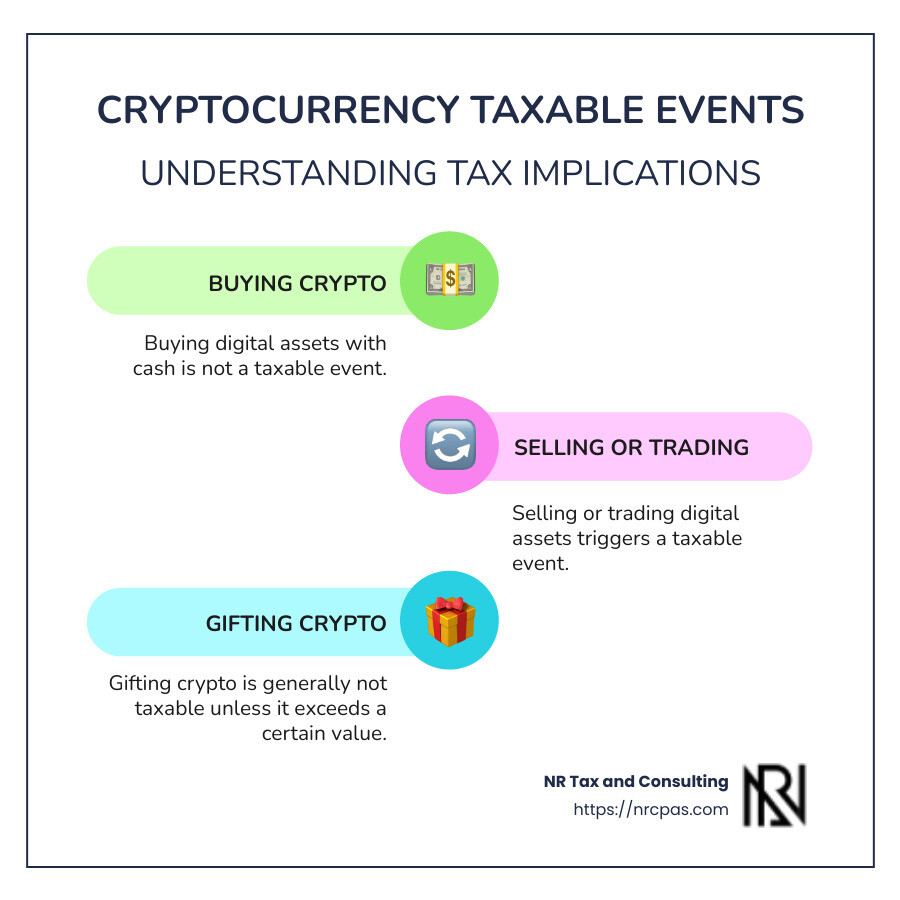

Cryptocurrency tax planning is becoming a crucial aspect of financial management as more individuals and businesses begin to accept digital currencies like Bitcoin and Ethereum. In short, if you're dealing with digital currencies, it's important to understand that the IRS treats cryptocurrencies as property, which means every transaction could be a taxable event. Here's a quick snapshot:

Buying digital assets with cash: Not taxable.

Selling or trading digital assets: Taxable event.

Gifting crypto: Generally not taxable unless it exceeds a certain value.

Receiving crypto as payment: Considered ordinary income and taxable.

Keeping track of these transactions is essential to avoid penalties and to ensure compliance with IRS regulations.

As the founder of NR Tax & Consulting, I've dedicated over a decade to helping clients steer the complexities of taxation, including cryptocurrency tax planning. My expertise lies in simplifying these processes, ensuring that even the most challenging aspects of digital asset taxation are manageable. Let's dig deeper into how you can smartly plan and report your cryptocurrency transactions.

Image Alt Text: Infographic on Taxable and Non-Taxable Cryptocurrency Events - cryptocurrency tax planning infographic infographic-line-3-steps-colors

Understanding Cryptocurrency Taxation

When it comes to cryptocurrency tax planning, the IRS has a clear stance: cryptocurrencies are treated as property, not currency. This classification has significant implications for how your digital transactions are taxed.

Property Classification

Imagine buying a house. When you sell that house, any profit (or loss) is subject to capital gains tax. Cryptocurrencies work the same way. Whether you're trading Bitcoin or selling NFTs, you're dealing with property. This means each transaction could result in a capital gain or loss. It's crucial to keep detailed records of your transactions to accurately report them come tax season.

Capital Gains

Capital gains are the profits you make from selling your crypto for more than you paid for it. These gains can be short-term or long-term, depending on how long you held the asset before selling. Short-term gains (assets held for a year or less) are taxed at your regular income tax rate, which can be as high as 37%. Long-term gains, on the other hand, enjoy lower tax rates, typically 0%, 15%, or 20%, depending on your total income.

Ordinary Income

Not all crypto-related income is treated as capital gains. If you receive cryptocurrency as payment for goods or services, it's considered ordinary income. This is just like receiving a paycheck, and it must be reported as such on your tax return. Mining and staking rewards also fall under this category. The fair market value of the crypto on the day you receive it is what you'll report as income.

Image Alt Text: Example of how crypto taxes work - cryptocurrency tax planning infographic 4_facts_emoji_blue

Why It Matters

Understanding these distinctions is crucial for effective cryptocurrency tax planning. Misclassifying your crypto transactions can lead to incorrect tax filings and potential penalties. This is why it's important to keep accurate records and consult with tax professionals who understand the nuances of digital asset taxation.

In the next section, we'll explore strategies to help you smartly plan your cryptocurrency transactions and minimize your tax liabilities.

Cryptocurrency Tax Planning Strategies

When it comes to cryptocurrency tax planning, having the right strategies in place can make all the difference. Let's explore some key approaches: long-term holding, tax-loss harvesting, and gifting crypto.

Long-term Holding

Holding onto your cryptocurrency for more than a year can significantly reduce your tax burden. Why? Because long-term capital gains are taxed at lower rates compared to short-term gains. For instance, if you sell your crypto after holding it for over a year, you might pay as little as 0% in taxes, depending on your income bracket. Compare that to short-term gains, which can be taxed as high as 37%!

Image Alt Text: Holding crypto for more than a year can lower your tax rate from 37% to as low as 0% - cryptocurrency tax planning infographic 4_facts_emoji_grey

Tax-Loss Harvesting

Tax-loss harvesting is like making lemonade out of lemons. If your crypto investments have taken a dive, you can sell these underperforming assets to offset your capital gains from other investments. This strategy can help reduce your overall tax liability.

Here's how it works:

Sell the crypto at a loss.

Use the loss to offset gains from other profitable investments.

Reduce your taxable income.

However, remember the "wash sale rule" doesn't apply to crypto. This means you can buy back the same crypto asset without waiting 30 days, unlike stocks.

Gifting Crypto

Did you know that gifting crypto can be a smart tax move? When you gift cryptocurrency, it's not considered a taxable event. You can give up to $15,000 per recipient annually without incurring gift taxes. Plus, if you donate your crypto to a qualified charity, you might be eligible for a charitable deduction. This can be a win-win if you're looking to support a cause and reduce your tax bill.

Key Takeaway

These strategies—long-term holding, tax-loss harvesting, and gifting crypto—can help you steer the complex world of cryptocurrency taxes. By planning ahead and making informed decisions, you can minimize your tax liabilities and keep more of your gains.

In the next section, we'll dive into how to report your cryptocurrency transactions on your taxes, ensuring you stay compliant with IRS guidelines.

How to Report Cryptocurrency on Your Taxes

Reporting your cryptocurrency transactions to the IRS might seem daunting, but it's crucial to stay compliant and avoid penalties. Here's a simple guide to help you steer through the process using Form 8949 and Schedule D.

Understanding Form 8949

Form 8949 is where you list all your cryptocurrency transactions. Think of it as your crypto diary. You'll need to include:

Date you acquired the crypto

Date you sold or disposed of it

Proceeds from the sale

Cost basis (what you originally paid)

Gain or loss from each transaction

This form is essential because it provides the IRS with detailed information about your crypto activities. Once you've filled out Form 8949, you'll transfer the totals to Schedule D.

Completing Schedule D

Schedule D is where you summarize your capital gains and losses. This form helps determine your overall tax liability. Here's what you need to do:

Summarize the totals from Form 8949

Separate short-term gains (held for less than a year) from long-term gains (held for more than a year)

Calculate your net gain or loss

The IRS uses this information to assess your tax rate. Long-term gains are taxed at a lower rate than short-term gains, making it beneficial to hold onto your crypto for over a year.

IRS Guidelines to Keep in Mind

The IRS treats cryptocurrencies as property, not currency. This means every transaction, whether it's a sale, trade, or purchase, could have tax implications. Here are a few guidelines to remember:

Report all transactions, even if they don't result in a gain.

Keep detailed records of your crypto activities, including dates, amounts, and transaction details.

Use reliable tax software or consult with a tax professional to ensure accuracy.

By following these steps and staying informed, you can confidently report your cryptocurrency transactions and remain in good standing with the IRS. In the next section, we'll explore how to calculate your cryptocurrency gains accurately, focusing on cost basis and different accounting methods like FIFO and LIFO.

Calculating Your Cryptocurrency Gains

When it comes to cryptocurrency tax planning, understanding how to calculate your gains is key. Let's break down the essentials: cost basis, FIFO, LIFO, and HIFO.

Cost Basis: Your Starting Point

The cost basis is what you originally paid for your crypto, including any fees. It's like the starting line in a race. Knowing your cost basis is crucial because it helps determine your gain or loss when you sell or trade your crypto.

Bought Bitcoin at $10,000? That's your cost basis.

Paid $100 in fees? Add that to your cost basis, making it $10,100.

If you received crypto as a gift or mined it, the cost basis might differ. For gifts, use the giver's original cost basis or the fair market value at the time of the gift, whichever is lower. For mined crypto, use the fair market value at the time you mined it.

FIFO, LIFO, and HIFO: Which Method to Choose?

Once you know your cost basis, you need to decide on a method to calculate your gains: FIFO, LIFO, or HIFO.

FIFO (First In, First Out): The first coins you bought are the first ones you sell. If you bought Bitcoin at $10,000 and later at $12,000, FIFO assumes you sold the $10,000 Bitcoin first.

LIFO (Last In, First Out): The last coins you bought are the first ones you sell. In the same scenario, LIFO assumes you sold the $12,000 Bitcoin first.

HIFO (Highest In, First Out): Sell the coins with the highest cost basis first. If you bought Bitcoin at $10,000, $12,000, and $15,000, HIFO assumes you sell the $15,000 Bitcoin first.

Each method can impact your taxable gains differently. For example, using LIFO might result in lower gains if prices have risen, potentially reducing your tax bill.

Why Choosing the Right Method Matters

Your choice of method can significantly affect your tax liability. Here's a quick example:

FIFO Example: You sell Bitcoin bought at $10,000 for $20,000. Your gain is $10,000.

LIFO Example: You sell Bitcoin bought at $15,000 for $20,000. Your gain is $5,000.

As you can see, LIFO results in a lower taxable gain in this scenario. Choose wisely based on your financial situation and consult with a tax advisor if needed.

Understanding these methods and keeping accurate records can make a big difference in your cryptocurrency tax planning. In the next section, we'll tackle some frequently asked questions about cryptocurrency tax planning, including the best tax methods and how much tax you might need to pay.

Frequently Asked Questions about Cryptocurrency Tax Planning

When diving into cryptocurrency tax planning, it's natural to have questions. Let's tackle some of the most common queries.

What is the Best Tax Method for Crypto?

Choosing the right tax method for your crypto transactions can impact how much tax you owe. The three main methods are FIFO, LIFO, and HIFO.

FIFO (First In, First Out): This method assumes the first coins you bought are the first you sell. It's straightforward and often used by default.

LIFO (Last In, First Out): Here, the last coins you bought are the first to be sold. This can be beneficial if crypto prices have increased over time, potentially lowering your taxable gains.

HIFO (Highest In, First Out): This method involves selling the coins with the highest cost basis first. It can minimize gains and, therefore, taxes.

Each method has its pros and cons. LIFO could reduce your tax bill if prices have risen significantly since your last purchase. However, always consult with a tax professional to choose the best approach for your situation.

How Much Tax Do I Need to Pay for Cryptocurrency?

The amount of tax you owe on crypto depends on whether your gains are short-term or long-term.

Short-Term Gains: These occur when you hold crypto for less than a year before selling. They're taxed at your ordinary income tax rate, which can be higher.

Long-Term Gains: Holding crypto for more than a year before selling qualifies you for long-term capital gains tax rates, which are usually lower.

For example, if you bought Bitcoin and sold it six months later for a profit, you'd pay tax at your regular income rate. But if you held it for over a year, you'd pay the reduced long-term rate. Always keep track of your holding periods to optimize your tax outcomes.

Can You Claim Crypto Losses on Your Taxes?

Yes, you can claim crypto losses. This is known as capital gains offset. If your crypto investments didn't go as planned, you can use those losses to offset gains from other investments.

Deduction Limits: You can deduct up to $3,000 of net capital losses per year against other types of income. If your losses exceed this limit, you can carry them forward to future years.

For instance, if you lost $4,000 on Bitcoin and gained $2,000 on another investment, you can offset the gain and still have $2,000 of losses to carry forward.

Understanding these elements is crucial for effective cryptocurrency tax planning. Keep detailed records and consult with a tax advisor to make the most of your tax situation.

Next, we'll dig into the specifics of reporting cryptocurrency on your taxes, including important forms and IRS guidelines.

Conclusion

Navigating cryptocurrency taxes can feel overwhelming, but it doesn't have to be. At NR Tax and Consulting, we are committed to providing personalized guidance to help you manage your crypto tax obligations with ease. Our team understands the complexities involved and is here to support you every step of the way.

Why Choose Us?

Personalized Guidance: We tailor our services to fit your unique needs. Whether you're a seasoned crypto investor or just starting out, we provide strategies that align with your financial goals.

Local Services: As a local firm, we pride ourselves on understanding the specific needs of our community. We offer face-to-face consultations to ensure you get the most out of our services.

Expertise in Cryptocurrency Tax Planning: Our experienced team stays up-to-date with the latest IRS guidelines and tax laws, ensuring you remain compliant while optimizing your tax situation.

By partnering with us, you gain access to a wealth of knowledge and expertise that can help you make informed decisions about your cryptocurrency investments. We aim to simplify the process, allowing you to focus on what matters most—growing your wealth.

For more information on how we can assist you with your tax needs, visit our IRS Tax Resolution Services page. Let's work together to make your cryptocurrency tax planning as seamless and efficient as possible.

Effective tax management is an ongoing process. Start your journey with NR Tax and Consulting today, and let us help you open up the full potential of your financial future.

Want tax & accounting tips and insights?

Sign up for our newsletter.