Miami Tax Accountants: How To Make The Right Choice

Finding The Best Tax Accountant In Miami: What You Need To Know

If you’re looking for a tax accountant in Miami, you’re probably aware of the complexities that come with managing financial records and ensuring compliance with tax laws. Whether you’re a small business owner aiming to optimize your tax savings or an individual needing expert advice, finding the right accountant is crucial.

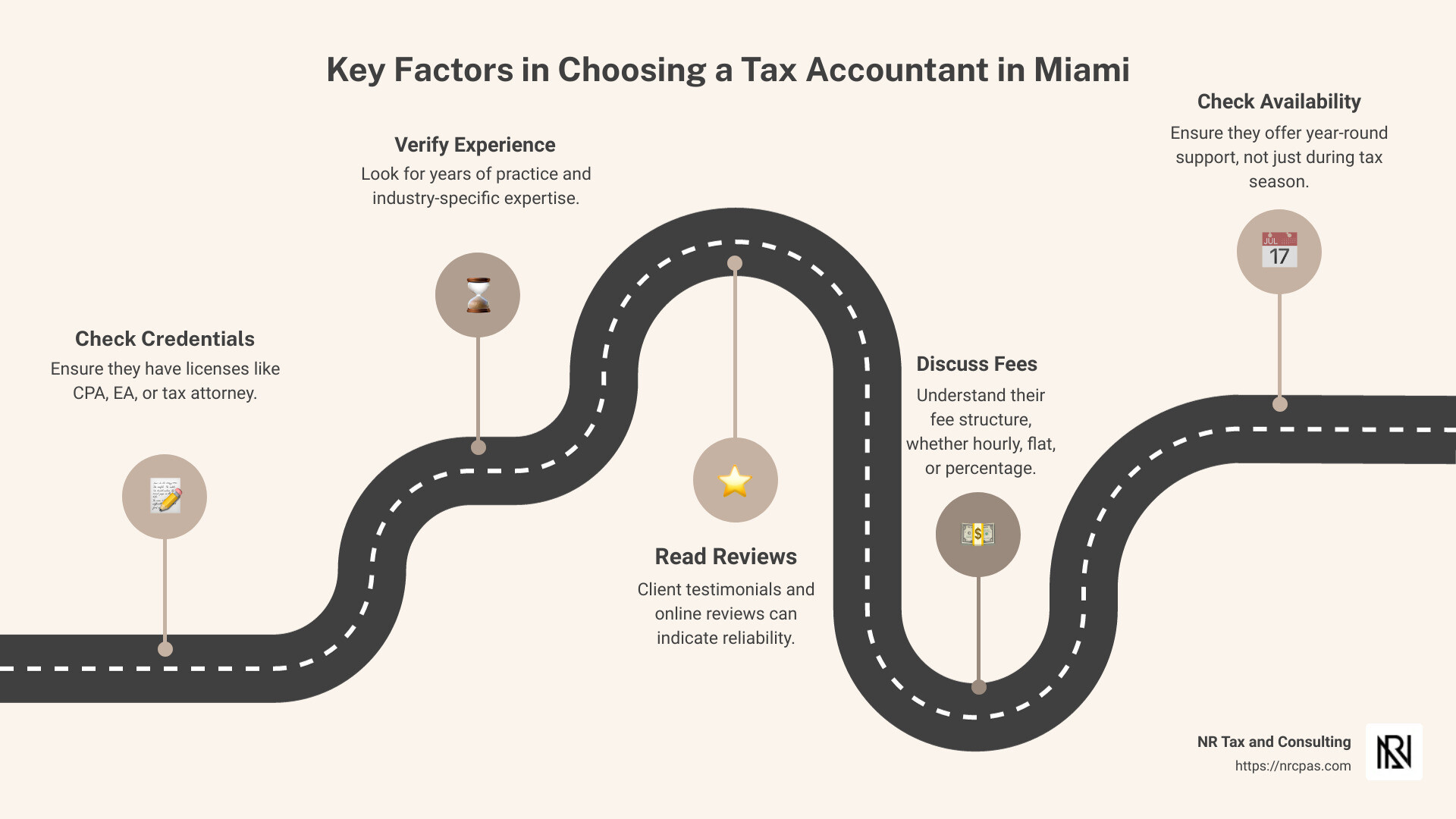

Here are some quick tips to help you make the right choice:

1. Check credentials: Ensure they have licenses and are qualified (like CPAs, EAs, or tax attorneys).

2. Verify experience: Look for someone with years of practice and expertise in your industry.

3. Read reviews: Client testimonials and reviews can give you a clear picture of their reliability.

4. Discuss fees: Understand their fee structure, whether it’s hourly, flat, or a percentage.

5. Availability: Make sure they offer year-round support, not just during tax season.

The importance of choosing the right tax accountant cannot be overstated. A knowledgeable accountant can help you steer complex tax regulations, maximize your returns, and avoid costly errors. Trust and communication are key; you need someone who not only understands the numbers but also takes the time to explain them to you.

My name is Nischay Rawal, and I have over 10 years of experience as a certified public accountant. At NR CPAs & Business Advisors, we’ve helped countless clients in Miami and beyond manage their taxes efficiently and effectively.

Understanding The Role Of A Tax Accountant

A tax accountant in Miami does much more than just crunch numbers. Here’s what you need to know about their key roles:

Tax Preparation

Tax preparation is the bread and butter of any tax accountant. They help you gather all necessary documents, such as W-2s and 1099s, to ensure your tax return is accurate and timely. A knowledgeable tax accountant can significantly impact your financial situation by maximizing your refund and ensuring compliance with tax laws.

Financial Consulting

Tax accountants don’t just file your taxes; they provide financial consulting to optimize your financial health. They can help you create a financial plan that minimizes tax liabilities and maximizes savings.

Regulatory Compliance

Navigating tax laws can be daunting. A tax accountant ensures you remain compliant with all local, state, and federal regulations. This helps you avoid penalties and legal issues.

IRS Representation

Facing the IRS can be intimidating. Tax accountants, especially those who are CPAs, enrolled agents, or tax attorneys, can represent you in front of the IRS. This is crucial if you face an audit or dispute. Having a professional by your side can make a significant difference in the outcome.

Key Services Offered By Miami Tax Accountants

When choosing a tax accountant in Miami, understand the wide range of services they offer. Here are some key services that can benefit both individuals and businesses:

Audit Services

Audits can be nerve-wracking, but a good tax accountant can make the process much smoother. They conduct thorough examinations of your financial records to ensure everything is accurate and compliant with regulations. This not only helps in avoiding penalties but also builds trust with stakeholders.

Tax Return Compliance

Filing tax returns accurately and on time is crucial to avoid penalties. Tax accountants ensure that all necessary documents are submitted correctly and punctually. They also help you take advantage of all possible deductions and credits to minimize your tax liability.

Business Advisory

Beyond just crunching numbers, tax accountants offer valuable business advisory services. They provide insights into financial planning, growth strategies, and investment opportunities. This can be particularly beneficial for small businesses looking to expand or optimize their operations.

Financial Statements

Accurate financial statements are vital for understanding your business’s financial health. Accountants prepare comprehensive statements, including balance sheets, income statements, and cash flow statements. These documents are essential for making informed business decisions and securing loans or investments.

Tax Credits & Incentives

Navigating the maze of tax credits and incentives can be challenging. Tax accountants identify and apply for applicable credits, such as those for research and development or energy efficiency, to reduce your overall tax burden.

International Taxation

For businesses and individuals with international income sources, understanding foreign tax laws is crucial. Miami tax accountants specialize in international taxation, helping you steer tax treaties and foreign tax credits to ensure compliance and minimize liabilities.

State & Local Taxation

Tax laws vary significantly by state and locality. Accountants help you understand and comply with these laws, ensuring that you’re not overpaying or underpaying your taxes. They also assist with state-specific deductions and credits.

How To Choose The Right Tax Accountant In Miami

Choosing the right tax accountant in Miami can make a significant difference in your financial health. Here are key factors to consider:

Experience

How long have they been practicing? Experience is crucial. A seasoned professional has likely encountered a situation similar to yours and can steer complex tax issues with ease.

Specialization

Do they specialize in a particular area? If you’re a small business owner, an accountant with a specialization in small business taxes could be invaluable.

Client Reviews

What are people saying about them? Client reviews can provide insights into the accountant’s reliability and expertise.

Cost

How do they charge for their services? Understanding the fee structure is critical. Some accountants charge by the hour, while others have a flat fee. Clarifying this upfront helps avoid surprises.

Availability

How often will we communicate? You need someone who’s available throughout the year, not just during tax season. Ask about their preferred mode of communication—some may prefer emails, while others are more responsive to phone calls.

Credentials

Can they represent you in front of the IRS? Ensure your accountant is authorized to represent you during audits or disputes. CPAs, attorneys, and enrolled agents are among those who can legally represent you before the IRS. Always verify their credentials through the IRS’s searchable database.

By considering these factors, you can find an accountant who not only has the expertise but also aligns with your communication preferences and financial goals.

Benefits Of Hiring A Tax Accountant In Miami

Error Reduction

Tax laws are complex and constantly changing. A small mistake on your tax return can lead to audits, penalties, and stress. Tax professionals are trained to catch errors that you might overlook.

Time-Saving

Filing taxes can be time-consuming, especially if you have a complex financial situation. Hiring a tax accountant in Miami allows you to focus on your business or personal life while they handle the paperwork. As noted, professionals like those at NR Tax and Consulting are not just available during tax season but throughout the year, offering continuous support and advice.

Maximized Tax Returns

Tax accountants are skilled at identifying deductions and credits you might miss. This ensures you get the most out of your tax return.

IRS Compliance

Staying compliant with IRS regulations is crucial. Tax professionals keep up with the latest tax laws and ensure your filings are up-to-date, protecting you from potential legal issues.

Financial Planning

Beyond tax filing, accountants provide valuable financial planning services. They help you prepare for the future, whether it’s saving for retirement or planning investments. According to NR Tax and Consulting, tax professionals can offer insights that align with your long-term financial goals, helping you make informed decisions.

By hiring a tax accountant in Miami, you gain a partner who can guide you through the complexities of tax laws, save you time, and help you achieve your financial goals. Next, let’s address some Frequently Asked Questions about Tax Accountants in Miami, including cost and who can file your taxes.

Frequently Asked Questions About Tax Accountants In Miami

What Is The Average Cost Of Hiring A Tax Accountant In Miami?

The cost of hiring a tax accountant in Miami can vary widely based on several factors:

Complexity of Returns: A simple individual tax return may cost between $150 and $300. However, if you have a small business with multiple revenue streams or properties, expect to pay more—often between $500 and $1,000 or even higher.

Bookkeeping Quality: Well-organized financial records can lower your costs. If your books are messy, your accountant will need more time to sort them out, increasing the fee.

Time Needed: Most tax accountants charge by the hour. The more time-consuming your tax situation, the higher the bill.

CPA Expertise: More experienced CPAs with specialized knowledge may charge higher rates, but their expertise often leads to greater tax savings.

Is It Worth It To Pay Someone To Do Your Taxes?

Absolutely. Here’s why:

Accuracy: A small mistake on your tax return can lead to audits and penalties. Professionals ensure every detail is correct, giving you peace of mind.

Compliance: Tax laws are complex and always changing. Tax professionals stay updated with the latest regulations, ensuring your filings comply with current laws.

Tax Savings: Experts can identify deductions and credits you might miss. Over time, these savings can be significant, often outweighing the cost of hiring a professional.

Who Can File My Taxes?

Anyone with a Preparer Tax Identification Number (PTIN) can file your taxes, but not all tax preparers are created equal. Here are your options:

CPAs (Certified Public Accountants): CPAs have extensive training and can represent you before the IRS. They are ideal for complex tax situations.

Enrolled Agents: These are federally-authorized tax practitioners who can also represent you before the IRS. They specialize in tax matters.

Tax Attorneys: Lawyers who specialize in tax law can provide legal advice and represent you in court.

PTIN Holders: These individuals are registered with the IRS to prepare taxes but may not have the same level of expertise as CPAs or enrolled agents.

Choosing the right tax professional depends on your specific needs. Consider the complexity of your tax situation and the level of expertise required. Always verify their credentials and ask about their experience and fees upfront.

Conclusion

Choosing the right tax accountant in Miami is crucial for ensuring your financial health and peace of mind. From tax preparation to financial planning, the expertise and personalized services of a professional can make a significant difference.

At NR CPAs & Business Advisors, we understand the unique needs of Miami residents and businesses. Our team is dedicated to providing personalized services that cater to your specific requirements. Whether you’re a small business owner like Jane, who benefited from custom advice on managing her finances, or an individual needing help with tax return compliance, we’re here to support you.

Our local expertise allows us to stay abreast of the latest tax laws and regulations affecting Miami. This ensures that you receive the most relevant and up-to-date advice. We believe in building long-term relationships with our clients, offering not just services, but a partnership aimed at your financial success.

Ready to take the next step? Contact NR CPAs & Business Advisors today to find how our specialized services can help you achieve your financial goals. With our team by your side, you can steer the complexities of taxation with confidence and ease.

For more detailed information or to schedule a consultation, visit our website or give us a call. Let us help you make the right choice for your tax and financial needs.

Want tax & accounting tips and insights?

Sign up for our newsletter.