Small Business Tax Planning: Year-End Strategies for Success

Small business year end tax planning is a critical process that ensures business owners make the most of available tax deductions, optimize financial health, and avoid any last-minute scrambles or penalties. As the calendar turns towards December, proactive measures taken now can save significant time and money later. Here’s a quick rundown of key areas to focus on for effective planning:

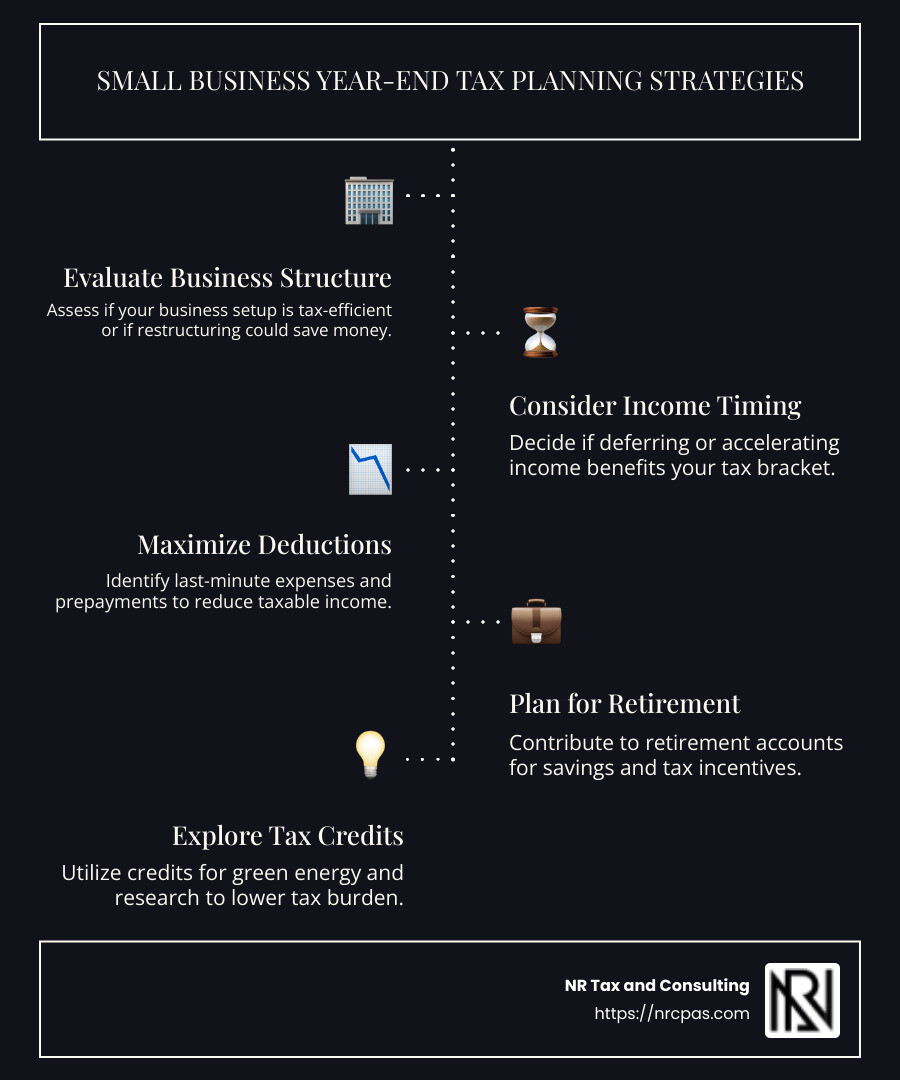

Evaluate Your Business Structure: Determine whether your current setup is tax-efficient or if restructuring could offer better savings.

Consider Income Timing: Decide whether to defer or accelerate income, depending on your expected tax bracket changes.

Maximize Deductions: Look into last-minute purchases and prepayments to reduce taxable income.

Plan for Retirement: Contribute to retirement plans to boost savings and benefit from tax incentives.

Explore Tax Credits: Leverage available credits, including those for green energy and research and development.

Effective tax planning is not just about compliance; it's a strategic approach to improve your business’s financial resilience and growth potential. Without careful preparation, small businesses may miss out on valuable opportunities to lower their tax burdens.

I’m Nischay Rawal, a certified public accountant with over a decade of experience in aiding small businesses like yours steer the complexities of financial management and tax regulations. My mission is to provide clarity and actionable strategies that help businesses succeed.

Image Alt Text: Overview of small business year end tax planning strategies with bullet points on business structure evaluation, income timing, maximizing deductions, retirement planning, and exploring tax credits. - small business year end tax planning infographic infographic-line-5-steps-dark

Common small business year end tax planning vocab:

business tax planning

small business tax advice

Understanding Small Business Taxes

Navigating taxes as a small business owner can feel overwhelming, but it doesn't have to be. Let’s break down the essentials of small business year-end tax planning to help you manage your tax responsibilities effectively.

Federal Taxes

Most small businesses need to file a federal tax return each year. The form you use depends on your business structure:

Sole Proprietorships: File Form 1040 with a Schedule C.

Partnerships: File Form 1065, and partners report their share of income on Form 1040.

Corporations: C corporations use Form 1120, while S corporations file Form 1120-S.

Understanding which form to use is crucial for compliance and ensuring you don't pay more than you owe.

State Taxes

State tax requirements vary widely. Most states require income tax payments, and if you sell goods, you’ll likely need to handle sales tax too. Some states have additional taxes, like franchise taxes. Always check your state’s specific requirements to avoid surprises.

Local Taxes

Local taxes might include property taxes if you own your business location, and sometimes local income taxes. Rules can differ even within the same state, so consult with a local tax advisor to ensure you're meeting all obligations.

Tax Deductions

Tax deductions can significantly reduce your taxable income. Common deductions for small businesses include:

Office Supplies: Pens, paper, and other necessary items.

Travel Expenses: Business trips, including transportation and lodging.

Utilities: Internet, phone, and electricity used for business.

Keeping detailed records of these expenses is key to maximizing your deductions.

Tax Credits

Tax credits offer a dollar-for-dollar reduction of your tax bill. Here are a few credits you might qualify for:

Small Business Health Care Tax Credit: For providing health insurance to employees.

Work Opportunity Tax Credit: For hiring individuals from certain target groups.

Disabled Access Credit: For making your business accessible to people with disabilities.

Each credit has specific requirements, so check with your tax advisor to see which ones apply to you.

Effective tax planning involves staying informed and proactive. By understanding your obligations and opportunities, you can make strategic decisions that benefit your business's bottom line.

Now, let's dive into Top Year-End Tax Strategies to further optimize your tax planning efforts.

Small Business Year-End Tax Planning

As we approach the end of the year, it's crucial to focus on small business year-end tax planning. This involves a mix of preparation, strategic moves, and consulting with professionals to ensure you're maximizing deductions and minimizing liabilities.

Tax Checklist

Creating a tax checklist is a smart way to stay organized. Here's a simple checklist to get you started:

Review Financial Statements: Ensure your income and expenses are accurately recorded.

Organize Receipts: Gather all receipts for business expenses throughout the year.

Check Payroll Records: Verify that all employee wages and benefits are correctly documented.

Inventory Assessment: Count and value your inventory to determine cost of goods sold.

Update Mileage Logs: If you use a vehicle for business, make sure your mileage log is up to date.

Image Alt Text: Organized tax checklist - small business year end tax planning

Tax Forms

Knowing which tax forms to file is essential. Here's a quick guide:

Form 1040 with Schedule C: For sole proprietorships.

Form 1065: For partnerships, with individual partners filing their share on Form 1040.

Form 1120: For C corporations.

Form 1120-S: For S corporations.

Each form has specific requirements, so double-check that you're using the correct one for your business structure.

Tax Deductions

Maximizing tax deductions can significantly reduce your taxable income. Consider these common deductions:

Home Office Deduction: If you work from home, you might qualify for this deduction.

Business Insurance: Premiums for business insurance are deductible.

Marketing Costs: Expenses related to advertising and marketing can be deducted.

Keeping detailed records of these expenses will help you claim the full amount you're entitled to.

Tax Credits

Tax credits can directly reduce your tax bill, making them highly valuable. Some credits to explore include:

Research and Development Credit: If your business invests in innovation, this credit can help offset costs.

Energy Efficiency Credit: For businesses that invest in energy-efficient upgrades.

Image Alt Text: Description of tax credit benefits - small business year end tax planning infographic 4_facts_emoji_light-gradient

CPA Consultation

Meeting with a Certified Public Accountant (CPA) is one of the most effective steps in year-end tax planning. A CPA can:

Estimate Tax Liability: Help you understand what you owe and why.

Identify Deductions and Credits: Ensure you don't miss out on potential savings.

Advise on Tax Strategies: Offer personalized strategies based on your business's financial health.

By consulting with a CPA, you can gain insights that might not be apparent from just looking at your financial statements.

Taking these steps in your small business year-end tax planning can help ensure you're well-prepared for tax season. Now, let's explore Top Year-End Tax Strategies to further improve your planning efforts.

Top Year-End Tax Strategies

Employ Family Members

Hiring family members can be a clever way to reduce your tax liability. When you employ your spouse, children, or parents, you may shift income to them, potentially taking advantage of their lower tax brackets. For example, if you run a small bakery and hire your 16-year-old to help with deliveries, you save on payroll taxes while offering them valuable work experience. Payments to children under 18 for legitimate work are exempt from Social Security and Medicare taxes, which can also fund their IRA contributions.

Equipment and Green Energy Deductions

Investing in new equipment can provide significant tax savings. Under Section 179, you can deduct the full purchase price of qualifying equipment purchased during the tax year. In 2024, the deduction limit is $1,220,000, with a phase-out starting at $3,050,000. Timing is crucial, so if you expect higher income next year, consider delaying the purchase to maximize deductions when your tax bill could be higher.

Bonus Depreciation is another tool to consider. For 2024, you can deduct 60% of the cost basis for property placed in service. This percentage is scheduled to drop in the coming years, making it wise to act now if you're on the fence about a purchase.

Green Energy Credits offer additional savings. The federal Inflation Reduction Act provides nearly $400 billion for clean energy tax credits, including those for electric vehicles and energy-efficient property. Check eligibility and restrictions with your tax advisor to make the most of these incentives.

Business Structure Evaluation

Your business structure affects how taxes are filed and can impact your tax liability. Many small businesses start as sole proprietorships due to their simplicity. However, as your business grows, an LLC or S corporation might offer better benefits, such as liability protection and potential tax savings. If your profits are increasing, an S corporation election might reduce your overall tax burden. Always consult with a tax advisor to determine the best structure for your business's needs.

Income Deferral and Acceleration

If your business uses cash basis accounting, you might defer income to the next year to reduce this year's tax bill. For instance, delay sending invoices until January if you want to lower taxable income for 2024. Conversely, if you expect higher income in 2025, consider accelerating income to take advantage of lower tax rates this year. This strategy doesn't apply if you use accrual accounting, as revenue must be recorded when the transaction occurs.

Retirement Contributions

Contributing to retirement plans like a SEP IRA, SIMPLE IRA, or 401(k) can defer taxes on the income you contribute until retirement. These contributions can also reduce your current year's taxable income, potentially placing you in a lower tax bracket. For instance, small business owners have until their tax return due date (including extensions) to contribute to a retirement plan. However, some plans must be established before year-end to qualify for deductions.

Consider a SEP IRA if you want to contribute up to 25% of each employee's pay. A SIMPLE IRA suits businesses with fewer than 100 employees, allowing employee contributions up to $15,500 in 2023. A 401(k) offers both traditional and Roth options, with a contribution limit of $22,500 for 2023.

By strategically employing these tactics, you can significantly improve your small business year-end tax planning efforts. Now, let's address some Frequently Asked Questions about Small Business Year-End Tax Planning.

Frequently Asked Questions about Small Business Year-End Tax Planning

How to prepare for tax season as a small business?

Preparing for tax season can be daunting, but a well-organized tax preparation checklist can make it manageable. Start by gathering all necessary tax forms, such as W-2s, 1099s, and any receipts for business expenses. Keep track of all income and expenses throughout the year to ensure accuracy.

Consider consulting with a CPA to review your financials and determine any potential tax deductions you might be eligible for. These could include home office expenses, travel costs, and equipment purchases. Regularly updating your records will help avoid last-minute stress and ensure you maximize your deductions.

What is the 20% tax deduction for small businesses?

The 20% tax deduction, also known as the pass-through deduction, is a significant tax break for small businesses. Under Section 199A, qualifying businesses can deduct up to 20% of their qualified business income from their taxable income. This deduction is available to owners of pass-through entities such as sole proprietorships, partnerships, and S corporations.

Eligibility and deduction amounts can vary based on your income and business type, so it's crucial to consult with a tax advisor to determine how this deduction applies to your business.

When should my business tax year end?

Choosing between a calendar year and a fiscal year for your business depends on your specific needs and operations. Most small businesses opt for a calendar year, ending on December 31, as it aligns with the personal tax year. This can simplify recordkeeping and tax filing.

However, a fiscal year, which ends on the last day of any month other than December, might be beneficial if your business cycle doesn't match the calendar year. For instance, if your busiest season is during the winter months, a fiscal year ending in the summer might make more sense. Discuss with your CPA to decide the best option for your business's unique circumstances.

Conclusion

Navigating small business year-end tax planning can be complex, but with the right guidance, it doesn't have to be overwhelming. At NR Tax and Consulting, we pride ourselves on offering personalized, expert financial advice custom to your business's unique needs.

Our team understands the intricacies of tax planning and is here to help you make informed decisions. Whether you're looking to maximize deductions, explore tax credits, or simply ensure compliance, we're here to support you every step of the way.

Local Expertise, Personalized Service

Being local accountants, we offer a deep understanding of the community's business landscape. This local expertise allows us to provide relevant and effective solutions that keep your business on track. Our personalized approach ensures that you receive advice that is specifically custom to your business's requirements.

We invite you to explore our business tax services to learn more about how we can assist you with your year-end tax planning. Let's work together to make tax season less stressful and more successful.

Effective tax management is not just about compliance; it's about setting your business up for financial growth. With NR Tax and Consulting by your side, you can steer the complexities of tax planning with confidence and ease.

Want tax & accounting tips and insights?

Sign up for our newsletter.