Plan Smart, Save Big: Miami Tax Planning Essentials

Miami tax planning is essential for anyone looking to optimize their financial situation in one of Florida's most vibrant cities. Whether you’re a business owner or a resident, understanding Miami's unique tax landscape can lead to significant savings and strategic advantages. Here’s what you need to know:

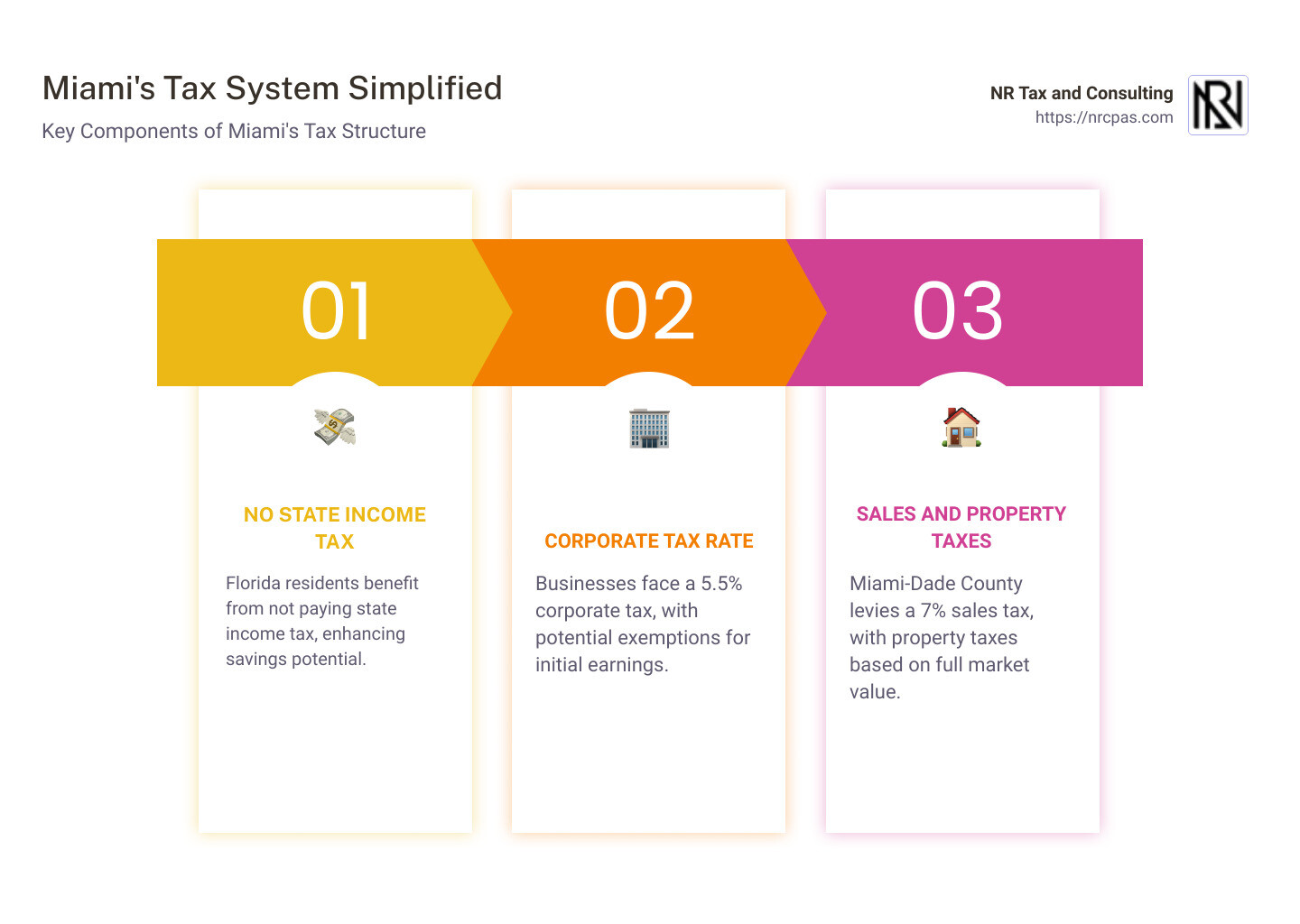

No State Income Tax: Florida residents enjoy the benefit of not paying state income tax, simplifying tax filing and potentially increasing savings.

Corporate Tax: Businesses are subject to a 5.5% corporate income tax, though exemptions for initial earnings exist.

Sales and Property Taxes: A 7% combined sales tax rate applies in Miami-Dade County, while property taxes are based on the full market value.

Navigating these can be overwhelming, but strategic planning can maximize your wealth and ensure compliance.

As an experienced Certified Public Accountant with over a decade of helping clients in the field of Miami tax planning, I've witnessed how a structured approach to taxes can transform a business's financial health. I'm Nischay Rawal, and I aim to provide you with practical insights and guidance to make better tax decisions.

Image Alt Text: Infographic: Miami's Tax System Simplified, highlighting no state income tax, 7% sales tax in Miami-Dade, and 5.5% corporate tax rate - Miami tax planning infographic pillar-3-steps

Understanding Miami's Tax Landscape

Miami's tax landscape offers unique opportunities and challenges that can significantly impact your financial planning. Let's break down the key components:

No State Income Tax

One of the most significant advantages of living in Miami is Florida's no state income tax policy. This means residents only need to worry about federal income taxes, simplifying the tax filing process and potentially leading to substantial savings. For many, this is a major draw of living in Florida, as it leaves more money in your pocket to invest or spend as you see fit.

Florida Sales Tax

While there is no state income tax, Florida does have a sales tax. The state rate is 6%, but in Miami-Dade County, an additional 1% surtax is applied, bringing the total to 7%. This sales tax applies to most goods and services purchased in the area. Understanding this tax is crucial for budgeting and planning your expenses.

Property Tax Assessment

Property tax is another essential element of Miami's tax landscape. In Miami, property is assessed at 100% of its market value. The property tax rate varies depending on the specific area within Miami-Dade County. These taxes are primarily used to fund local services like schools and infrastructure.

To manage property taxes effectively, it's important to stay informed about your property's assessed value and understand how it impacts your annual tax bill.

Understanding these tax elements is crucial for effective Miami tax planning. By taking advantage of Florida's tax benefits and preparing for its obligations, you can optimize your financial health and make informed decisions about your future.

Miami Tax Planning Strategies

Planning your taxes can feel like a puzzle. But with the right strategies, you can fit the pieces together to save money and reduce stress. Miami tax planning involves several smart strategies to help you keep more of your hard-earned money.

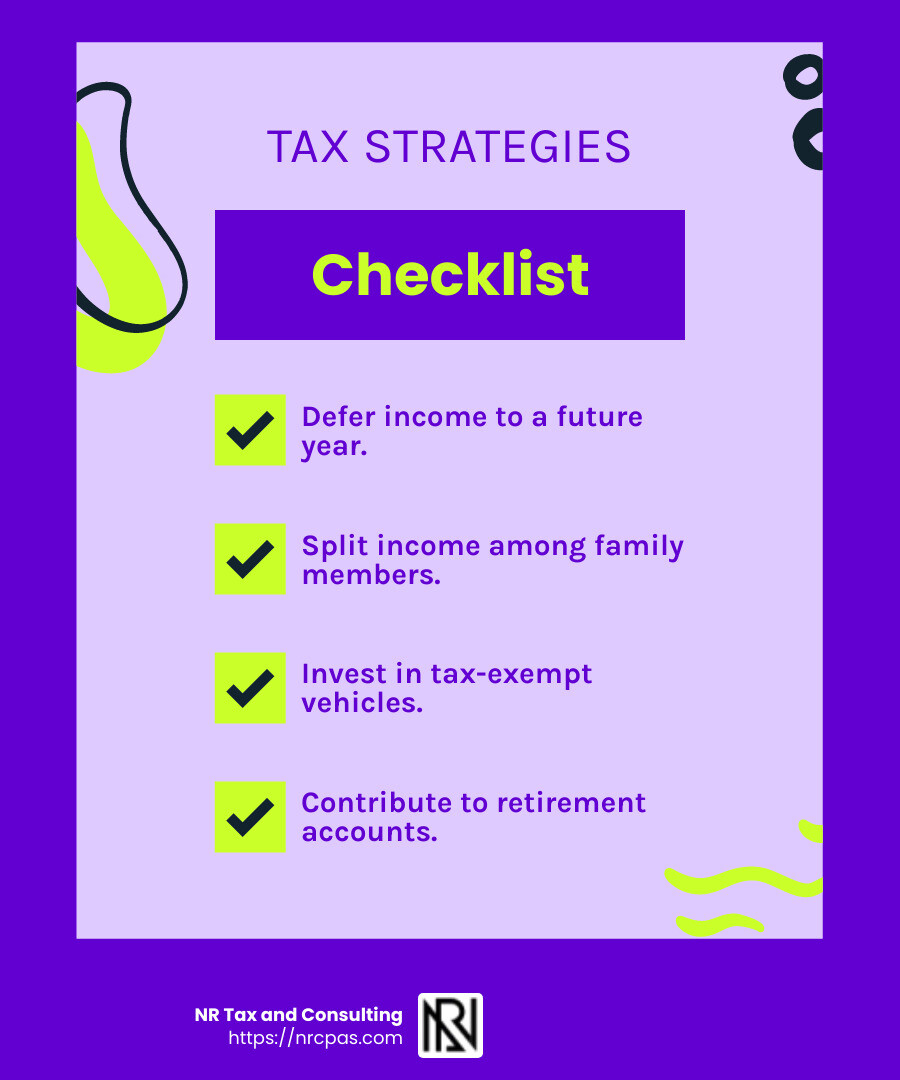

Defer Income

One effective strategy is to defer income. This means postponing some of your income to a future year. By doing this, you might avoid higher tax rates in the current year. For instance, if you expect to be in a lower tax bracket next year, deferring income can lead to paying less in taxes overall.

Think about bonuses or other discretionary income. If possible, arrange to receive these payments in the next tax year. This simple move can be a smart way to manage your tax liability.

Reduce Taxes

Reducing taxes isn't just about paying less. It's about keeping more of what you earn. There are several ways to achieve this:

Split Income: Allocate income among family members who are in lower tax brackets. This is especially useful if you own a business. Paying family members for legitimate work can reduce your overall tax burden.

Tax-Exempt Investments: Invest in vehicles that offer tax-free income. Municipal bonds are a popular choice. They provide interest income that is exempt from federal taxes, and sometimes state taxes too.

Retirement Contributions: Contributing to retirement accounts like 401(k)s or IRAs can reduce your taxable income. This not only saves you money now but also prepares you for the future.

Tax Saving Strategies

There are many strategies to save on taxes, and they often involve careful planning throughout the year. Here are a few that can make a big difference:

Shift Income and Expenses: Move income or expenses between years to benefit from lower tax rates. For example, if you know you'll be in a higher tax bracket next year, accelerate income into this year while delaying expenses to the next.

Use Deductions: Make sure to claim all eligible deductions. This might include home office expenses, medical expenses, or charitable donations. Keeping detailed records throughout the year can ensure you don't miss out on these savings.

Leverage Tax Credits: Tax credits directly reduce the amount of tax you owe. Look for opportunities to claim credits for education, energy-efficient home improvements, or childcare expenses.

Image Alt Text: Tax saving strategies can help you keep more of your earnings. - Miami tax planning infographic checklist-fun-neon

By implementing these tax saving strategies, you can effectively manage your taxes and improve your financial well-being. The key is to plan ahead and stay informed about the latest tax laws and opportunities.

Next, we'll dive into tax preparation and compliance to ensure you're meeting all necessary requirements and maximizing your savings.

Tax Preparation and Compliance

When it comes to Miami tax planning, understanding tax preparation and compliance is crucial. Proper preparation ensures you meet all legal requirements and avoid penalties. Here’s a simple breakdown of what you need to know.

Tax Forms

Filing taxes involves various forms, each serving a different purpose. For individuals, the most common forms are Form 1040 and Form 1040NR for non-residents. Businesses might deal with forms like Form 1120 for corporations or Form 1065 for partnerships.

Each form requires specific information, so it's important to gather all necessary documents in advance. This includes income statements, deduction receipts, and any relevant financial records. Keeping these organized can simplify the filing process.

IRS Compliance

Compliance with the IRS is not just about submitting forms on time. It means ensuring all your information is accurate and complete. Mistakes can lead to audits or penalties, so double-checking your entries is vital.

One way to ensure compliance is by staying informed about tax law changes. The tax code can be complex and ever-changing, so it’s beneficial to consult with a tax professional who stays updated on the latest regulations. They can help you steer these changes and ensure your filings are correct.

Managing Tax Liability

Your tax liability is the total amount of tax you owe. Reducing this liability is a key objective in tax planning. There are several strategies to manage it effectively:

Use Deductions and Credits: Deductions reduce your taxable income, while credits directly reduce the tax you owe. Make sure to claim all available options, such as education credits or deductions for home office expenses.

Consider Timing: The timing of income and expenses can affect your tax liability. For instance, accelerating deductions or deferring income can lower your tax bill.

Retirement Contributions: Contributing to retirement accounts like a 401(k) can lower your taxable income. This is a smart way to save for the future while reducing your current tax burden.

By focusing on tax preparation and compliance, you can avoid common pitfalls and make the most of your financial resources. The next section will explore Miami tax incentives and benefits to help you further optimize your tax strategy.

Miami Tax Incentives and Benefits

When planning your taxes in Miami, it's important to understand the incentives and benefits available. These can significantly reduce your tax burden and boost your financial health.

Tax Credits and Job Creation

One of the most impactful incentives is the availability of tax credits. These credits directly reduce the amount of tax you owe, making them extremely valuable. For businesses, credits related to job creation are particularly beneficial. By creating new jobs, companies not only contribute to the local economy but also qualify for specific tax benefits.

For example, businesses that hire employees in certain zones or industries may receive tax credits. This not only helps reduce their tax liability but also encourages economic growth in the region.

Average Wages and Economic Impact

The average wage level in Miami can influence the types of tax incentives available. Higher wages can lead to greater disposable income, which can, in turn, stimulate economic activity. This cycle of growth is supported by tax incentives that encourage businesses to invest in their workforce.

By offering competitive wages and benefits, businesses not only attract top talent but also gain access to tax credits. These credits can offset costs associated with employee benefits, such as health insurance or retirement plans.

Leveraging Miami's Tax Benefits

To make the most of Miami tax planning, it's crucial to leverage available benefits strategically. This involves understanding which credits apply to your situation and how to qualify for them. For instance:

Clean Energy Initiatives: Businesses investing in clean energy solutions, like solar panels or electric vehicles, can avail of tax credits. These not only reduce operational costs but also align with environmental goals.

Research and Development: Engaging in innovative projects can qualify businesses for R&D tax credits. This encourages investment in new technologies and processes, further enhancing business growth.

By taking advantage of these tax incentives and benefits, individuals and businesses can optimize their tax strategies and contribute positively to Miami's economic landscape.

Frequently Asked Questions about Miami Tax Planning

What taxes do you pay in Miami?

Living in Miami comes with some unique tax advantages. One of the most significant perks is that there's no state income tax in Florida. This means residents only need to worry about federal income taxes, which can save a substantial amount each year.

However, there are other taxes to be aware of:

Florida Sales Tax: The state imposes a 6% sales tax on goods and services. In Miami-Dade County, an additional 1% surtax is added, bringing the total sales tax to 7%. This is something to keep in mind when budgeting for purchases.

Property Tax: If you own property in Miami, you’ll pay property taxes. These are based on the assessed value of your property, which is determined annually. The millage rate—the amount per $1,000 of property value—is used to calculate your tax bill. This rate can vary depending on where you live within Miami-Dade County.

How do property taxes work in Miami?

Property taxes in Miami are calculated using two key components: the assessed property value and the millage rate. The assessed value is determined by the county property appraiser and reflects the market value of your property.

Once the assessed value is set, the millage rate is applied. This rate is expressed in mills, where one mill equals $1 per $1,000 of assessed value. For example, if the millage rate is 20 mills and your property is assessed at $200,000, your property tax would be $4,000.

Property taxes fund essential services like schools, infrastructure, and public safety, making them a critical component of local government budgets.

What is considered tax planning?

Tax planning involves strategizing to minimize your tax liability and maximize savings. It’s about making informed decisions to align your financial activities with tax laws.

Key elements of tax planning include:

Timing of Income: Deciding when to receive income can impact your tax bracket and liability. For instance, deferring income to a lower-income year could reduce your tax rate.

Understanding Tax Brackets: The U.S. tax system is progressive, meaning higher income is taxed at higher rates. Knowing your bracket helps in planning deductions and credits effectively.

Effective tax planning requires a good understanding of the tax code and proactive management of your financial activities. By doing so, you can take full advantage of available deductions, credits, and other opportunities to reduce your tax burden.

Conclusion

Navigating the complexities of Miami tax planning can be challenging, but with the right guidance, it becomes an opportunity rather than a burden. At NR Tax and Consulting, we specialize in providing personalized financial guidance that aligns with your unique financial situation and goals.

Our approach goes beyond just crunching numbers. We aim to build lasting relationships with our clients, ensuring that each plan is custom to maximize your financial success. By understanding the local tax landscape and leveraging our expertise, we help you make informed decisions that can lead to substantial savings.

Whether you're a business owner or an individual, our team is dedicated to supporting you at every stage of your financial journey. We stay updated with the latest tax laws and regulations, ensuring that you receive the most relevant and up-to-date advice.

Ready to take control of your financial future? Contact us today to find how our specialized services can help you achieve your tax and financial goals. With NR Tax and Consulting by your side, you can confidently steer the complexities of taxation with ease and assurance.

Image Alt Text: Choosing the right tax consultant can have a significant impact on your financial health. - Miami tax planning infographic 4_facts_emoji_grey

Want tax & accounting tips and insights?

Sign up for our newsletter.