Pay Less, Save More: Tax Tips for Business Owners

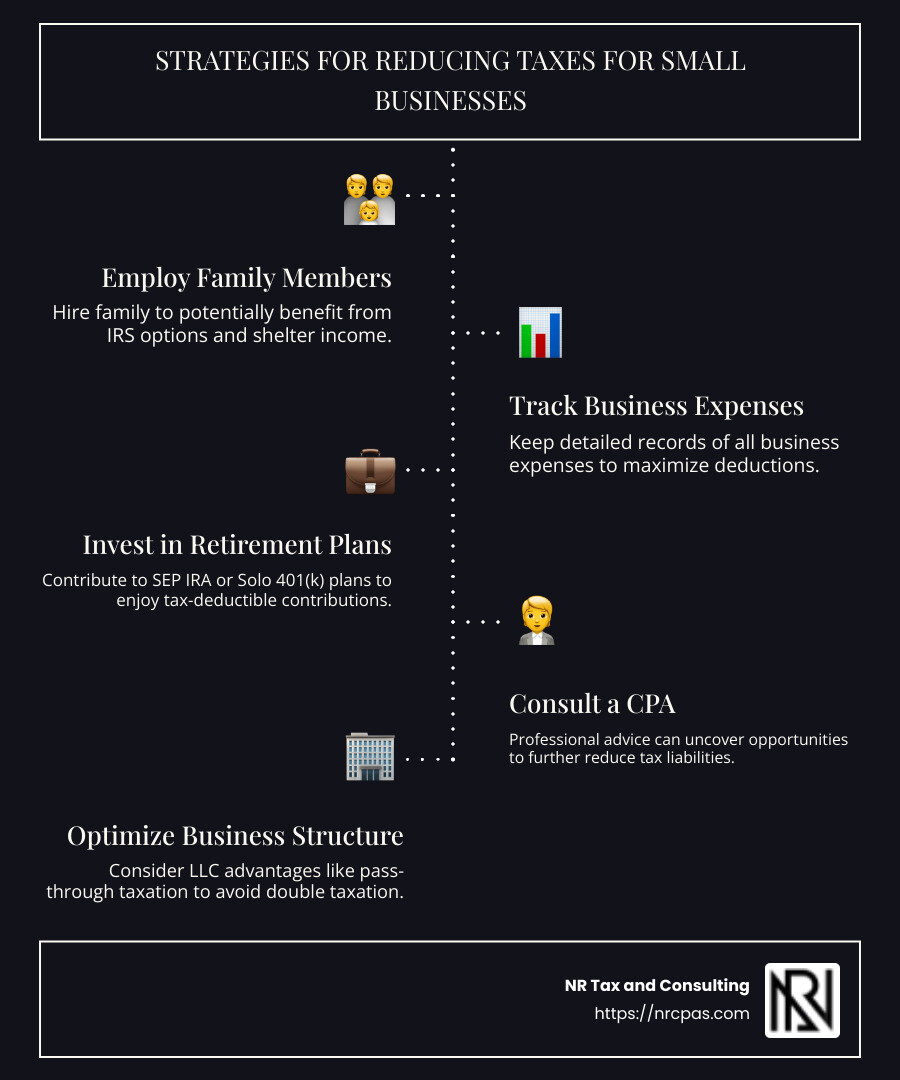

How do business owners pay less taxes? This pressing question arises for many small business owners striving to optimize their financial strategies. The answer lies in implementing effective tax-saving methods such as hiring family members, tracking all business expenses, investing in retirement plans, and consulting with a skilled CPA. These strategies not only reduce tax burdens but can also lay the groundwork for sustained business growth and profitability.

For countless small business owners, navigating the complex world of taxes can feel daunting. However, remember that significant savings are within reach. By keeping detailed records, employing family strategically, and maximizing allowable deductions, you can substantially lower your tax bill. Furthermore, professional advice from expert financial advisors can illuminate overlooked opportunities to save even more.

I'm Nischay Rawal, and with over a decade of experience in tax consultation, I've assisted countless business owners in finding how do business owners pay less taxes. My firm, NR Tax & Consulting, prides itself on offering stress-free and personalized solutions to both individuals and small businesses. Transitioning now to specific actionable steps, let's dig into the sector of employing family members as a proven method for tax savings.

Image Alt Text: Strategies for Reducing Taxes for Small Businesses: Employ Family Members, Track Expenses, Retirement Plans - how do business owners pay less taxes infographic infographic-line-5-steps-dark

Quick how do business owners pay less taxes definitions:

business tax planning

small business tax advice

Employ Family Members

One of the smartest ways for business owners to pay less in taxes is by hiring family members. The IRS offers several options that allow you to shelter income from taxes, making this strategy both practical and rewarding.

Why Hire Family Members?

1. Tax Benefits: Hiring family members can result in significant tax savings. For instance, if your business is a sole proprietorship, wages paid to your children under 18 are not subject to Social Security and Medicare taxes. This means both you and your child can save on these payroll taxes. Moreover, wages paid to your spouse are exempt from the Federal Unemployment Tax Act (FUTA), as long as they are a legitimate employee and not a partner in the business.

2. Lower Tax Brackets: By shifting income to family members, you can take advantage of their lower tax brackets. This is particularly beneficial if their income falls into a lower marginal tax rate than yours.

3. Retirement Savings: Hiring your children can also set them up for future financial success. With earned income, they (or you on their behalf) can contribute to a Roth IRA, allowing their retirement savings to grow tax-free. Starting early can give them a significant head start in building a solid retirement fund.

Real-World Example

Imagine you own a small bakery. By hiring your 16-year-old to help with deliveries, you can save on payroll taxes while giving them valuable work experience. This not only benefits your tax situation but also provides them with an opportunity to learn and contribute to the family business.

Key Considerations

Legitimate Work: Ensure that the work done by family members is legitimate and necessary for the business. The wages should be reasonable, ordinary, and necessary for the services provided.

Documentation: Keep detailed records of the work performed and the wages paid. This documentation is crucial if the IRS questions the legitimacy of the employment.

Business Structure: Different rules apply if your business is set up as a corporation. Consult with a tax advisor to understand how hiring family members can impact your specific business structure.

Employing family members is a strategic move that can reduce your tax burden while benefiting your family. In the next section, we'll explore how maximizing retirement contributions can further improve your tax-saving strategies.

Maximize Retirement Contributions

Saving for retirement isn't just smart for your future—it's a powerful way to pay less in taxes today. As a business owner, you have access to some special retirement plans that offer significant tax advantages.

Retirement Plans for Business Owners

1. SEP IRA (Simplified Employee Pension Plan): This plan is ideal for self-employed individuals or small business owners. It allows you to contribute up to 25% of your income, with a cap of $69,000 in 2024. Contributions are tax-deductible, which means you can lower your taxable income significantly while saving for retirement.

2. Solo 401(k) Plan: Also known as a one-participant 401(k), this plan is perfect if you run a business without any full-time employees, except perhaps a spouse. For 2024, you can contribute up to $69,000 if you're under 50, and up to $76,500 if you're 50 or older, thanks to catch-up contributions. Contributions to a Solo 401(k) are also tax-deductible, helping you reduce your tax bill.

Image Alt Text: Tax-deductible contributions can significantly reduce your taxable income. - how do business owners pay less taxes infographic 4_facts_emoji_blue

Why Maximize Contributions?

Immediate Tax Savings: Every dollar you contribute to these retirement plans reduces your taxable income. This means less money going to taxes and more going into your retirement fund.

Compound Growth: The money in these accounts grows tax-deferred. This means you won't pay taxes on the earnings until you withdraw them, ideally in retirement when you might be in a lower tax bracket.

Flexibility: Both SEP IRAs and Solo 401(k)s offer flexibility in contributions. You can adjust how much you contribute each year based on your business's performance.

Real-World Scenario

Consider a freelance graphic designer, Jane, who opts for a Solo 401(k). By contributing the maximum amount each year, she not only reduces her taxable income but also secures a robust retirement fund. Over time, her tax-deferred savings compound, providing her with a significant nest egg for the future.

Key Considerations

Eligibility: Ensure you meet the eligibility requirements for these plans. For example, a Solo 401(k) is specifically for those with no employees, aside from a spouse.

Contribution Limits: Be aware of the annual contribution limits and adjust your savings strategy accordingly.

Consult a Tax Professional: Retirement plans can be complex, so it's wise to consult with a tax advisor to ensure you're maximizing your tax benefits.

Maximizing retirement contributions is a win-win strategy for business owners—reducing taxes now while securing your future. Next, we'll dive into how optimizing your business structure can further improve your tax savings.

Optimize Business Structure

Choosing the right business structure can be a game-changer when it comes to how business owners pay less taxes. Let's explore why structuring your business as a Limited Liability Company (LLC) might be the savvy move you need.

LLC Advantages

An LLC combines the simplicity of a sole proprietorship with the liability protection of a corporation. This means your personal assets are shielded from business debts and lawsuits. But the perks don't stop there.

Flexibility: LLCs offer flexibility in management and tax treatment. You can choose how you want to be taxed—either as a sole proprietorship, partnership, or corporation—based on what benefits you most.

Credibility: Operating as an LLC can improve your business's credibility with customers, suppliers, and potential investors.

Pass-Through Taxation

One of the standout features of an LLC is pass-through taxation. This means the business itself doesn't pay taxes on its income. Instead, profits pass through to the owners, who report them on their personal tax returns. This can result in significant tax savings.

No Double Taxation: Unlike C corporations, LLCs avoid the dreaded double taxation, where income is taxed at both the corporate and personal levels.

Simplified Tax Reporting: With pass-through taxation, you simplify your tax reporting, reducing the paperwork and potential headaches.

Avoid Double Taxation

Double taxation is a common concern for business owners, especially those considering incorporation. LLCs, with their pass-through structure, offer a straightforward solution to this problem.

Single Layer of Taxation: By taxing income only once, at the individual level, LLCs ensure that more of your earnings stay in your pocket.

Strategic Tax Planning: LLCs allow you to strategize your tax planning more effectively, leveraging deductions and credits to minimize your tax burden.

Real-World Scenario

Imagine a small business owner, Tom, who runs a successful local bakery. By restructuring his business as an LLC, Tom benefits from liability protection and avoids double taxation. This choice allows him to reinvest more profits into expanding his bakery, all while keeping his personal assets safe.

Key Considerations

State Regulations: LLCs are subject to state-specific regulations and fees. It's essential to understand these requirements to maintain compliance.

Operating Agreement: Drafting a clear operating agreement can help outline the management structure and operational procedures, preventing potential disputes.

Consult a Tax Professional: Navigating the nuances of business structure and taxation can be complex. Consulting with a tax advisor ensures you're making the most informed decisions.

Optimizing your business structure as an LLC can lead to substantial tax savings and operational benefits. Next, we'll explore how using Health Savings Accounts (HSAs) can further improve your tax strategy.

Use Health Savings Accounts (HSAs)

When it comes to smart tax strategies, Health Savings Accounts (HSAs) are a powerful tool for business owners. They not only help you save on taxes but also prepare for future healthcare needs. Here's how they work.

Tax-Free Contributions

HSAs allow you to set aside money pre-tax to cover medical expenses. This means the money you contribute reduces your taxable income, effectively lowering your tax bill.

For 2024, you can contribute up to $4,150 for individual coverage or $8,300 for family coverage. If you're 55 or older, there's an additional "catch-up" contribution of $1,000. These contributions are tax-deductible, which means they reduce your taxable income dollar-for-dollar.

Triple Tax Advantage

HSAs offer a unique triple tax advantage:

Tax-Deductible Contributions: Contributions to your HSA are made with pre-tax dollars, reducing your taxable income.

Tax-Free Growth: The money in your HSA grows tax-free. Any interest or investment gains are not taxed.

Tax-Free Withdrawals: Withdrawals for qualified medical expenses are tax-free. This means you won't pay any taxes on the money you use for healthcare costs.

Future Healthcare Needs

Healthcare costs are on the rise, and having an HSA can be a financial lifesaver. The funds in your HSA roll over from year to year, so you don't lose unused money at the end of the year. This makes it a great way to save for future medical expenses, providing peace of mind that you'll have funds available when you need them.

Real-Life Example

Consider Sarah, a small business owner who set up an HSA for herself and her family. By contributing the maximum allowable amount each year, Sarah reduces her taxable income significantly. Over time, her HSA grows through tax-free investments, providing a substantial nest egg for future medical expenses. This strategic move not only saves her money on taxes now but also ensures she has funds available for healthcare needs down the line.

Key Considerations

Eligible Plans: To open an HSA, you must be enrolled in a high-deductible health plan (HDHP). Ensure your plan qualifies before setting up an HSA.

Qualified Medical Expenses: Familiarize yourself with what the IRS considers qualified medical expenses to ensure your withdrawals remain tax-free.

Long-Term Savings: Treat your HSA as a long-term savings vehicle. While you can use it for immediate medical expenses, allowing it to grow can maximize its benefits.

By leveraging the advantages of HSAs, business owners can effectively reduce their tax burden while planning for future healthcare costs. Next, we'll dig into how deducting business expenses can further optimize your tax strategy.

Deduct Business Expenses

When it comes to paying less taxes, business owners have a powerful ally: deductible business expenses. By understanding what you can deduct, you can significantly reduce your taxable income. Let's explore some key areas where you can make deductions.

Travel Expenses

Business travel can add up quickly, but the IRS allows you to deduct many of these costs. Deductible travel expenses include:

Transportation (flights, trains, buses, and car rentals)

Lodging (hotel stays)

Meals (50% of the cost during business trips)

Local transportation (taxis, Uber, subway tickets)

Other expenses (parking, tolls, and even laundry)

A real-life example: Imagine you're attending a conference in another state. Your flight, hotel, and meals are all deductible. Just remember to keep detailed records and receipts to substantiate these expenses.

Home Office Deduction

If you work from home, the home office deduction can be a great way to lower your taxes. To qualify, you must use part of your home exclusively and regularly for business. There are two methods to calculate this deduction:

Simplified Option: Multiply the square footage of your office (up to 300 square feet) by $5. This method is straightforward and requires less paperwork.

Regular Method: Calculate the percentage of your home used for business and apply that percentage to your home expenses, like mortgage interest, rent, utilities, and insurance.

This deduction can be especially beneficial for freelancers and small business owners who operate primarily from their homes.

Vehicle Deductions

Using your vehicle for business? You can deduct the expenses associated with it. There are two ways to do this:

Standard Mileage Rate: Track your business miles and multiply by the IRS mileage rate (e.g., $0.67 per mile for 2024).

Actual Expense Method: Deduct the actual costs of operating the vehicle (gas, maintenance, insurance) based on the percentage of business use.

For example, if you drove 5,000 miles for business in a year, you could deduct $3,350 using the standard mileage rate. Keep a mileage log to ensure accuracy and compliance with IRS requirements.

By understanding and applying these deductions, business owners can pay less taxes and keep more money in their pockets. Next, we'll explore other strategies to optimize your tax planning.

How Do Business Owners Pay Less Taxes?

Navigating taxes can be daunting for business owners. However, understanding tax deductions, tax credits, and the business income deduction can make a significant difference in how much you pay. Let's break it down.

Tax Deductions

Tax deductions reduce your taxable income, which means you owe less in taxes. Common deductions include business expenses, as discussed earlier. Other examples are:

Health Insurance Premiums: Self-employed individuals can deduct premiums for medical, dental, and long-term care insurance.

Retirement Plan Contributions: Contributions to retirement plans like SEP IRAs or Solo 401(k)s are deductible, reducing your taxable income today while saving for the future.

Tax Credits

Unlike deductions, tax credits directly reduce the amount of tax you owe, dollar for dollar. Some valuable credits for small businesses include:

Work Opportunity Tax Credit (WOTC): This credit is available for businesses that hire individuals from certain targeted groups, like veterans.

Small Business Health Care Tax Credit: If you provide health insurance to your employees, you might qualify for this credit, which helps cover part of the premiums.

Business Income Deduction

The Qualified Business Income (QBI) Deduction allows eligible self-employed and small business owners to deduct up to 20% of their qualified business income. This deduction is particularly beneficial for those organized as sole proprietorships, partnerships, or S-corporations. However, the rules can be complex, and limits apply based on income levels and business type.

Real-Life Example

Consider Joe, a self-employed writer. By identifying $6,000 in contractor expenses, he reduced his taxable income from $60,000 to $54,000. This simple action saved him over $1,500 in taxes. Joe's example highlights the power of understanding and applying deductions effectively.

By leveraging these strategies, business owners can significantly lower their tax burden, keeping more money to reinvest in their business or save for the future. Up next, we'll tackle frequently asked questions about business taxes to further improve your understanding.

Frequently Asked Questions about Business Taxes

How to pay less taxes as a small business owner?

Minimizing tax liability is a key focus for many business owners. One effective strategy is to employ family members. For instance, hiring your children can shelter income from taxes. If they are under 18, their wages aren't subject to Social Security and Medicare taxes. This approach not only reduces your tax burden but can also provide valuable work experience for your kids.

Additionally, contributing to a retirement fund is a smart move. Plans like SEP IRAs and Solo 401(k)s offer tax-deductible contributions, which lower your taxable income. For example, in 2024, you can contribute up to $69,000 to a Solo 401(k), plus an extra $7,500 if you're over 50.

Can you save on taxes by owning a business?

Yes, owning a business opens up numerous opportunities to deduct expenses and lower your tax bill. Common deductions include travel expenses, home office costs, and vehicle expenses. For instance, if you travel for business, you can deduct costs such as airfare, lodging, and 50% of meal expenses.

Owning a business also comes with other small business benefits. You can use Health Savings Accounts (HSAs) to save for future healthcare needs with tax-free contributions. Moreover, if you're self-employed, you can deduct your health insurance premiums, lowering your taxable income.

How much can an LLC write-off?

An LLC can write off various expenses, reducing its taxable income. Startup costs are one of the first expenses you can deduct. According to the IRS tax code, you can deduct up to $5,000 in startup costs in the first year, with the remainder amortized over 15 years.

Additionally, LLCs can deduct ongoing business expenses like rent, utilities, and salaries. If you use a vehicle for business, you can deduct either the actual expenses or use the standard mileage rate.

Understanding these deductions and how to apply them can help LLC owners maximize their write-offs and minimize their tax liability.

By leveraging these strategies and insights, business owners can effectively manage their tax obligations and keep more of their hard-earned money.

Conclusion

Navigating the complex world of business taxes can be daunting, but with the right strategies, you can significantly reduce your tax burden. At NR Tax and Consulting, we specialize in providing personalized financial guidance custom to your unique needs. Our team is dedicated to helping you make the most of your tax situation, ensuring that you pay less and save more.

Our local accountant services are designed to offer you the personalized attention that your business deserves. We understand the intricacies of the tax code and how it applies to small businesses in your community. Whether you're looking to employ family members, maximize retirement contributions, or optimize your business structure, we're here to guide you every step of the way.

By partnering with us, you're not just getting a service; you're gaining a team of experts committed to your success. We focus on helping you identify valuable deductions and credits, ensuring compliance with the latest tax laws, and ultimately, enhancing your potential for savings and financial growth.

Ready to take control of your business taxes? Explore our services and see how we can help you achieve your financial goals. Let's work together to open up the full potential of your tax deductions and set you up for a successful year.

Want tax & accounting tips and insights?

Sign up for our newsletter.