Hire a Bookkeeper: Your Path to Financial Clarity

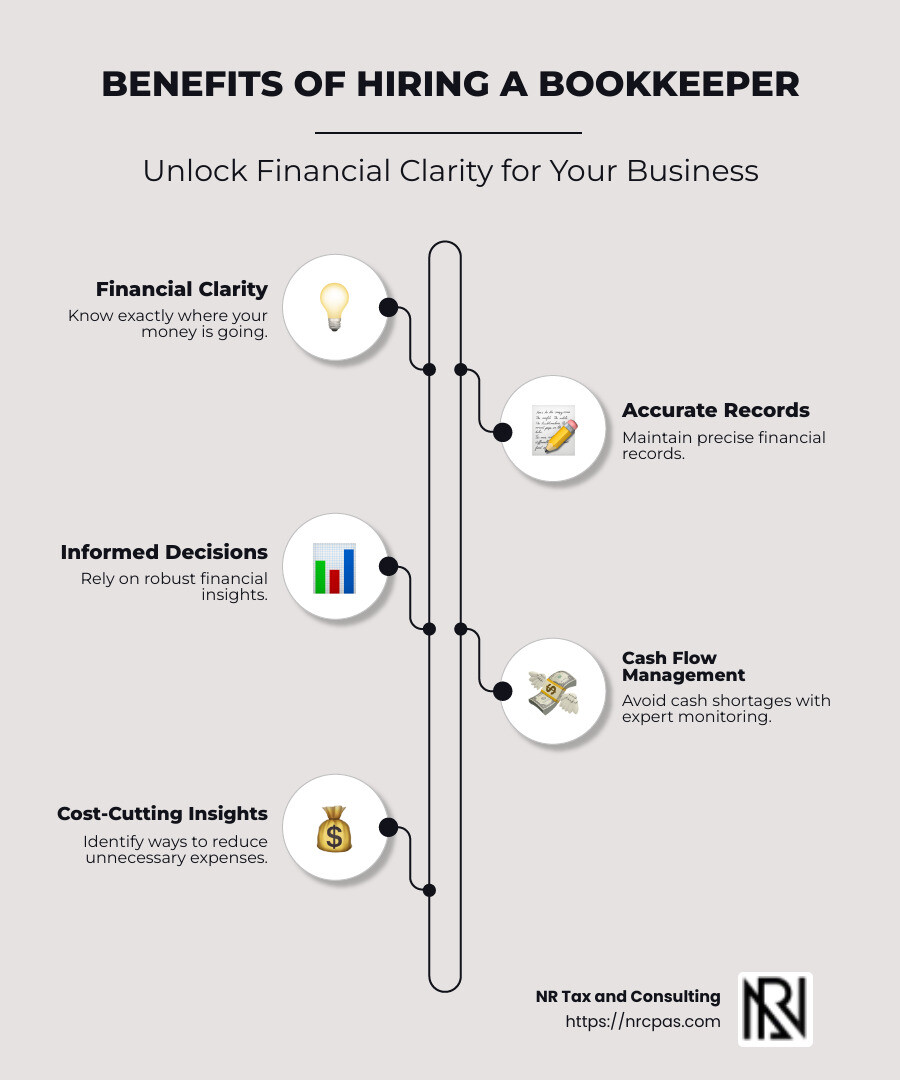

Hire a bookkeeper to open up financial clarity and transform your small business's financial management. Imagine having someone to carefully track your revenues and expenses, providing you a clear, organized view of your business's financial health. Here’s a quick look at the benefits:

Financial Clarity: Know exactly where your money is going.

Accurate Records: Maintain precise financial records.

Informed Decisions: Rely on robust financial insights for decision-making.

Cash Flow Management: Avoid cash shortages with expert monitoring.

Cost-Cutting Insights: Identify ways to reduce unnecessary expenses.

As a small business owner, untangling complex financial tasks can feel overwhelming. A skilled bookkeeper not only simplifies these obligations but also empowers you to make better financial decisions that drive growth and stability.

I am Nischay Rawal, with over a decade in assisting businesses streamline their financial processes, empowering them to succeed both today and tomorrow. My journey at NR Tax & Consulting has always prioritized relieving the burden on business owners, allowing them the freedom to focus on what they do best.

Image Alt Text: Infographic detailing benefits of hiring a bookkeeper: financial clarity, accurate records, informed decisions, cash flow management, and cost-cutting insights - hire a bookkeeper infographic infographic-line-5-steps-neat_beige

Why Hire a Bookkeeper?

Navigating the financial landscape of a small business can be daunting. That's where hiring a bookkeeper comes into play. Their expertise can turn financial chaos into clarity.

Expertise

Bookkeepers are the unsung heroes of financial management. They bring specialized knowledge in handling the complexities of your business's finances. With certifications in leading financial software like QuickBooks, they ensure your books are accurate and up-to-date.

Image Alt Text: Expertise in bookkeeping - hire a bookkeeper

Imagine having peace of mind knowing your financial records are in expert hands. You can focus on growing your business while they handle the numbers.

Financial Data Interpretation

A bookkeeper is like a translator for your business's financial data. They turn raw numbers into actionable insights. With detailed reports, they help you understand your business's financial health at a glance.

This interpretation is crucial for making informed decisions. Whether you're considering an investment or looking to cut costs, a bookkeeper provides the clarity you need.

"With accurate records and financial reporting, you gain a clear overview of your business’s financial status."

Image Alt Text: Financial data interpretation - hire a bookkeeper infographic 4_facts_emoji_grey

Compliance

Staying compliant with financial regulations is non-negotiable. A bookkeeper ensures your business adheres to ever-changing laws and standards. They keep track of deadlines, manage your taxes, and ensure your financial practices align with legal requirements.

This compliance not only protects your business from potential fines but also builds trust with stakeholders. When your financial house is in order, you can confidently present your business to investors and partners.

In summary, hiring a bookkeeper is a strategic move. Their expertise, ability to interpret financial data, and commitment to compliance bring immense value to your business. This sets a solid foundation for growth and success, freeing you to focus on what truly matters: your business vision.

Cost of Hiring a Bookkeeper

Understanding the costs involved in hiring a bookkeeper is crucial for small business owners. It helps you budget effectively and ensures you get the right level of service for your needs.

Monthly Cost

The monthly cost of bookkeeping services can vary widely. For basic services, you might pay as little as $39 per month. If you need more comprehensive support, costs can rise to $299 or more per month. These prices often depend on the complexity of your business and the volume of transactions.

Service Scope

When you hire a bookkeeper, it's important to define the scope of services you need. Basic tasks might include:

Tracking income and expenses

Managing invoices and receipts

Preparing financial statements

Reconciling bank accounts

Some bookkeepers offer additional services like setting up accounting software or running detailed reports. Knowing what you need helps you choose the right service package.

Pricing Factors

Several factors influence the cost of hiring a bookkeeper:

Business Size: Larger businesses with more transactions may incur higher fees.

Complexity: Businesses with complex financial needs may require more in-depth services.

Frequency: The frequency of bookkeeping services (weekly, monthly, quarterly) can affect pricing.

Experience: Bookkeepers with more experience or certifications may charge higher rates.

Outsourcing your bookkeeping can be a cost-effective solution, especially if you don't need full-time support. It allows you to pay only for the services you use, avoiding the overhead of hiring an in-house employee.

In conclusion, understanding the costs and scope of services when you hire a bookkeeper helps you make informed decisions. This ensures you get the financial clarity you need without overspending.

Bookkeeping Solutions: In-House vs. Professional Services

Choosing between in-house bookkeeping and professional services is a key decision for any business. Let's break down the options.

In-House Software

In-house software, like QuickBooks or Quicken, allows businesses to manage their own finances. QuickBooks is popular among small business owners for its user-friendly interface and comprehensive features. It helps track sales, manage invoices, and generate financial reports.

The benefits of using in-house software include:

Control: You have direct access and control over your financial data.

Cost-Effectiveness: Software subscriptions are often cheaper than hiring a professional.

Flexibility: You can update and manage your books anytime.

However, in-house solutions require time and a good understanding of bookkeeping principles. Mistakes can lead to costly errors.

Professional Expertise

Hiring a professional bookkeeper brings expertise to your business. Professionals can interpret financial data, ensure compliance, and provide strategic insights.

Benefits of professional expertise:

Accuracy: Professionals reduce the risk of errors in your financial records.

Time-Saving: Free up your time to focus on running your business.

Financial Insights: Get detailed reports and insights to make informed decisions.

Professional bookkeepers often use advanced tools and software, ensuring your business stays compliant with financial regulations.

Financial Reports

Both in-house software and professional services offer financial reporting, but the depth and accuracy can vary.

In-House Software: Generates basic reports like profit and loss statements, balance sheets, and cash flow statements. These are sufficient for simple financial tracking.

Professional Services: Provide more detailed and customized reports. They can help with budgeting, forecasting, and identifying cost-cutting opportunities.

In summary, choosing between in-house software and professional services depends on your business needs. If you have the time and expertise, in-house software might suffice. But for comprehensive support and strategic insights, hiring a professional bookkeeper is often the better choice.

Frequently Asked Questions about Hiring a Bookkeeper

How much does it cost to have a personal bookkeeper?

The cost of hiring a personal bookkeeper can vary widely based on several factors, including the size of your business and the complexity of your financial transactions.

For small businesses, monthly fees can start as low as $39 for basic services and can go up to $299 or more for comprehensive plans that might include dedicated accountants and advanced financial management tools. It's important to discuss your specific needs with the service provider to get a clear understanding of the costs involved.

Is it worth paying a bookkeeper?

Absolutely. Hiring a bookkeeper can provide significant benefits for a small business. Bookkeepers ensure accountability by keeping your financial records accurate and up-to-date. This accuracy can prevent costly mistakes and penalties, especially during tax season.

A bookkeeper also frees up your time, allowing you to focus on leadership tasks and strategic decision-making. With a professional handling your books, you can concentrate on growing your business and making informed decisions based on accurate financial insights.

Should I use in-house software or hire a bookkeeper?

Deciding between in-house software and hiring a bookkeeper depends on your business needs and resources.

In-house software like QuickBooks offers control and cost-effectiveness, making it a viable option for businesses with simpler financial needs and the capacity to manage their own books. However, it requires a solid understanding of bookkeeping principles to avoid errors.

On the other hand, hiring a bookkeeper provides strategic financial insights that software alone can't offer. Professionals can interpret complex financial data, ensure compliance, and provide detailed reports that support strategic decision-making.

In short, if you seek comprehensive support and detailed financial insights, hiring a bookkeeper is often the better choice. If you're comfortable managing your finances and have the time to do so, in-house software might suffice.

Previous Section: Bookkeeping Solutions: In-House vs. Professional Services

Conclusion

Choosing to hire a bookkeeper can be a pivotal decision for your business. At NR Tax and Consulting, we understand that each business is unique, and that's why we offer personalized guidance custom to your specific needs. Our team is dedicated to providing expert financial consulting services, ensuring your business stays on track.

Our local accountant services focus on building strong relationships within the community. We know the local market and can provide insights that a generic service simply can't. By partnering with us, you're not just hiring a bookkeeper; you're gaining a team committed to your success.

Whether you need help with tax preparation, financial analysis, or strategic planning, NR Tax and Consulting is here to support you every step of the way. Our goal is to deliver clarity and peace of mind, allowing you to focus on what you do best—running your business.

Find how our monthly bookkeeping services can benefit your business by visiting our service page. Let us help you achieve financial clarity and drive your business forward.

Want tax & accounting tips and insights?

Sign up for our newsletter.