The Art of Financial Planning: How to Secure Your Future

Financial planning is your roadmap to achieving financial security and preparing for the future. Whether you’re aiming to buy a home, save for retirement, or guard your business against financial pitfalls, having a well-thought-out plan is crucial. It involves setting clear goals, devising strategies to reduce debts, and ensuring you have enough saved for emergencies and future milestones.

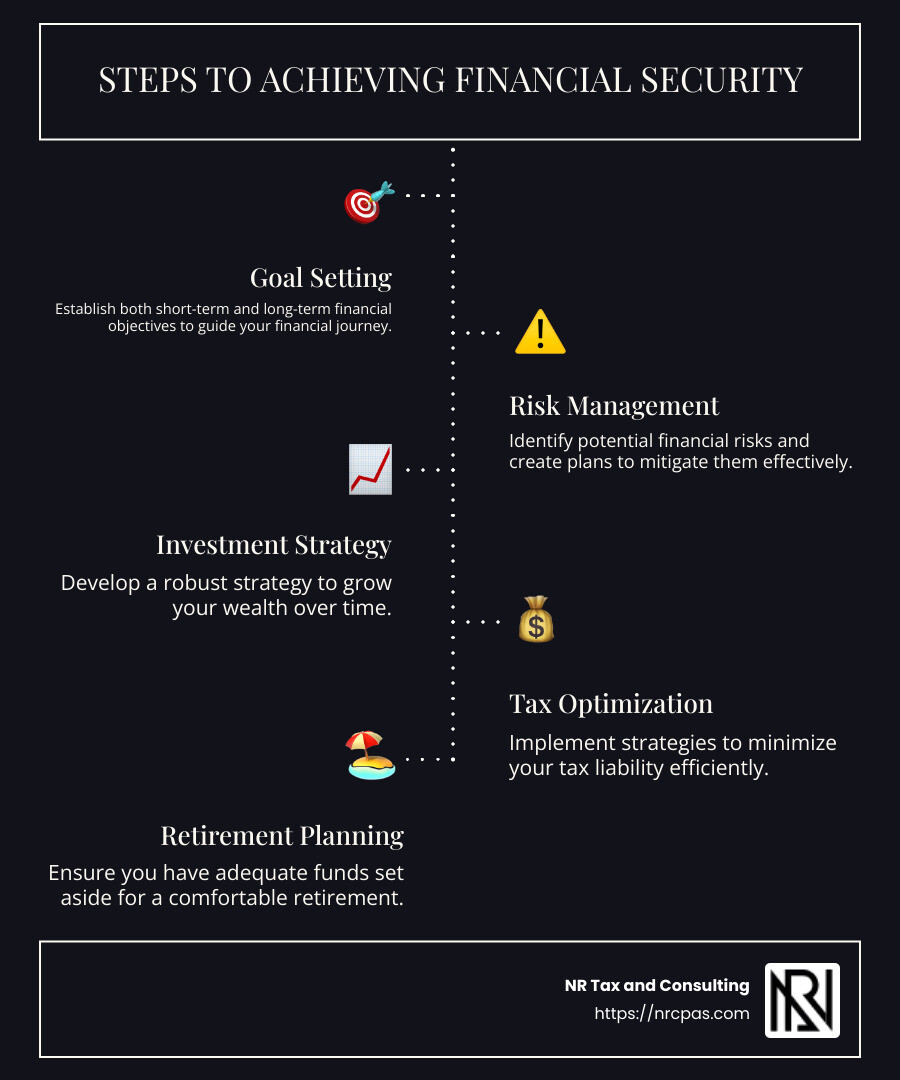

Goal Setting: Establish short-term and long-term financial objectives.

Risk Management: Identify potential financial risks and create a plan to mitigate them.

Investment Strategy: Develop a strategy to grow your wealth over time.

Tax Optimization: Implement strategies to minimize tax liability.

Retirement Planning: Ensure you have adequate funds for a comfortable retirement.

Estate Planning: Ensure your assets are distributed according to your wishes.

As a small business owner, achieving financial security can seem complex. It’s about balancing everyday expenses with future dreams while navigating ever-changing financial laws. Navigating these complexities doesn’t have to be overwhelming when equipped with the right knowledge and tools.

I’m Nischay Rawal, founder of NR CPAs & Business Advisors, with over 10 years of experience in financial planning. My passion is to simplify complex financial processes for our clients, with a focus on ensuring that both individual and business financial futures are secure.

Understanding Financial Planning

When it comes to financial planning, three pillars stand out: budgeting, investment strategies, and risk management. Let’s break these down into simple terms.

Budgeting

Budgeting is like mapping out your money journey. It’s about knowing where your money comes from and where it goes. By creating a budget, you can control your spending and ensure you have enough to meet your needs and save for the future.

Track Your Income and Expenses: Start by listing all your sources of income and every expense. This helps you see where you might be overspending.

Set Spending Limits: Allocate specific amounts to different categories, like groceries, entertainment, and savings.

Adjust as Needed: Life changes, and so should your budget. Review it regularly to ensure it aligns with your current situation and goals.

Investment Strategies

Investments are about making your money work for you. They can help grow your wealth over time and secure your financial future.

Diversify Your Portfolio: Don’t put all your eggs in one basket. Mix different types of investments to spread risk and increase potential returns.

Long-Term Focus: Investments typically perform better over the long run. Stay patient and avoid reacting to short-term market changes.

Understand Your Risk Tolerance: Know how much risk you’re comfortable taking. This helps you choose investments that fit your financial goals and peace of mind.

Risk Management

Risk management is like having a safety net. It’s about preparing for unexpected events that could impact your finances.

Insurance: Consider different types of insurance, such as health, life, and property, to protect against unforeseen events.

Emergency Fund: Aim to save three to six months’ worth of expenses. This fund can help you handle emergencies without derailing your financial plan.

Regular Reviews: Assess your financial situation and risks periodically. This ensures your risk management strategies remain effective.

By understanding these components, you lay a strong foundation for your financial future. This approach helps you make informed decisions, ensuring you’re prepared for life’s uncertainties while working towards your financial dreams.

Next, we’ll dig into the Key Components of Financial Planning, focusing on savings, retirement planning, and tax optimization.

Key Components of Financial Planning

Financial planning is like building a house. You need a strong foundation to support everything else. Let’s look at three essential components: savings, retirement planning, and tax optimization.

Savings

Think of savings as the cornerstone of your financial house. It’s the money you set aside for future needs and emergencies.

Emergency Fund: Aim for three to six months of expenses. This safety net helps you handle unexpected events like medical emergencies or job loss without stress.

Regular Contributions: Make saving a habit. Set up automatic transfers to your savings account to ensure consistency.

Short and Long-Term Goals: Divide your savings into different goals, like a vacation, buying a home, or a child’s education. This helps you stay focused and motivated.

Retirement Planning

Retirement planning is about ensuring you have enough money to live comfortably when you stop working. It’s a long-term process that requires careful thought and action.

Start Early: The sooner you start, the more time your money has to grow. Even small contributions can make a big difference over time.

Participate in Retirement Accounts: Use plans like 401(k)s or IRAs to save for retirement. These accounts offer tax advantages that can boost your savings.

Estimate Your Needs: Consider your desired retirement lifestyle and healthcare needs to estimate how much you’ll need. This helps you set realistic savings goals.

Tax Optimization

Tax optimization is about making your money work smarter by minimizing your tax liability.

Understand Tax Deductions and Credits: Familiarize yourself with available deductions and credits to reduce your taxable income.

Strategic Investments: Consider tax-efficient investments that can provide returns while minimizing taxes.

Consult a Professional: A financial advisor or tax professional can help you steer complex tax rules and identify strategies to save money.

By focusing on these key components of financial planning, you can build a secure financial future. Savings ensure you’re prepared for life’s surprises, retirement planning helps you enjoy your golden years, and tax optimization keeps more money in your pocket.

Next, we’ll explore The Role of Financial Planning Consulting Services and how they provide personalized advice, expert guidance, and custom strategies.

The Role of Financial Planning Consulting Services

Financial planning consulting services are like having a personal trainer for your money. They help you make smart financial choices and reach your goals. Let’s see how they do this with personalized advice, expert guidance, and custom strategies.

Personalized Advice

Everyone’s financial situation is unique. That’s why personalized advice is so important. A financial planner looks at your entire financial picture—your income, expenses, debts, and goals. They then tailor advice to fit your specific needs.

For example, if you’re a young professional with student loans, a planner might suggest ways to pay down your debt while saving for a house. Or, if you’re nearing retirement, they might focus on maximizing your retirement savings and minimizing taxes.

Expert Guidance

Navigating finance can be confusing. That’s where expert guidance comes in. Financial planners are trained professionals who know the ins and outs of money management. They stay updated on the latest financial trends and laws, ensuring you get the best advice.

A good planner acts as a fiduciary, meaning they must act in your best interest. They help you make informed decisions about investments, insurance, and other financial products. This guidance can prevent costly mistakes and help you grow your wealth over time.

Custom Strategies

Financial planning isn’t one-size-fits-all. It’s about creating custom strategies that align with your goals and values. A financial planner works with you to develop a plan that addresses your short-term and long-term objectives.

For instance, they might help you create a budget to manage your monthly expenses or design an investment strategy to build your wealth. They can also assist with estate planning, ensuring your assets are protected and distributed according to your wishes.

Financial planning consulting services offer a roadmap to financial success. They provide the tools and knowledge you need to make confident financial decisions.

Next, we’ll explore the Benefits of Professional Financial Planning and how it can lead to goal achievement, stress reduction, and financial literacy.

Benefits of Professional Financial Planning

Professional financial planning offers numerous advantages that can significantly impact your life. Let’s explore how it helps with goal achievement, stress reduction, and financial literacy.

Goal Achievement

Setting and reaching financial goals is like climbing a mountain. Without a clear path, it can be overwhelming. Professional financial planners help map out this path. They break down your goals into manageable steps, making it easier to reach them.

For example, if your dream is to buy a house, a financial planner will help you save for a down payment, improve your credit score, and find the best mortgage rates. This structured approach increases the chances of achieving your dreams.

Stress Reduction

Money worries can be a major source of stress. A well-crafted financial plan can alleviate this burden. By organizing your finances, you gain a sense of control and clarity.

Imagine knowing exactly where your money is going each month and having a plan for unexpected expenses. This peace of mind can reduce anxiety and improve your overall well-being. As noted in the research, stress-free accounting and planning can improve mental health and productivity.

Financial Literacy

Understanding your finances is crucial for making informed decisions. Professional financial planners educate you about money matters, increasing your financial literacy. This knowledge empowers you to make smarter financial choices.

For instance, a planner might teach you about different investment options, helping you understand risk and return. This education ensures you feel confident when making financial decisions, whether it’s investing in stocks or planning for retirement.

In summary, professional financial planning is a powerful tool. It helps you achieve your goals, reduces stress, and boosts your financial knowledge.

Next, let’s address some Frequently Asked Questions about Financial Planning to further clarify its importance and benefits.

Frequently Asked Questions about Financial Planning

What is financial planning?

Financial planning is like creating a roadmap for your money. It involves setting goals for your finances and figuring out how to reach them. This plan includes budgeting, saving, investing, and managing debt. Think of it as a guide to help you make smart money choices today and in the future.

Financial planning helps you understand your current financial situation and plan for both short-term and long-term goals. Whether you want to buy a house, save for your kids’ college, or retire comfortably, a financial plan can guide you.

Why is financial planning important?

Financial planning is crucial because it provides a clear path to achieving your financial goals. Without a plan, it’s easy to lose track of where your money is going. Planning helps you prioritize your spending and savings, ensuring you are prepared for emergencies and future needs.

It also helps reduce financial stress. Knowing you have a plan in place can bring peace of mind. As highlighted in the research, financial literacy and planning can have a material impact on families, helping them balance budgets, buy homes, and ensure a comfortable retirement.

How can financial planning help in retirement?

Retirement planning is a critical part of financial planning. It ensures you have enough money to live comfortably once you stop working. A well-thought-out retirement plan helps you identify how much you need to save and the best ways to grow your retirement funds.

Financial advisors can help you consider factors like your desired retirement age, lifestyle, and healthcare needs. They use strategies to maximize your savings and investments, ensuring your money lasts throughout your retirement years. As noted in the research, retirement should be active and rewarding without worrying about financial constraints.

Financial planning for retirement involves assessing your current assets, estimating future expenses, and creating a savings plan. It’s about making sure you have the resources to enjoy your retirement without financial worries.

Conclusion

In today’s world, financial planning is more important than ever. It’s not just about numbers; it’s about securing your future and achieving peace of mind. At NR CPAs & Business Advisors, we understand that everyone’s financial journey is unique. That’s why we offer personalized financial guidance custom to your specific needs.

Our expert team is here to help you steer the complexities of financial planning. Whether you’re saving for your child’s education, planning for retirement, or looking to optimize your taxes, we have the tools and knowledge to assist you. Our approach is simple: we listen, we plan, and we guide you every step of the way.

By partnering with us, you’re not just getting a service; you’re gaining a partner committed to helping you achieve your financial goals. We believe that with the right plan, you can secure your future and enjoy the financial freedom you deserve.

Don’t leave your financial future to chance. Let NR CPAs & Business Advisors provide the expert guidance you need to make informed decisions and achieve your dreams. Contact us today and take the first step towards a secure and prosperous future.

Want tax & accounting tips and insights?

Sign up for our newsletter.