Informing Your Clients: Corporate Transparency Act Compliance Letters

Informing Your Clients: Corporate Transparency Act Compliance Letters

Understanding the Corporate Transparency Act Compliance

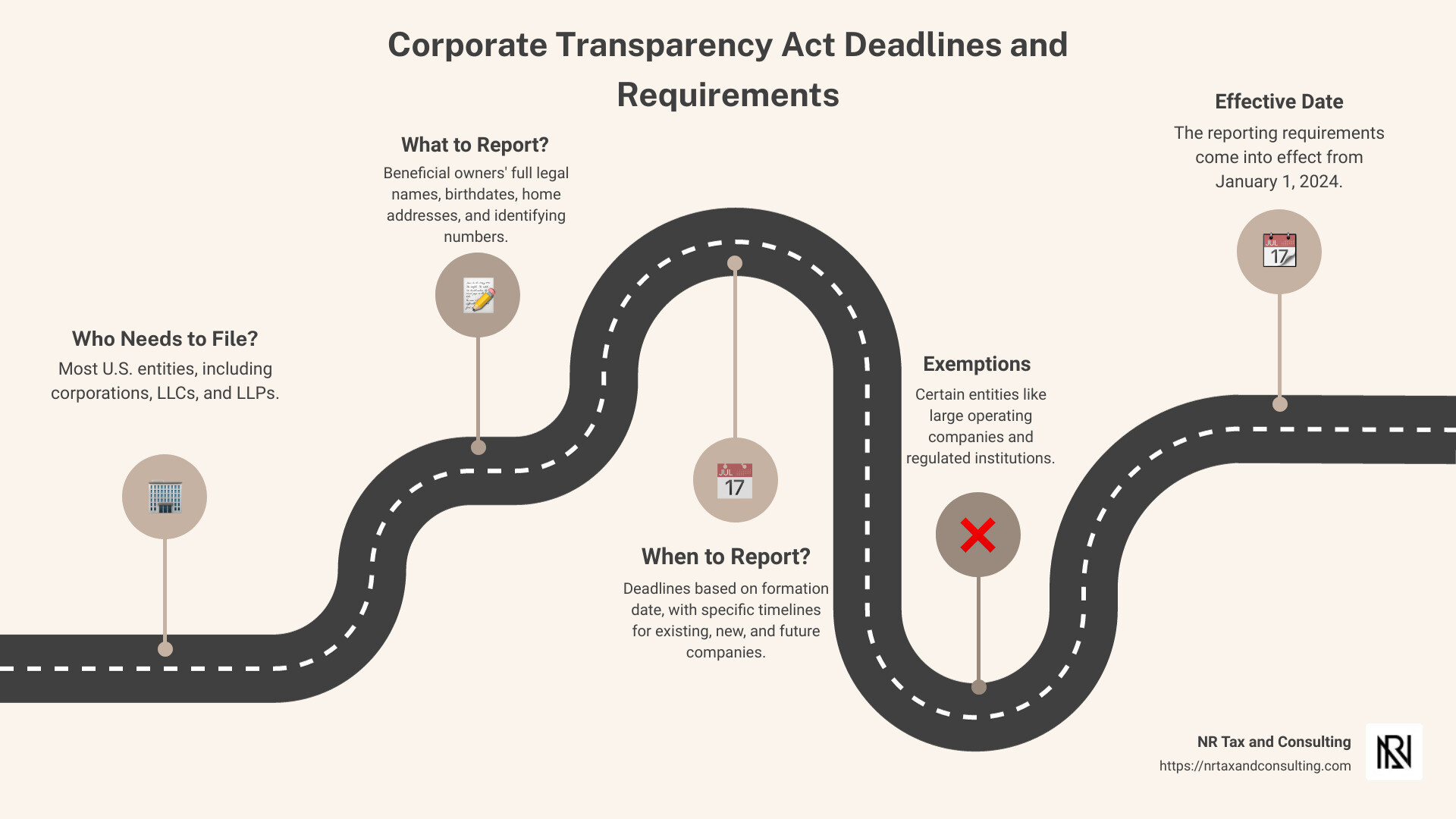

Corporate Transparency Act client letter is a crucial communication tool to inform your clients about the new reporting requirements related to beneficial ownership under the Corporate Transparency Act (CTA). Effective January 1, 2024, businesses in the U.S. must start reporting detailed information on their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). This critical change aims to enhance transparency and fight illicit activities.

Here's what you need to know right away:

Who Needs to File? Most U.S. entities, including corporations, LLCs, and LLPs, must report.

What to Report? Beneficial owners' full legal names, birthdates, home addresses, and identifying numbers.

When to Report? Deadlines vary based on the formation date, with specific timelines for existing, new, and future companies.

Exemptions? Certain entities like large operating companies and regulated institutions are exempt.

My name is Nischay Rawal, and I have over a decade of experience in tax and financial management. At NR CPAs & Business Advisors, we specialize in guiding small businesses through complex compliance landscapes like the Corporate Transparency Act client letter requirements.

Understanding the Corporate Transparency Act

What is the Corporate Transparency Act?

The Corporate Transparency Act (CTA) is a federal law effective January 1, 2024. It aims to combat illicit finance activities such as money laundering, terrorist financing, and tax fraud. The CTA requires certain companies to disclose their beneficial ownership information (BOI) to the Financial Crimes Enforcement Network (FinCEN).

The main goal of the CTA is to increase transparency in the U.S. financial system. By uncovering the true owners behind shell companies, law enforcement agencies can better track and prevent illegal activities.

Who Needs to File a BOI Report?

Companies that need to file a BOI report are generally referred to as "reporting companies." These include:

Corporations, LLCs, and similar entities created by filing a document with a state or tribal office.

Foreign entities registered to do business in the U.S.

The BOI report must include details about the company’s beneficial owners—those who own or control the company. This includes their name, birth date, address, and a government-issued photo ID.

Key Exemptions to Reporting

Not all companies are required to file a BOI report. The CTA provides 23 specific exemptions. Here are some key exemptions:

Publicly Traded Companies: Companies registered with the SEC are already subject to strict reporting requirements and are exempt from the CTA.

Tax-Exempt Entities: Non-profits and similar organizations that qualify for tax-exempt status, such as charities and religious organizations, are exempt.

Large Operating Companies: To qualify for this exemption, a company must:

Have over 20 full-time employees in the U.S.

Show more than $5 million in gross receipts or sales on a federal tax return.

Maintain a physical office in the U.S.

Subsidiaries of Exempt Entities: If a subsidiary is 100% owned or controlled by an exempt entity, it also qualifies for an exemption.

Regulated Public Utilities: Companies providing services like telecommunications, electricity, natural gas, water, and sewer services within the U.S. are exempt if they meet specific regulatory criteria.

For a more detailed list of exemptions, you can refer to FinCEN’s FAQ page.

Understanding these exemptions is crucial for determining whether your company needs to comply with the CTA. If you have any doubts, consulting with a professional advisor can help navigate these complex regulations.

Next, let's dive into how to prepare your Corporate Transparency Act client letter to ensure compliance.

Preparing Your Corporate Transparency Act Client Letter

Essential Elements of a Client Letter

When preparing a Corporate Transparency Act client letter, it’s important to ensure it covers all the necessary compliance requirements and beneficial ownership information mandated by FinCEN. Here are the key elements your client letter should include:

1. Introduction to the Corporate Transparency Act (CTA):

Briefly explain the purpose of the CTA, which is to combat illicit finance by requiring businesses to disclose their beneficial owners.

Mention the effective date: January 1, 2024.

2. Explanation of Beneficial Ownership Information (BOI):

Define what constitutes a beneficial owner (anyone who exercises substantial control or owns at least 25% of the entity).

List the required information: full legal name, birthdate, home address, identifying number from a non-expired government ID, and an image of the ID.

3. Reporting Requirements:

Detail what companies need to report and the deadlines:

Existing companies (formed before January 1, 2024) must file by January 1, 2025.

New companies (formed between January 1, 2024, and December 31, 2024) must file within 90 days of creation.

Future companies (formed on or after January 1, 2025) must file within 30 days of creation.

Emphasize the need to report updates to beneficial ownership within 30 days of any change.

4. Client Responsibilities:

Clarify that clients are responsible for:

Determining if they are a reporting company.

Identifying their beneficial owners.

Providing timely, complete, and accurate information.

Reviewing and approving the draft BOI report before submission.

5. FinCEN Portal:

Inform clients about the FinCEN Beneficial Ownership Secure System (BOSS) where they can submit their BOI reports.

6. Consequences of Noncompliance:

Highlight the penalties for failing to comply: up to $500 per day, a maximum of $10,000, and potential imprisonment for up to 2 years.

7. Resources and Support:

Provide links to FinCEN’s Small Entity Compliance Guide and FAQ page for additional guidance.

Offer your services to assist with compliance and answer any questions.

Sample Client Letter Template

Here's a sample template to guide you in drafting your Corporate Transparency Act client letter:

[Your Company Letterhead]

[Date]

[Client’s Name]

[Client’s Address]

Dear [Client’s Name],

Subject: Important Compliance Requirement Under the Corporate Transparency Act (CTA)

We are writing to inform you about a critical new compliance requirement under the Corporate Transparency Act (CTA), which takes effect on January 1, 2024. This law mandates that most U.S. entities must report their beneficial ownership information (BOI) to the Financial Crimes Enforcement Network (FinCEN).

What is Required: As part of this new regulation, your company must disclose the following information about its beneficial owners:

Full legal name

Birthdate

Home address

Identifying number from a non-expired government ID (e.g., driver’s license, passport)

Image of the ID

Deadlines:

Existing Companies (formed before January 1, 2024): Must file by January 1, 2025.

New Companies (formed between January 1, 2024, and December 31, 2024): Must file within 90 days of creation.

Future Companies (formed on or after January 1, 2025): Must file within 30 days of creation.

Updates to beneficial ownership must be reported within 30 days of any change.

Client Responsibilities: You are responsible for:

Determining if your company is a reporting entity.

Identifying your beneficial owners.

Providing timely, complete, and accurate information.

Reviewing and approving the draft BOI report prior to submission.

Non-compliance with these requirements can result in significant penalties, including fines up to $10,000 and imprisonment for up to 2 years.

Resources and Support: For detailed guidance, you can refer to FinCEN’s Small Entity Compliance Guide and FAQ page. Should you need any assistance, our team is here to help you navigate these new requirements and ensure your compliance.

Please do not hesitate to contact us at [Your Contact Information] if you have any questions or need further assistance.

Sincerely,

[Your Name]

[Your Title]

[Your Contact Information]

By including all these essential elements in your client letter, you can help ensure your clients understand their responsibilities and the importance of compliance with the Corporate Transparency Act.

Next, let's explore the reporting requirements and deadlines in more detail.

Reporting Requirements and Deadlines

Initial BOI Reporting Timelines

Understanding the reporting timelines is crucial for staying compliant with the Corporate Transparency Act. Here’s what you need to know:

Existing Companies:

If your company was created or registered before January 1, 2024, you have until January 1, 2025 to file your initial Beneficial Ownership Information (BOI) report with FinCEN. This must be done through the Beneficial Ownership Secure System (BOSS).

New Companies:

For companies created or registered on or after January 1, 2024, you have 90 calendar days from the date of creation or registration to file your initial BOI report. Starting January 1, 2025, this timeline shortens to 30 days.

Corrections:

If you make any mistakes in your initial BOI report, you have 90 days to correct them without facing penalties.

Change in BOI Reporting Timeline

If there are any changes to the information previously reported to FinCEN, such as a change in a beneficial owner’s address, you must file an updated report within 30 calendar days of the change. This ensures that FinCEN always has the most current information.

Filing Costs

The cost to prepare and submit an initial BOI report is anticipated to be around $85 for companies with simple management and ownership structures. However, more complex entities may incur higher costs due to the need for professional assistance.

Penalties

Noncompliance with the BOI reporting requirements can lead to severe penalties:

Civil Penalties:

A fine of $500 per day (up to a maximum of $10,000) for willfully failing to report or update BOI.

Criminal Penalties:

Up to two years of imprisonment for anyone who willfully fails to report or provides false information.

These penalties highlight the importance of timely and accurate reporting.

Next, let's dive into the frequently asked questions about the Corporate Transparency Act to address common concerns.

Frequently Asked Questions about the Corporate Transparency Act

What is Beneficial Ownership Information?

Beneficial Ownership Information (BOI) refers to the details about individuals who own or control a company. This information is crucial for transparency and combating illicit activities like money laundering.

What to Report:

Name

Date of birth

Address

Identifying number and issuer (like a U.S. driver's license or passport)

Starting January 1, 2024, many businesses must report this information to the Financial Crimes Enforcement Network (FinCEN). This reporting aims to make it harder for criminals to hide their identities behind shell companies.

Who is Considered a Beneficial Owner?

A Beneficial Owner is anyone who:

Exercises substantial control over the company, or

Owns or controls at least 25% of the company’s ownership interest

Substantial Control can mean:

Serving as a senior officer

Having authority over appointing or removing senior officers or board members

Influencing important company decisions

Any other form of significant control

Ownership Interest includes any equity, stock, capital, or profit interest. Even if ownership is through a trust or intermediate entity, it must be reported.

What are the Penalties for Noncompliance?

Noncompliance with BOI reporting can result in severe penalties:

Civil Penalties:

$500 per day for willfully failing to report or update BOI, up to a maximum of $10,000.

Criminal Penalties:

Up to two years of imprisonment for anyone who willfully fails to report or provides false information.

These penalties underscore the importance of timely and accurate reporting. FinCEN has the authority to conduct audits and investigations to ensure compliance.

Next, let's explore the reporting requirements and deadlines for the Corporate Transparency Act.

Conclusion

Navigating the complexities of the Corporate Transparency Act (CTA) can be overwhelming. However, with the right guidance, compliance becomes manageable. At NR CPAs & Business Advisors, we specialize in helping businesses meet their beneficial ownership information (BOI) reporting requirements to FinCEN.

Why Choose Us?

We offer personalized compliance assistance tailored to your business needs. Our team of experts stays updated on the latest regulations, ensuring you avoid costly penalties and legal issues.

Comprehensive Services

We provide a range of services, including:

Initial BOI Reporting: We'll help you gather and submit the required information accurately and on time.

Ongoing Compliance: We monitor any changes in your beneficial ownership and ensure timely updates to FinCEN.

Exemption Analysis: We'll help you determine if your business qualifies for any exemptions, such as the large operating company exemption.

Proven Expertise

Our experience speaks for itself. For instance, we recently helped a small bakery owner navigate the complexities of the CTA, ensuring they met all reporting requirements and avoided penalties. This personalized guidance significantly improved their compliance and financial health.

Don't let compliance stress you out. Trust NR CPAs & Business Advisors to guide you through the complexities of the Corporate Transparency Act. Visit our Tax Planning Services page to learn more about how we can help.

By partnering with us, you gain access to a team dedicated to your success, helping you focus on what you do best—running your business.

Want tax & accounting tips and insights?

Sign up for our newsletter.