Accounting and Taxation Services: What You Need to Know

Accounting and taxation services are crucial for maintaining the financial health of any business. While they help ensure tax compliance and optimize savings, these services also provide essential financial insights and strategic planning guidance. By addressing complex tax regulations, businesses can not only avoid legal pitfalls but also position themselves for growth and success.

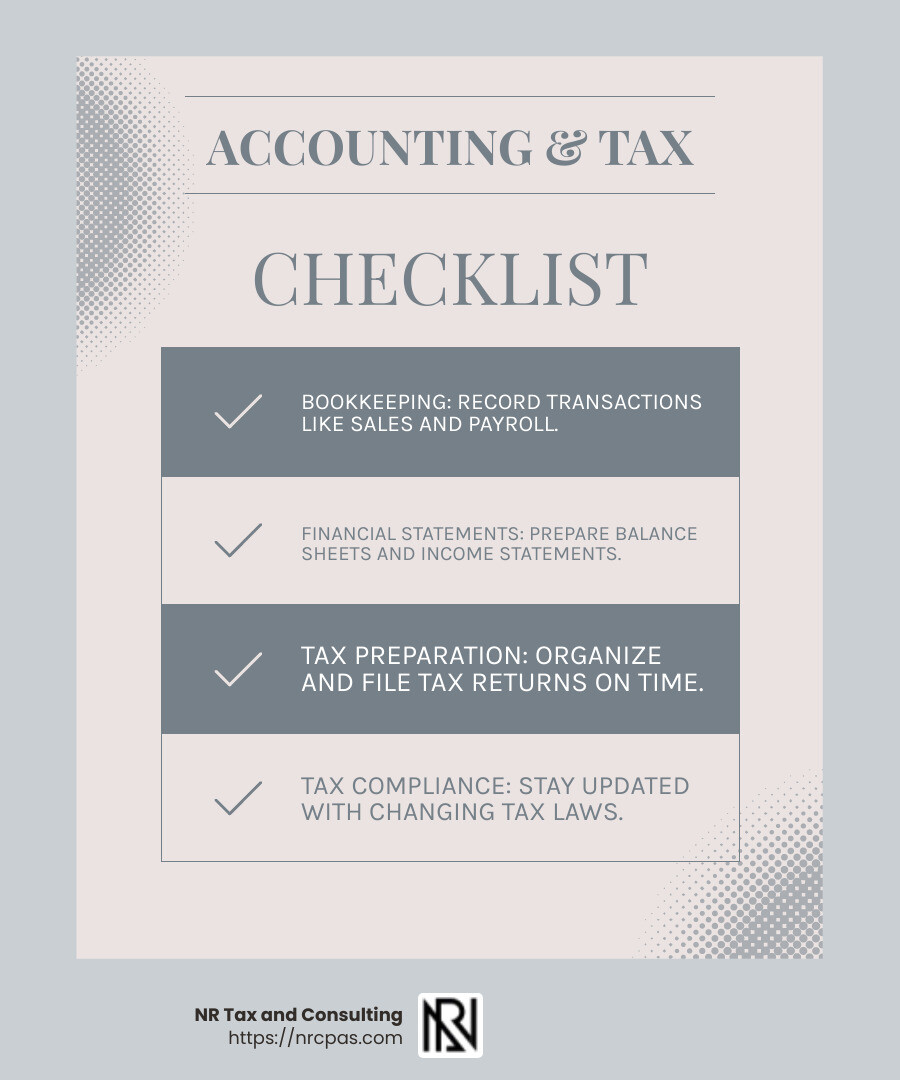

In simple terms, these services involve:

Financial Health: Keeping track of earnings and expenses to maintain a healthy business operation.

Strategic Planning: Planning for the future by aligning financial goals with business objectives.

Tax Regulations: Understanding and complying with tax laws to avoid penalties and optimize savings.

I'm Nischay Rawal, and I've dedicated over a decade to simplifying accounting and taxation services for businesses and individuals. My experience in the field has equipped me to help you steer financial challenges with stress-free solutions.

Image Alt Text: infographic on accounting and taxation benefits - accounting and taxation services infographic infographic-line-3-steps-blues-accent_colors

Understanding Accounting and Taxation Services

When it comes to managing finances, accounting and taxation services are your best allies. These services are essential for keeping your business financially healthy and compliant with laws. Let's break down what they involve:

Accounting Services

Accounting services are all about keeping your financial records in order. This includes:

Bookkeeping: Recording daily transactions like sales, expenses, and payroll.

Financial Statements: Preparing balance sheets and income statements to give a clear picture of your financial standing.

Payroll Services: Ensuring employees are paid accurately and on time.

Imagine your business as a ship. Accounting services are like the maps and compasses that keep you on course, helping you steer through financial waters.

Tax Services

Tax services focus on ensuring you meet your tax obligations without overpaying. They include:

Tax Preparation: Organizing and filing your tax returns accurately and on time. This helps avoid penalties and maximizes deductions.

Tax Compliance: Keeping up with ever-changing tax laws to ensure your business is always in the clear.

Think of tax services as your personal tax GPS. They help you find the best route through complex tax codes, ensuring you reach your financial destination smoothly.

Financial Reporting

Financial reporting is about transparency and accountability. It involves:

Regular Reports: Providing updates on your financial status to stakeholders and decision-makers.

Compliance Reporting: Meeting legal requirements by submitting accurate financial data to government agencies.

Financial reporting is like the dashboard in your car. It tells you how fast you're going, how much fuel you have, and alerts you to any issues that need attention.

Image Alt Text: Understanding accounting and taxation services can simplify business operations and improve decision-making. - accounting and taxation services infographic checklist-light-blue-grey

By understanding these components of accounting and taxation services, you can make informed decisions and plan effectively for the future. Whether you're a small business owner or an individual, these services can help you save money, reduce stress, and focus on what you do best.

Next, we'll explore the key benefits of these services and how they can empower your business to thrive.

Key Benefits of Accounting and Taxation Services

In the business world, accounting and taxation services offer several crucial benefits that can make a significant difference to your operations.

Informed Decision-Making

Having a clear picture of your finances allows you to make smarter decisions. Accounting services provide detailed financial statements and reports, giving you insights into your cash flow, expenses, and revenue. For instance, accurate bookkeeping can reveal patterns in your spending, helping you identify areas where you can cut costs and improve profitability. As Dale S. Goldberg, CPA, puts it, "Accurate bookkeeping is the backbone of any successful business."

Tax Compliance

Navigating the labyrinth of tax regulations can be daunting. Tax services ensure that your business stays compliant with all tax laws, minimizing the risk of penalties. By staying updated on the latest tax codes, accountants can guide you through complex requirements, ensuring timely and accurate filings. This proactive approach not only keeps you in the clear but also helps you take advantage of tax incentives and deductions. According to NR Tax and Consulting, not paying estimated taxes can lead to higher overall costs due to penalties.

Financial Insights

Beyond compliance, accounting and taxation services offer valuable financial insights. Regular financial reporting provides transparency and accountability, making it easier to track your business's performance over time. This information is crucial for strategic planning, helping you set realistic goals and measure your progress. With expert guidance, you can identify opportunities for growth and make informed decisions that align with your long-term objectives.

By leveraging these benefits, you can focus on growing your business while ensuring financial stability and compliance. Next, we'll discuss how to choose the right accounting and taxation services to meet your specific needs.

Choosing the Right Accounting and Taxation Services

Selecting the right accounting and taxation services is a crucial step for any business. Here’s how to make the best choice for your needs.

Personalized Service

Every business is unique, and a one-size-fits-all approach won't work. Look for a provider that offers personalized service. This means they take the time to understand your specific goals and challenges. At NR Tax and Consulting, we focus on getting to know you and your business, which helps in crafting custom solutions. This personalized approach ensures that the services you receive align with your business objectives.

Expertise

Expertise is non-negotiable. You want a team that not only knows the numbers but understands your industry. Experienced professionals who bring a wealth of knowledge from various business roles can offer insights beyond basic accounting. They can help with strategic planning, financial management, and more. Ensure that the team includes qualified experts, such as CPAs and EAs, who can provide comprehensive support.

Affordability

While expertise is important, the cost should also fit your budget. Many firms, like NR Tax and Consulting, offer services for a low monthly fee without hourly charges, making it easier to manage expenses. When evaluating costs, ask about their fee structure. Is it a flat rate or based on services used? Understanding this helps avoid unexpected charges and ensures that you get value for your investment.

By focusing on these factors, you can find accounting and taxation services that not only meet your current needs but also support your long-term business goals. Up next, we'll tackle some frequently asked questions about accounting and tax services to clear up common concerns.

Frequently Asked Questions about Accounting and Taxation Services

What are accounting and tax services?

Accounting and tax services are essential for maintaining a business's financial health. They involve managing financial records, preparing tax documents, and ensuring compliance with tax regulations. These services help businesses with strategic planning by providing accurate financial reporting. With the right accounting support, businesses can make informed decisions and plan for the future.

How much should a tax accountant cost?

The cost of hiring a tax accountant can vary based on several factors, including location and services needed. On average, individual tax preparation can cost between $150 and $190. For businesses, the fees may be higher, especially if additional services like bookkeeping or payroll are required. It's important to get a detailed estimate upfront to avoid surprises. Some firms charge a flat fee, while others bill by the hour. Cheaper isn't always better. Paying for expertise can save money in the long run by maximizing deductions and avoiding errors.

Is a CPA more expensive than a tax preparer?

CPAs typically charge more than standard tax preparers, but there's a reason for this. CPA expertise goes beyond basic tax filing. CPAs have extensive training and can offer a broader range of services, including strategic financial planning and complex tax advice. While they might cost more upfront, their expertise can lead to better financial outcomes for your business. When comparing costs, consider what level of service and expertise you need. Investing in a CPA can be worthwhile if your business requires comprehensive accounting and financial guidance.

By understanding these aspects of accounting and tax services, you can make better decisions for your business's financial future. If you still have questions or need personalized guidance, NR Tax and Consulting is here to help. Up next, we'll conclude with how NR Tax and Consulting can provide local, custom assistance for your accounting and taxation needs.

Conclusion

At NR Tax and Consulting, we believe that personalized guidance is key to helping businesses succeed. Our approach is custom to meet the unique needs of each client, ensuring that you receive the expert financial support necessary to thrive in today's competitive market.

Located in Miami, we focus on providing local accountant services that understand the specific challenges and opportunities within your community. This local focus allows us to offer solutions that are both relevant and effective, ensuring that your business stays on the right track.

Our team is dedicated to your success. Whether you need help with strategic business planning or navigating complex tax regulations, we're here to offer the support you need. By partnering with NR Tax and Consulting, you gain access to a wealth of knowledge and expertise that can help you make informed decisions for your business's future.

For more information on how we can assist with your accounting and taxation needs, visit our Strategic Business Planning page. Let us help you achieve your financial goals with confidence and clarity.

Want tax & accounting tips and insights?

Sign up for our newsletter.