2025 Year-End Tax Planning: Strategies to Save Big

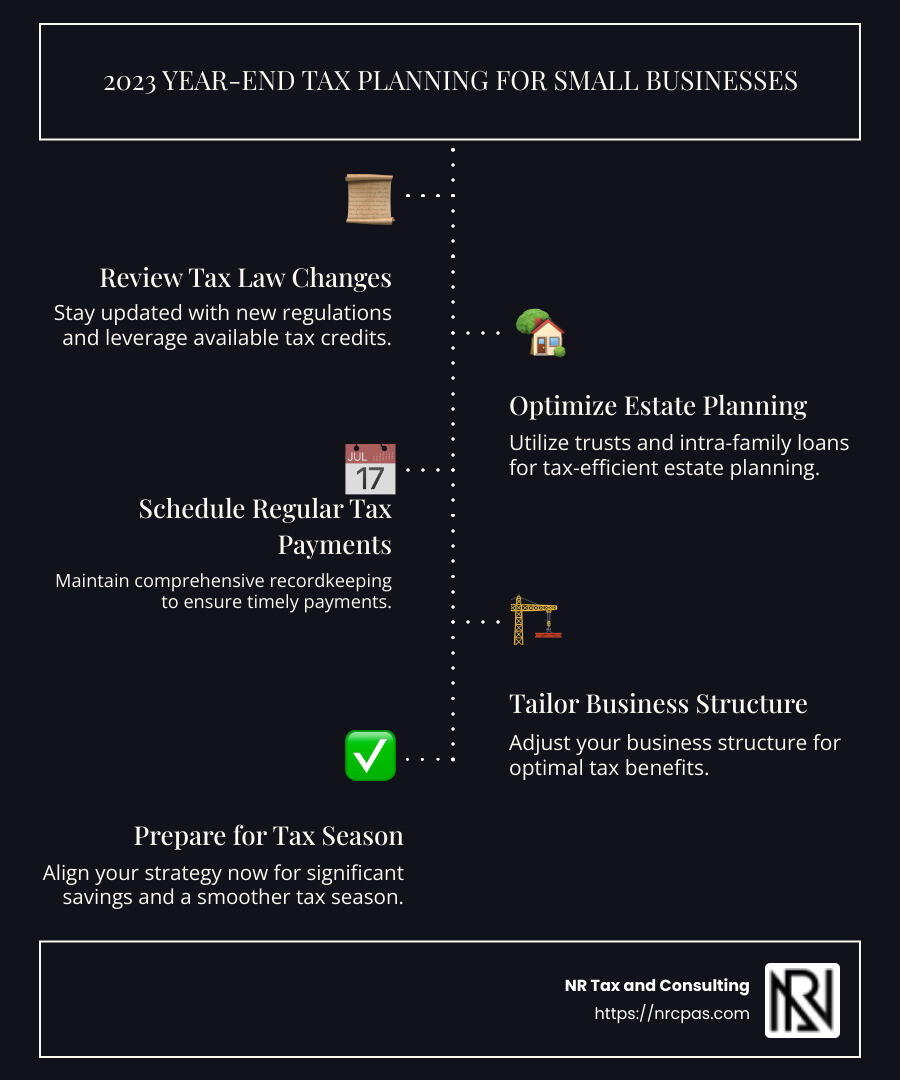

2023 year end tax planning is critical for small business owners looking to maximize their savings and steer complex tax regulations. As the year draws to a close, consider these essentials:

Review changes in tax laws and leverage available tax credits.

Consider tax-efficient estate planning tools like trusts and intra-family loans.

Stay proactive with regular tax payments and comprehensive recordkeeping.

Tailor tax strategies to your business structure to optimize benefits.

For businesses, aligning your strategy now can mean significant savings and a smoother tax season ahead.

I'm Nischay Rawal, a tax consultant with over a decade of experience in 2023 year end tax planning. Among the many clients I've assisted, I've particularly focused on simplifying financial management for small businesses, helping them make the most of tax regulations to support their growth.

Image Alt Text: Infographic detailing 2023 year end tax planning strategies for small businesses, featuring key points such as tax law review, leveraging credits, and estate planning tools, with graphical representations of each strategy. - 2023 year end tax planning infographic infographic-line-5-steps-dark

2023 year end tax planning basics:

business tax planning

small business tax advice

Understanding 2023 Year-End Tax Planning

As we approach the end of 2025, it's crucial to reflect on the strategies that have been effective over the past years, including those from 2023. This retrospective view helps us understand what worked well and how these strategies can be adapted for future tax planning. Let's revisit the basics: tax credits, deductions, and retirement contributions.

Tax Credits

Tax credits are valuable tools—they directly reduce the amount of tax you owe. For instance, back in 2023, credits related to energy efficiency, electric vehicles, and education were particularly beneficial. These examples serve as a reminder to always check for relevant credits that can significantly lower your tax bill. Consulting with a tax advisor is recommended to ensure you're capitalizing on all available credits.

Deductions

Deductions are another way to reduce your taxable income. Common deductions include mortgage interest, state and local taxes, and charitable contributions. Reflecting on past years, if you itemized, you could deduct cash donations to qualified charities up to 60% of your adjusted gross income. This principle remains useful as you plan for deductions in future tax years.

Retirement Contributions

Contributing to retirement accounts continues to be a win-win strategy. Historical limits, such as those in 2023 allowing up to $22,500 in a 401(k) and up to $6,500 in an IRA, highlight the importance of maximizing these contributions to reduce taxable income and enhance your retirement savings.

By understanding these enduring strategies, you can better prepare for the current tax year and beyond, ensuring you utilize all opportunities to reduce your tax liability and secure your financial future.

Key Strategies for 2023 Year-End Tax Planning

As we close out 2025, it's beneficial to look back at key strategies from previous years, like 2023, that have proven effective in reducing tax liabilities. This historical perspective helps in fine-tuning our current approaches to optimize financial outcomes.

Tax Deductions

Leveraging tax deductions is a timeless strategy. Reflecting on past advice, consider deductions such as mortgage interest, state and local taxes, and charitable donations. These areas continue to offer potential tax relief and should be considered each year as part of your comprehensive tax planning strategy.

Income Deferral

Deferring income has been a useful tactic in managing tax brackets. For example, if expecting a year-end bonus, arranging with your employer to receive it in the following year could defer tax liabilities. This strategy remains relevant as it can help manage your taxable income effectively across different tax years.

Charitable Contributions

Charitable contributions not only support worthwhile causes but also provide tax benefits. Techniques like Qualified Charitable Distributions (QCDs) and bunching donations have been beneficial in the past and continue to be relevant. These methods can significantly enhance your tax planning strategy by optimizing the tax benefits of your charitable activities.

By revisiting and adapting these strategies from 2023, you can ensure that your tax planning is as effective as possible for minimizing your current and future tax liabilities.

Maximizing Tax Benefits for Individuals

When it comes to 2023 year-end tax planning, there are several ways individuals can maximize their tax benefits. Let's explore how retirement plans, IRA contributions, and capital gains management can help you save more.

Retirement Plans

Setting up or contributing to a retirement plan is one of the smartest ways to reduce your taxable income while securing your financial future.

401(k) Plans: Contributing to a 401(k) allows you to save with pre-tax dollars. In 2023, you can contribute up to $66,000 if you're 50 or older, including both employee and employer contributions.

SEP IRA: Ideal for small business owners, you can contribute up to 25% of your net earnings, with a maximum of $66,000 in 2023. It's simple to set up and flexible, making it a great choice if your income varies.

SIMPLE IRA: For businesses with fewer than 100 employees, this plan allows contributions up to $15,500, with a $3,500 catch-up for those 50 or older.

IRA Contributions

Individual Retirement Accounts (IRAs) offer another pathway to tax savings.

Traditional IRA: Contributions may be tax-deductible, reducing your taxable income for the year. There's no age limit for contributions, making it a versatile option.

Roth IRA: Though contributions are made with after-tax dollars, the benefit comes later with tax-free withdrawals. This can be a strategic move if you expect to be in a higher tax bracket in the future.

Tip: For those reaching age 73 in 2023, remember to take your first required minimum distribution (RMD) by April 1, 2024.

Capital Gains

Managing capital gains effectively can also reduce your tax bill.

Harvesting Losses: Offset gains by selling investments that have lost value. This can balance out taxable gains and lower your overall tax liability.

Long-Term Gains: Holding investments for more than a year often results in lower tax rates on gains. This can be a significant tax-saving strategy.

Example: If you have stocks that have appreciated over the years, consider donating them to charity. You can deduct the full market value while avoiding capital gains tax.

By taking advantage of these strategies, individuals can make the most of their 2023 year-end tax planning efforts. Next, we'll dive into business tax planning and how companies can steer the complexities of tax accounting and compliance.

Business Tax Planning for 2023

When it comes to 2023 year-end tax planning for businesses, understanding tax accounting methods, strategic planning, and compliance can make a huge difference. Let's break it down.

Tax Accounting Methods

Choosing the right tax accounting method is crucial for accurate financial reporting. Here are the main options:

Cash Method: Income and expenses are recorded when cash is received or paid. It's simple and often preferred by small businesses for its straightforward approach.

Accrual Method: Income and expenses are recorded when they are earned or incurred, regardless of when cash changes hands. This method provides a more accurate picture of a business's financial health and is required for some businesses by the IRS.

Tip: Review your current method to see if a change could benefit your 2023 tax strategy. Consult a tax professional for guidance.

Strategic Planning

Strategic tax planning is about looking ahead and making informed decisions to minimize tax liabilities. Here’s how:

Defer Income: If possible, delay income to the next tax year. This can be done by postponing invoices or delaying the completion of a contract until January.

Accelerate Deductions: Pay expenses like bonuses, office supplies, or contributions to retirement plans before the end of the year to claim deductions in 2023.

Leverage Tax Credits: Explore tax credits available for your industry. For example, businesses investing in clean energy might qualify for specific incentives.

Example: A Miami-based tech company could benefit from R&D tax credits by documenting and claiming expenses related to innovation and development.

Compliance

Staying compliant with tax laws is non-negotiable. Here's what to focus on:

Recordkeeping: Keep detailed and organized records. This includes receipts, invoices, and any documentation supporting deductions and credits claimed.

Deadlines: Mark key dates on your calendar. Missing deadlines for quarterly tax payments or annual filings can lead to penalties.

Regulatory Changes: Stay updated on tax law changes. For instance, new regulations around Form 1099-K might impact how you report income from payment processors.

By focusing on these areas, businesses can steer the complexities of tax planning with confidence. Up next, we'll tackle frequently asked questions about 2023 year-end tax planning to help you make the most of your tax return.

Frequently Asked Questions about 2023 Year-End Tax Planning

What are the major tax changes for 2023?

In 2023, there are a few key tax changes to be aware of. One major update is related to Form 1099-K. This form is used to report income received through third-party payment processors like PayPal or Venmo. The reporting threshold has been lowered to $600, meaning more people may receive this form than in previous years.

Another change involves tax credits for clean vehicles. If you're considering buying an electric or hybrid car, you might qualify for federal tax credits. These credits can significantly reduce your tax bill, making green choices even more appealing.

How to get the most out of tax return 2023?

To maximize your 2023 tax return, start with your filing status. Choosing the correct status can affect your standard deduction and tax bracket. For example, filing jointly as a married couple often provides more benefits than filing separately.

Next, focus on tax credits and deductions. Credits directly reduce your tax bill, while deductions lower your taxable income. Common credits include the Child Tax Credit and the Earned Income Tax Credit. Deductions might include mortgage interest or student loan interest.

How can I lower my taxable income in 2023?

Lowering your taxable income can save you money. One effective way is through retirement contributions. Contributions to traditional IRAs or 401(k) plans are tax-deductible, reducing your taxable income. For 2023, the IRA contribution limit is $6,500, or $7,500 if you're 50 or older.

Another strategy is income reduction. This could involve timing your income and expenses strategically. For instance, if you can defer income to 2024 or prepay certain expenses in 2023, you might reduce your taxable income for the current year.

By understanding these changes and strategies, you can make informed decisions to optimize your tax situation. Up next, we'll conclude with how NR Tax and Consulting can provide personalized guidance to steer these complexities.

Conclusion

Navigating the complexities of year-end tax planning can feel overwhelming, but it doesn't have to be. At NR Tax and Consulting, we specialize in providing personalized financial guidance custom to your unique needs. Our team of experts is here to help you make sense of the changing tax landscape, ensuring you make the most of your financial opportunities.

Why choose us? It's simple. We offer local accountant services that understand the specific challenges and opportunities in your community. Our approach is hands-on and customized, because we know that no two businesses or individuals are alike. Whether you're a small business owner or an individual taxpayer, we provide the insights and strategies you need to thrive.

Our commitment to excellence means we're always up-to-date on the latest tax laws and regulations. This ensures that you receive the most relevant advice and support, helping you to minimize taxes and maximize savings.

Ready to take control of your financial future? Contact NR Tax and Consulting today to find how our expertise in 2023 year-end tax planning can benefit you. With our personalized services, you can confidently steer the tax season and achieve your financial goals.

Want tax & accounting tips and insights?

Sign up for our newsletter.